Equity Markets Snapshot For The Week

- USA and China will publish inflation figures

- Eurozone, China and US will publish Industrial Production growth figures.

- Domestic investors will watch for Q1Fy21 earnings, Inflation and Industrial Production growth figures.

- Implied volatility (IV) for put and call at the money options stood at 22 and 17 levels respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 75 billion in July 2020 and bought shares worth Rs. 78 billion in August 2020 (till 09th August 2020). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures, Index Options and Stock Futures.

The Nifty Index futures witnessed rise in open interest by 1% for August series and 17% rise for the September series. Implied volatility (IV) fell for call option and put option in the last week. Fall in IV for call option and put option shows steady support for Nifty at present levels.

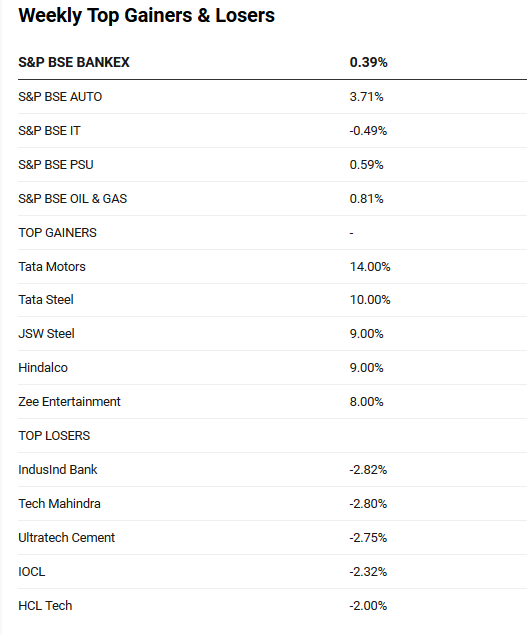

The BSE Sensex index closed on a flat note on Friday as investors remained cautious amid rising tensions between the US and China. During the week, RBI kept the repo rate at 4.00% and reverse repo rate at 3.35% and forecasted Fy21 GDP real growth to be negative.

Click here to read our RBI policy-meeting analysis note.

On domestic earnings front, Cipla reported 9% revenue growth, 16% EBITDA growth, EBITDA margins improved by 145 bps and net profit 21% up. India business for Cipla up by 16%, South Africa market 24% up and US markets 14% (q-o-q). zero debt company as of June 2020. Continued to deliver better than market growth despite COVID-19 issues. Lower expenses improved margins and profitability. Affle India reported 23% revenue growth and 43% net profit growth. Ebit margins declined to 11% from 27%. Bata reported 71% drop in revenue and Rs. 1 billion loss compared to Rs. 1 billion profit during same quarter last year mainly due to closure of stores.

On global front, Wall Street closed on a mixed note on Friday, as the US-China tensions and uncertainty over fresh stimulus dampened investors sentiment. During the week, Dow Jones surged by 3.80%, Nasdaq gained by 2.50% and S&P 500 rose by 1.9%.

European stocks erased early losses to close slightly higher on Friday after the US reported stronger-than-expected jobs growth in July 2020. In addition, data in Europe showed industrial output in Germany and France grew more than expected in June and German exports jumped 14.9% from a month earlier. During the week, FTSE gained by 2.30% and DAX surged by 3%.

During the week, Brent Crude Oil gained by 2%. However, sentiment for Brent crude oil on Friday was weak amid escalating tensions between the US and China and mounting concerns that a spike in global coronavirus infections could hamper fuel demand recovery.

Global Economy

The US economy added 1.76 million jobs in July 2020, easing from a record 4.8 million in the previous month, as a resurgence in COVID-19 cases hit the labor market recovery. The US unemployment rate dropped to 10.2% in July of 2020 from 11.1% in June 2020 and below market expectations of 10.5%.

The IHS Markit US Services PMI was revised higher to 50 level in July 2020 from a preliminary estimate of 49.6 level and compared to June's final reading of 47.9 level. The latest PMI figure signaled a stabilization in service sector business activity as economy continued to reopen following coronavirus-induced lockdowns in prior months.

The US trade deficit narrowed to USD 50.7 billion in June 2020 from a revised 18 month high of USD 54.8 billion in the previous month and compared to market expectations of USD 50.1 billion. Both exports and imports rebounded firmly as global demand recovers from the coronavirus shock.

China's trade surplus widened sharply to USD 62.33 billion in July 2020 from USD 44.02 billion in the same month the previous year and far above market expectations of USD 42 billion. Exports rose by 7.2%, the fastest pace since December 2019, while imports unexpectedly fell by 1.4%.

China's current account surplus widened to USD 119.6 billion in Q2Fy20 from USD 30.52 billion in the same period last year. That was the largest current account surplus since an all-time high of USD 133.1 billion in the last three months of 2008, as the economy recovers from the coronavirus shock.

The number of Americans filing for unemployment benefits rose by 1.2 million in the week ended 01st August 2020, the least since the pandemic started and compared to market expectations of 1.4 million. It was also the largest weekly drop in jobless benefits applications in almost two months.

US crude oil stocks slumped by 7.373 million barrels in the week ended 31st Jul 2020, after a 10.612 million decrease in the previous period and compared to market expectations of a 3.001 million drop, according to the EIA Petroleum Status Report.