Cheap liquidity from ECB, BOJ, BOE has flooded markets and the impact of this cheap liquidity can be seen in bond yields of majority of countries that are trading at year lows

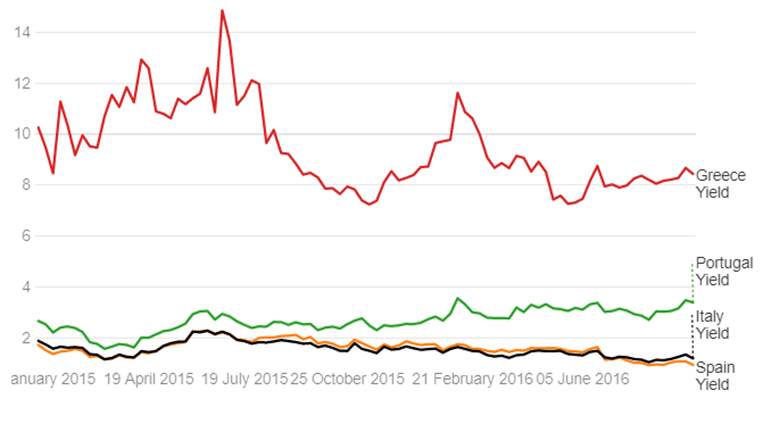

We can see in the above table, from past one year where most nations government bond yields have fallen, yields of Portugal Bond have risen. Portugal bond yields have risen when compared with other PIGS bonds.

Benchmark 10 Year Bond Yields Movement

From the above table we can see when compare with the Q2 2015-16 GDP to Q2 2016-17 GDP, GDP has fallen for all the country.

What factors caused Portugal Bond Yields to rise?

Fitch, Moody and S&P had rated Portugal as non-investment grade, and only DBRS kept Portugal’s rating at BBBL, its lowest investment grade, and maintained the stable trend. For Portugal’s bonds to qualify for purchase under the ECB’s quantitative-easing plan, the nation must be rated investment grade by at least one major rating company but the bond yield shot higher when DBRS warned of a slowdown in the economy and a deficit that would miss EU targets. Rating firm DBRS is due to review the country’s rating on 21st October 2016.

What factors caused Spain Bond Yields to fall?

In August 2016, European Union agreed to waive fines for Spain and Portugal over their excessive budget deficits. Under EU rules, member countries are not supposed to run budget deficits greater than 3% of their total economic output. Last year Spain had deficit of 5.1% of GDP and Portugal had deficit of 4.4% of GDP. However under exceptional circumstances, the EU Council has given each country more time to conform to the rules and bring their deficits down. Spain bond yields have fallen on the back of expectations of political stability.

Spain interim prime minister has asked for support from opposition parties in exchange for political reform. Centrist party Ciudadanos proposed the six-point reform package – aimed at fighting corruption and making the voting system more proportional – to the Conservative People’s Party (PP) and its leader Mariano Rajoy last week. An endorsement by the PP, which won national elections in June but fell short of a majority, would open the way to Ciudadanos (“Citizens”) backing Rajoy – currently acting premier – as head of a new government in a parliamentary investiture vote.

What factors caused Italy Bond Yields to fall?

Italy Government is aiming to approve an offering banks a state guarantee to help them sell their bad loans. Italy’s lenders have been struggling for months to unload 360 billion Euros (USD 400 billion) of non-performing loans – about one third of the Eurozone total. Prime Minister Matteo Renzi in (July 2016) said a deal with the European Commission to allow public support for its weakest lenders was “absolutely within reach”.

What factors caused Greece Bond Yields to fall?

Greece bond yields are falling because Rating Agency S&P in (Jan 2016) had raised country rating by one notch to B-, Greece is also debating its politically sensitive pension reform, a precondition for completing the first bailout review. If the review is successful it could potentially lead to the inclusion of Greek bonds in the ECB asset purchase programme.