Equity Markets Snapshot For The Week

- USA and China will publish trade figures.

- USA will publish non-farm payroll data.

- Domestic investors will watch for Q1Fy21 earnings and RBI monetary policy outcomes.

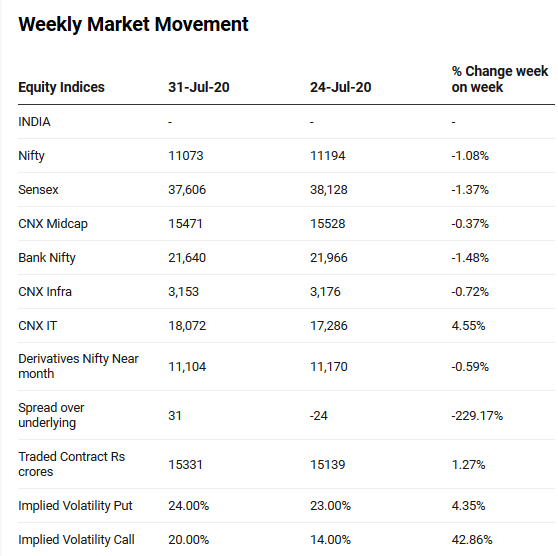

- Implied volatility (IV) for put and call at the money options stood at 24 and 20 levels respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 218 billion in June 2020 and bought shares worth Rs. 75 billion in July 2020 Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Index Futures, Index Options and Stock Futures.

The Nifty Index futures witnessed rise in open interest by 204% for August series and 118% rise for the September series. Implied volatility (IV) rose for call option and put option in the last week. Rise in IV for call option and put option shows unsteady support for Nifty at present levels.

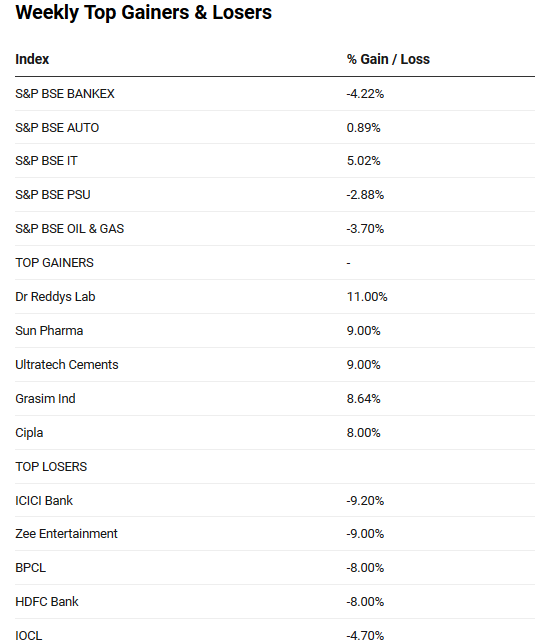

The BSE Sensex index closed on a negative note on Friday, with heavyweight Reliance Industries and HDFC Bank leading the losses and with Bharti Airtel, Infosys, and Sun Pharma among the top gainers. India's economic recovery continued to worry investors as a resurgence in coronavirus cases could lead to prolonged lockdown measures. On macro-economic front, Infrastructure output in India fell 15% (Y-o-Y) in June 2020, following a downwardly revised 22% drop in the previous month and a record 37% plunge in April 2020. India's fiscal deficit widened to Rs. 6.62 trillion in April-June 2020-21 from Rs. 4.32 trillion in the corresponding period of the previous fiscal year.

On domestic earnings front, SBI reported 81% (Y-o-Y) rise in net profit due to one-off gains on account of stake sale from SBI Life Insurance, NII rose by 16% (Y-o-Y), bad loans provisions fell by 19% (Y-o-Y) and Net NPA ratio stood at 1.88%. Sun Pharma reported 9% (Y-o-Y) fall in revenues, operating profits declined by 8% (Y-o-Y) and EBITDA margins stood at 23.3%. Reliance Industries reported 44% (Y-o-Y) fall in revenues, operating profit fell by 21% (Y-o-Y). Revenue from refining and Petro-chemical business declined by 54% (Y-o-Y) & 33% (Y-o-Y) respectively.

On global front, Wall Street closed in green on Friday lead by rally of Tech companies as the earnings for the quarter were better than expectations. On the macro side, consumer confidence in the US fell to 72.5 levels in July 2020 from 78.1 levels in June 2020 amid a resurgence in coronavirus cases. Investors continued to flock to safe-haven assets and gold hit a new all-time high of USD 2000 an ounce. During the week, Dow Jones declined by 0.20%, Nasdaq surged by 3.69% and S&P 500 gained by 1.61s%.

European indices closed in deep negative territory on Friday, as hopes for a V-shaped economic recovery in the UK faded after Prime Minister Boris Johnson announced the country will slow down its reopening efforts. During the week, FTSE slumped by 3.7% and DAX declined by 4%.

During the week, Brent Crude Oil gained by 5%, amid China's PMI data showed 5th consecutive positive data boosted investors sentiment over global economy recovery. Expectations of more stimulus in the US after official data showed the economy shrank at a record 32.9% annualized rate in Q2. On the supply side, latest data from both the EIA and API showed a surprise drop in US crude inventories last week.

Global Economy

The Federal Reserve held interest rates steady at 0%-0.25% during its policy meeting held on 29th July 2020. Outlook remained tepid on the economy and mentioned to continue using the full range of tools to support the economy.

The US economy shrank by an annualized 32.9% during Q2Fy20, compared to forecasts of a 34% plunge, the advance estimate showed. It is the biggest contraction ever, pushing the economy into a recession as the coronavirus pandemic forced many businesses shut.

The Eurozone economy shrank by 12.1% in June 2020 quarter, entering a steep recession. That was the biggest contraction on record, as lockdowns imposed to contain the spread of the coronavirus pandemic hit activity and global demand. All major economies in the region posted record declines in GDP: Spain (-18%), Italy (-12.4%), France (-13%) and Germany (-10%).

Industrial production in Japan rebounded 2.7% (M-o-M) in June 2020, compared to an 8.9% drop in the previous month and beating market expectations of a 1.2% increase, preliminary data showed. This ended four straight months of contraction in industrial output as the economy recovers from the COVID-19 shock.

The Manufacturing PMI in China rose to 51.1 levels in July 2020 from 50.9 levels in the previous month and compared with market estimates of 50.7 levels. This was the fifth straight month of increase in factory activity and the strongest since March 2020.

The number of Americans filling for unemployment benefits rose 1.43 million in the week ended 25th July 2020, lifting the total reported since 21st March 2020 to 54.1 million and compared to market expectations of 1.45 million.