The question to ask now is, will Leicester City win the Premier League this year too and will the Yen and the Euro continue to rise? The answer may not be an obvious Yes but it definitely is not an Obvious No either and that sets the trend for the markets in the coming months.

The odds of Leicester City winning the Premier League at the beginning of the season last year was the same as the odds of the Japanese Yen strengthening against the USD. Both Leicester City and the Yen have defied the odds, with one (Leicester City) causing happiness and the other (Yen) causing grief.

The Yen is causing a lot of grief now. Chart 1. The Yen was the biggest short sell against the USD in the market as Bank of Japan together with the Shinzo Abe government unleashed the Three Arrow approach to reviving the Japanese economy including massive monetary easing, fiscal stimulus and structural reforms. The Yen depreciated by over 30% against the USD since 2013 when what is known as “Abenomics” was adopted.

The loose monetary policy approach of the Bank of Japan (BOJ) coincided with the Fed turning neutral on interest rates and this led to the policy divergence trade, a “No Brainer”. The trade did work extremely well for three years but is turning bitter now.

The Bank of Japan, following its 2% inflation target, brought down interest rates to negative in the beginning of 2016. This lent strength to Yen bears who further went short the Yen. However, at this point, the Yen started to defy odds as the Fed dithered on following its December 2015 rate hike of 25bps in the policy meets in 2016. Markets started to get nervous on shorts and started short covering at lower levels of the Yen. The Yen started to strengthen even as incoming data from Japan showed continued weakness in inflation and growth. However nervous short covering increased demand for the Yen resulting in further strengthening of the Yen.

The BOJ too helped the Yen by refraining from more stimulus in its April meeting. The Yen, since the beginning of 2016, has appreciated by over 13% against the USD and is trading at close to levels last seen in September 2014.

The sharp rise in the value of the Yen has burnt holes amongst traders and hedge funds that had a one way bet on the Yen.

Similarly, the Euro too is appreciating against the USD partly in sympathy with the Yen rise and partly on the Fed dithering on rate hikes. Chart 2. Euro has risen by over 6% against the USD since January 2016 to trade at one year high levels. The rise in Euro is despite the ECB lowering rates to record lows and increasing asset purchase size in March 2016.

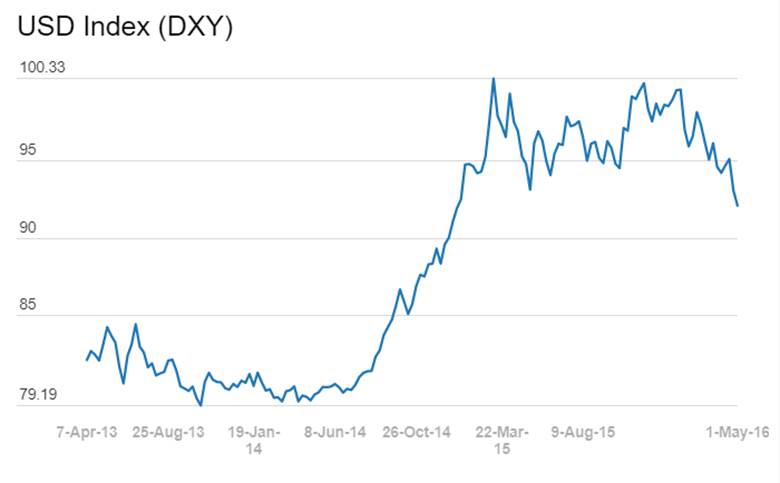

The USD index, which was seen as rising throughout this year has fallen by almost 7% in 2016 given the rise in the Euro and the Yen. Chart 3. Markets are questioning the overall strength of the USD now and given that markets have got used to a strong USD, the reaction to a weakness in USD would have a knock on effect across global markets.