Mid & small cap stocks have seen sharp correction in prices since April 2018. While some have warranted a correction, many others have posted strong results with very optimistic guidance and the markets will be forced to look at the valuations that have come off for these stocks in the correction.

Overall the economy is on a positive trend with strong 4th quarter fiscal 2017-18 GDP numbers. The government is front loading spending, monsoons are on track and global economy is showing steady growth, all positive for corporate performance.

The last quarter also saw banks cleaning up their books with surge in provisioning and there were resolution of a few companies under NCLT. This is positive for the banks as well as the economy as many of the NCLT companies can start to function normally under new ownership.

Domestic lending has not slowed down despite banking sector woes as many NBFC’s have shown high growth all round especially in the consumer finance segment. This will drive the domestic consumption theme.

Road construction sector saw positive results from companies with strong guidance for growth. The government is moving fast in its road construction policy and order books and execution are growing at a faster pace.

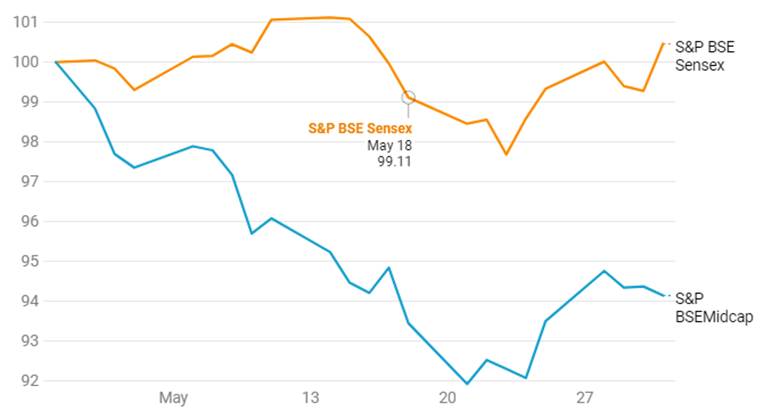

Indian markets witnessed extreme volatility in midcaps and smallcaps despite posting results in-line with or better that market expectations. Sensex & Nifty declined by 1.16% & 0.72% respectively in the last one month. Markets witnessed volatility on the back of both domestic and global factors which include political uncertainty (Karnataka Elections), global cues (Trade war & Euro crisis) and FIIs selling pressure. S&P BSE midcap index has underperformed the Sensex by 4% in the month of May 2018 due to heavy selling by FIIs despite companies reporting better than expected Q4Fy18 results.

The month of June 2018 is expected to enhance the market sentiment and all ignored positives are expected to be factored in. Positive triggers that the market would factor in are as follows:

· Companies have shrugged off the GST & demonetisation effect which had hit them hard last year. Quarterly results of the Financial Year 2018-19 are expected to be better than Financial Year 2017-18 due to low base effect.

· India is a strong attraction for global companies as seen by the Walmart – Flipkart deal at USD 16 billion. Global companies are also bidding for assets placed under the NCLT, indicating strong interest in infrastructure assets in India. Closure of 3 NCLT cases, including Bhushan Steel, ElectroSteel Casting and Binani Cement suggests that there is demand for stressed assets on back of improving prospects for cyclical industries.

· Ongoing strong reporting of Q4Fy18 results by Indian companies will bring down the trailing price to earnings ratio of Sensex & Nifty Companies, which would attract foreign investors.

Market participants will be looking for Macro-Economic data, RBI Policy Outcome and Global cues on Euro Crisis in the month ahead for cues.

Sensex vs BSE Midcap - May 2018

Global Economy

The US economy expanded at an annualized 2.3% during Q1Fy18, below 2.9% in the previous period but beating market expectations of 2%. Unemployment in US rate fell to 3.9% in April 2018 from 4.1% in the previous month. Annual inflation rate edged up to 2.5% in April 2018 from 2.4% in the previous month, matching market expectations. It is the highest rate since February 2017. Core inflation was flat at 2.1%.

The Eurozone’s GDP grew by 0.4% during Q1Fy18, unrevised from the preliminary estimate and below 0.7% in the previous period. GDP growth slowed down in Germany & France and was unchanged in Spain & Italy. The Eurozone’s current account surplus narrowed to EUR 40.6 billion in March 2018 from EUR 45.2 billion in the same month of the previous year. The consumer price inflation rate in the Euro Area came in at 1.9% (Y-o-Y) in May 2018 vs market expectation.

The British economy advanced 1.2% (Y-o-Y) in the first three months of 2018, slowing from a 1.4% rise in the previous quarter. Annual inflation in the UK edged down to 2.4% in April of 2018 from 2.5% in March 2018, below market expectations of 2.5%. It is the lowest rate since March 2017, mainly due to a slowdown in cost of transport, food and clothing and footwear.

The Japanese economy contracted 0.2% on quarter in the Q1Fy18, after a downwardly revised 0.1% growth in the previous period while markets expected flat growth. On an annualized basis, the GDP shrank 0.6%, compared to a 0.6% expansion in the preceding quarter. Consumer price inflation fell to 0.6% (Y-o-Y) in April 2018 from 1.1% in the prior month, food inflation eased to 5-month low and cost of transport increased less.

Global Central banks policies:

Major global central banks had left their key interest rates steady and are expecting favorable movement in inflation, exports and GDP figures.

The Federal Reserve left its target range for the federal funds rate steady at 1.5%-1.75% during its May 2018 policy-meeting, in line with market expectations. Policymakers said the labor market has continued to strengthen, economic activity has been rising at a moderate rate and both inflation and core inflation have moved close to 2%, suggesting a June 2018 rate hike is on the table.

The Bank of England held the Bank Rate at 0.5% on 10th May 2018 policy-meeting, due to a sharp slowdown in GDP growth in the Q1Fy18.

The Bank of Japan left its key short-term interest rate unchanged at -0.1% at its April 2018 policy-meeting, as expected. Policymakers also kept its 10-year government bond yield target around 0% but dropped their target date for reaching 2% inflation.

The Bank of Korea held its base rate steady at 1.5% during monetary policy-meeting as expected. While saying the solid trend of domestic economic growth will continue due to favorable movements in consumption and exports.

The central bank of Mexico decided unanimously to keep its benchmark interest rate steady at 7.5% on 17th May 2018 policy-meeting. Policymakers said the current monetary stance is appropriate to bring the inflation back to the 3% target.

Global Market

Despite trade concerns and issues related with North Korea, Wall Street has managed to post positive returns on monthly basis. U.S. government will start imposing tariffs on imports of Steel and Aluminium from Canada, Mexico and European Union starting 1st June 2018. Tech stocks had touched new highs during the month of May 2018 post reporting better than expected quarterly earnings, this has helped Nasdaq to surge more than S&P 500 and Dow Jones during the month of May 2018. During the month, Dow Jones gained by 2%, S&P 500 jumped by 2.8% and Nasdaq surged by 5.6%.

The Reuters CRB Commodity index touched a three-year high but is still more than 50% below peaks seen in 2008. The recent rally in crude oil and Aluminium is more due to supply concerns than demand surge, though an improving global economy has improved prospects for commodity demand.

Brent Crude has witnessed volatility after a U.S. has imposed sanctions on Iran and Venezuela crude oil exports. Brent Crude oil touched a high of USD 80 per barrel. Saudi Arabia, UAE and Russia are considering easing restrictions on oil production in response to a fall in Venezuelan and Iran output. During the month Brent Crude oil price has risen by 3%.

Indian Market

The Indian economy expanded 7.7% (Y-o-Y) during Q4Fy18, higher than a downwardly revised 7% in the previous quarter and beating market forecasts of a 7.3%. It is the strongest growth rate in seven quarters as manufacturing and investments grew at a faster pace. On the production side, manufacturing, agriculture and construction were the main contributors to growth.

India’s fiscal deficit narrowed to Rs. 1.52 trillion in April 2018 from Rs. 2.06 trillion in the same period of the previous fiscal year. The budget gap was equivalent to 24.3% of the government’s target for the whole financial year (FY19), compared with 37.6% last year.

Industry Specific trends

Q4Fy18 earnings had kicked off with TCS reporting 8.2% growth in net sales and has given announcement on massive deals, which has increased the expectations for Fy19 revenue growth. However, Infosys reported 7.2% growth in net sales and gave tepid guidance for Fy19. BSE IT index has declined by 0.86% and underperformed the Sensex by 0.14% in the month of May 2018. Depreciating INR acts like a catalyst to the IT industry’s turnover.

FMCG giant, Hindustan Unilever reported 14% jump in net profit due to increase in consumption and normalization of trade conditions after the debut of GST. Rural demand is witnessing higher growth than urban areas, which shows higher consumer confidence in rural areas. Rural has grown ahead of urban even for peers like Dabur India Ltd and Godrej Consumer Products Ltd (GCPL) who announced their earnings earlier this month. For Dabur, rural demand growth at 9% outpaced urban growth at about 7%. For GCPL, rural grew at 7-8% compared to its overall domestic volume growth of 6%. Consumer companies are optimistic on seeing consumption recovery with volume growth in double digits in 2019. This will also help the companies in retail space to post strong results going ahead. S&P BSE FMCG index has outperformed Sensex by 0.72% in the month of May 2018.

Airline companies’ current problem is higher crude oil prices as fuel costs eat up a major portion of total costs. Interglobe Aviation & SpiceJet, which are profitable airline companies, have posted weak EBITA margins. Interglobe Aviation has witnessed fall in yields for the Q4Fy18 indicating pricing pressure. However, as per the data of Airport Authority of India, passenger growth has witnessed 26% jump in April 2018. All airline companies are running at close to 90% capacity utilization as on April 2018. Recent news about the Ministry of Civil Aviation recommending the Government of India to consider Aviation Turbine Fuel under the GST regime would benefit the Aviation Industry by Rs. 35 – 40 billion per year if it is taken into consideration and implemented.

City Gas Distribution stocks have slumped by more than 5% in the month of May 2018 while S&P BSE Oil & Gas index was flat on a monthly basis. Rise in gas prices (LNG) during the quarter (17% up), INR depreciating against the USD and the inability to pass on the rise in raw material cost to consumers on a timely manner due to government-mandated formula had hit hard on the quarterly financials of the companies in this sector.

The Auto industry produced a total 2,645,618 vehicles including passenger vehicles, commercial vehicles, three wheelers, two wheelers and quadricycle in April 2018 as against 2,242,965 in April 2017, registering a growth of 17.95 percent over the same month last year. The S&P BSE Auto Index declined by more than 5% in the month of May 2018. The growth in the sale of Passenger Cars, Commercial Vehicles and Two Wheelers continue to remain robust.

The pricing pressure in U.S. market is weighing on the pharma companies’ financial performance and making it tough for them to protect market share. S&P BSE healthcare index underperformed the Sensex by 7% in the last week. However, companies with less exposure to U.S. markets are expected to have relatively better revenue growth.

Currency

The INR saw sustained strength in calendar year 2017 on the back of FII flows into debt and equity. RBI bought USD 33 billion in fiscal 2017-18 and built up forward purchases of USD 20.8 billion as of end March 2018 to build up fx reserves and prevent a very fast appreciation of the INR.

The INR fell below Rs 68 levels against the USD in May 2018 and is currently trading at levels of Rs 67.43, down by 5% so far in 2018 and fell to a low of Rs 68.8 (seen in August 2013). The rupee has fallen close to its all-time low level despite better macroeconomic conditions as compared to 2013.