Weekly Market Highlights:

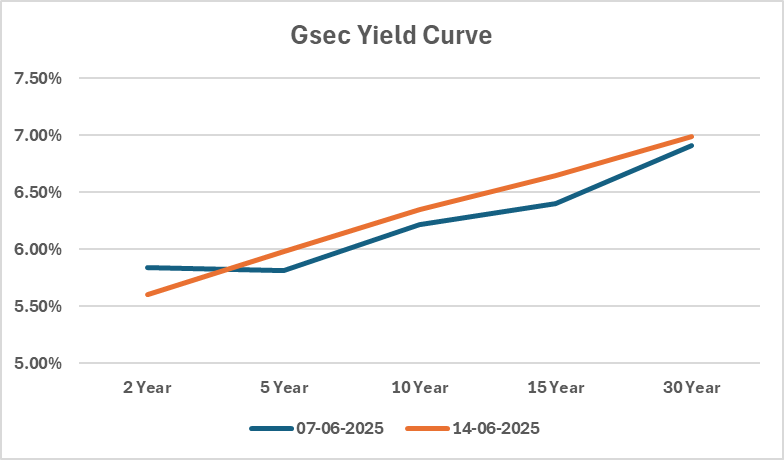

G-secs are to be driven by RBI MPC meeting minutes, WPI and US Job data this week. India’s May WPI release is expected to show a slight easing in wholesale inflation to around 0.8% YoY, down from April’s 0.85%—pointing to continued softening pressure in producer prices. For the U.S., the June non‑farm payrolls report is forecast to show around 130 k jobs added, with the unemployment rate remaining near 4.2%, while ADP showed a soft private‑sector print of just 37 k in May. Should payrolls land near expectations, it would underscore a cooling but still resilient labor market—likely keeping the Fed on hold at the upcoming FOMC meeting—whereas a significantly stronger or weaker print could swing sentiment on near‑term monetary policy. The Gsec auction cutoff on friday for 6Y and 50Y Gsec was at 6.23% and 7.14% while the closing yields were about 2 bps lower than the cut-off yield indicating strong secondary market demand following the auction.

India’s weekly bond auctions continue to exert supply pressure, with Rs 300 bn of bonds—including liquid seven-year papers—set for sale this week. The RBI recently canceled a Rs 50 bn 30-year green bond auction due to aggressive yield bids, highlighting market resistance to current pricing. FPIs have withdrawn a record Rs 255.4 bn from Indian government securities between 2nd April and 3rd June —the largest quarterly outflow since India’s inclusion in global bond indices—driven by a narrowing yield spread between Indian and U.S. 10-year bonds, which has declined from over 250 basis points in November 2023 to around 170–180 currently. At the same time, Brent crude has climbed above USD 75 per barrel—an 8% rise—amid escalating tensions in the Middle East, adding upside risk to inflation and potentially constraining the RBI’s policy space. Although retail inflation in India eased to 2.82% in May—the lowest in over six years and well below the RBI’s 4% target—the central bank has already cut rates by 100 basis points since February and signaled limited scope for further easing. The outcome of the Rs 300 bn auction will be a key gauge of investor appetite and market direction.

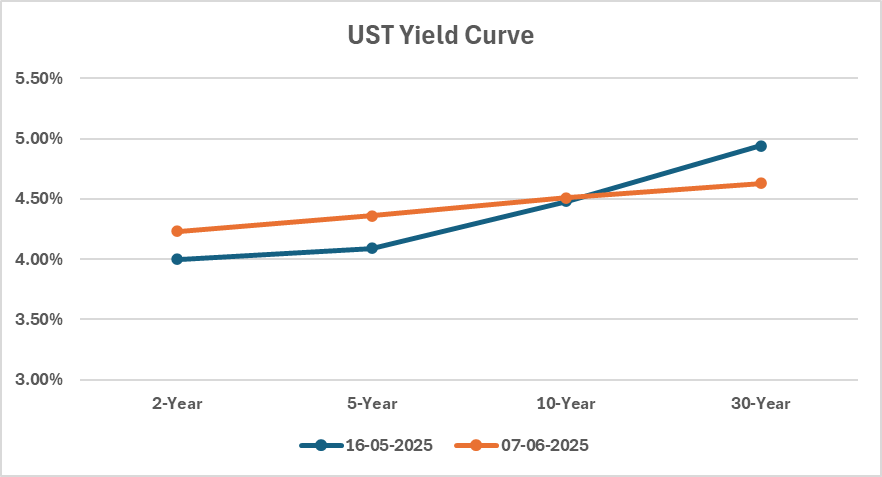

Oil prices surged sharply in June 2025, jumping 7–8% in a single session after Israel launched airstrikes on Iranian military and nuclear sites, triggering fears of supply disruptions in the Middle East—a key oil-producing region. Brent crude futures climbed to around USD 74–75 per barrel, with WTI crude also rallying, reflecting the market’s acute sensitivity to geopolitical risk. This spike builds on a broader upward trend over the past month, though prices remain below year-ago levels. Looking ahead, oil is expected to trade within a USD 70–80 range next week, with risks skewed to the upside if tensions escalate further, particularly around critical chokepoints like the Strait of Hormuz. Meanwhile, U.S. Treasury yields initially rose earlier in the week on concerns over fiscal deficits and credit ratings, with the 10-year yield reaching around 4.55%. However, following the flare-up in the Middle East, yields reversed as investors shifted to safe-haven assets. The 10-year yield dropped by about 2 basis points on Friday, with similar moves across the curve. For the coming week, yields are expected to remain slightly lower or range-bound around 4.35–4.45%, as markets balance geopolitical uncertainty with macroeconomic fundamentals and potential signals from the Federal Reserve. The combined movements in oil and Treasuries underscore the market’s heightened sensitivity to global risks and shifting investor sentiment.

Market Data | |||

Particulars | 7/6/2025 | 30/5/2025 | Change |

10 Yr Benchmark Gsec (%) | 6.25% | 6.29% | -4 bps |

Banking Liquidity (in Rs Billion) | 3131 | 1799 | 74.04% |

5 Yr OIS (%) | 5.54% | 5.67% | -13 bps |

1 Yr OIS (%) | 5.43% | 5.57% | -14 bps |

INRBonds Retail High Yield Index | 9.68% | 9.68% | 0 bps |

Nifty | 25,003 | 24,750 | 1.02% |

10 Yr SDL | 6.64% | 6.60% | 4 bps |

91 Day T-Bill (%) | 5.58% | 5.62% | -4 bps |

182 Day T-Bill (%) | 5.60% | 5.63% | -3.01 bps |

10 Yr US Treasury Yield (%) | 4.50% | 4.40% | 10 bps |

US Junk Bond Yield (%) | 7.22% | 7.24% | -2 bps |

Brent Crude Oil (In USD per Barrel) | 64.61 | 62.69 | 3.06% |

Primary & Secondary Corporate Bonds Data | |||

Top 5 Secondary Retail Trades | Maturity | Yield | - |

9.30% The Andhra Pradesh Mineral Development Corporation Limited | 9/5/2028 | 9.41% | |

9.65% Muthoot Fincorp Limited | 19/5/2028 | 9.64% | |

9.10% Mahindra Rural Housing Finance Limited | 6/5/2026 | 9.48% | |

9.50% 360 One Prime Limited | 16/1/2035 | 9.25% | |

10.25% IIFL Finance Limited | 21/4/2030 | 10.27% | |

Currency Market Data | |||

Particulars | 7/6/2025 | 23/5/2025 | Change |

USD/INR | 85.564 | 85.525 | 0.05% |

DXY | 99.03 | 99.33 | -0.30% |

USD/ Brazil Real | 5.59 | 5.75 | -2.78% |

EUR/ USD | 1.1415 | 1.1348 | 0.59% |

USD/CNY | 7.187 | 7.1998 | -0.18% |

USD/JPY | 144.47 | 144.06 | 0.28% |

USD/ Russian Ruble | 78.85 | 77.5 | 1.74% |