The FOMC Minutes for November 2016 suggest that Fed officials are keen on raising rates at the earliest, prompting bond markets to price in a 93.5% probability of a hike in December. US 10 year benchmark treasury yields closed at 2.35% on the 23rd of November, up by 55bps from levels seen prior to Trump victory. The sharp rise in US treasury yields has pulled up bond yields across the globle, except India. The ten year benchmark Indian government bond yield has fallen 55bps since Trump victory, largely on the back of demonetisation of Rs 500 and Rs 1000 notes by the government.

Data showed that U.S housing starts for October 2016 jumped by 26 percent, the fastest pace since August 2007 and weekly jobless claims for week ended 18th November, fell to the lowest level since 1973, the latest sign of a robust jobs market. Record close of US equity indices also placed fresh pressure on bond yields.

Bank of Japan surprised the market by saying it will buy an unlimited amount of Japanese Government Bonds at fixed rates for the first time since the introduction of new policy framework. This move makes clear the intention of the Central Bank, which is to keep the lid on rising yields. Japanese 10-year benchmark bond yields closed flat on weekly basis.

Germany 10-year benchmark bund yields fell by 2 bps on weekly basis, Bund yields fell after ECB President Mario Draghi signaled that monetary support is needed to hit the ECB Inflation target. Bund yields also fell after weak PMI numbers, data showed that Germany manufacturing PMI for November fell 54.4 from 55 in October.

U.K bond yields rose by 2 bps on weekly basis, however yields have fallen from highs of 1.45% after primary dealers forecast that there will be 3.2% increase in U.K bond sales, Primary dealers are expecting there will be additional sales of GBP 4.25 billion of gilts in FY2016/17 on top of GBP 131.5 billion targeted in March.

Italy bond yields rose by 10 bps as most polls showed that prime minister Matteo Renzi is set to be on the losing side of a vote on constitutional reform. Portugal bond yields rose by 3 bps, the yields on the benchmark 10-year bond rose to 3.89%, its highest level since Feb 2016. Greece 10-year benchmark bond yield fell by 52 bps as Greece and institutions managing its bailout are currently negotiating on policy reforms and if negotiations are successful, it could ease the terms of the country’s debt burden. Spain bond yields rose by 4 bps.

Emerging economies 10-year benchmark bond yields were mixed last week. Brazil benchmark bond yields fell by 7 bps on rising commodity prices, commodity plays important role in Brazil’s economic output. Russian bond yields fell by 12 bps as oil prices surged to 3 week highs, Chinese bond yields rose by 1 bps. South African bond yields fell by 6 bps on rising commodity prices. Indian bond yields fell by 17 bps and Indonesia bond yields rose by 14 bps.

US high yield bond yields fell 21 bps and Eurozone high yield bond yields rose 10 bps last week.

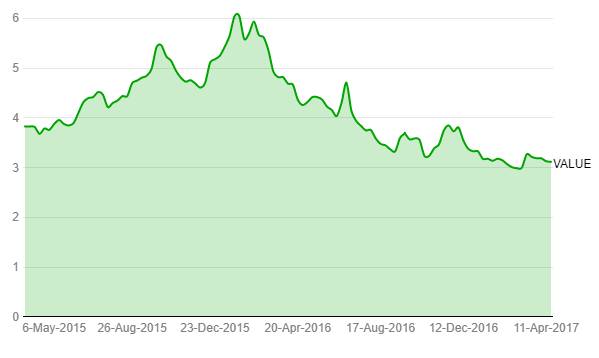

Benchmark US High Yield corporate Bond Yields %

Benchmark Euro High Yield corporate Bond Yields %