Equity Markets Snapshot For The Week

- COVID-19 will remain in focus in the US as concerns about the second wave of infections are growing as several states are reporting an increase in new cases after easing the lockdowns. Investors will watch for corporate earnings.

- China will publish Q2 GDP growth figures.

- European Union leaders will meet to discuss a common recovery plan, while central banks in the Euro Area and Japan will be deciding on interest rates.

- Domestic investors will watch for Q1Fy21 earnings and inflation growth figures.

- Implied volatility (IV) for put and call at the money options stood at 24 and 19 levels respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 218 billion in June 2020 and sold shares worth Rs. 22 billion in July 2020 (till 12th July 2020). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Stock Options, Index Futures, Index Options and Stock Futures.

The Nifty Index futures witnessed rise in open interest by 7% for July series and 55% rise for the August series. Implied volatility (IV) fell for put option and rose for call option in the last week. Fall in IV for put option and rise in IV for call option shows unsteady support for Nifty at present levels.

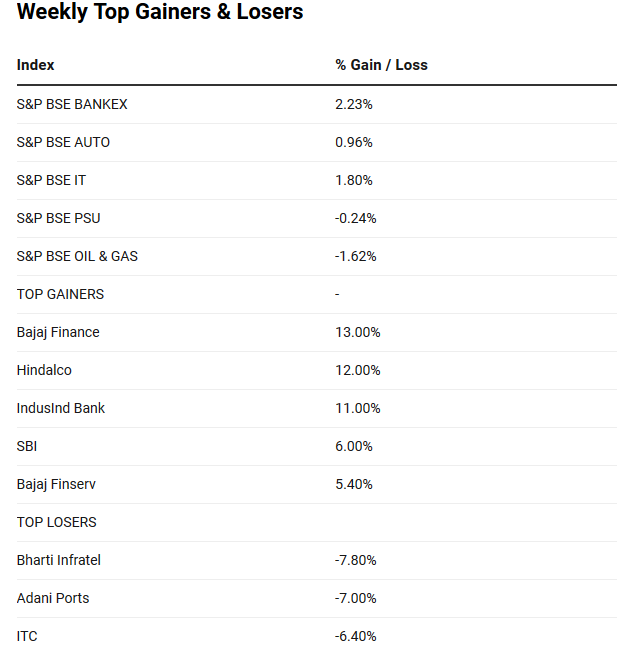

S&P BSE Sensex index declined by 0.4% on Friday, as surging coronavirus infections fuelled concerns about further lockdowns and the economic recovery. The number of cases in India, surpassed 866,000, forcing several state governments to re-impose the lockdown. During the week, Sensex and Nifty gained by 1.59% and 1.50% respectively. IMD reported rainfall has been 12% surplus this year so far. On Q1Fy20 earnings front, TCS reported 6.3% (Y-o-Y) revenue growth in constant currency terms, EBITDA margins at 23.6% and net profit margins stood at 18.3%. Management of TCS management said, Covid-19 impact has bottomed out and expects growth returning in coming quarters.

On global front, Wall Street closed deeply in green on Friday and the Nasdaq booked a new high led by Amazon and Netflix, as a potential COVID-19 treatment raised hopes for an economic recovery following mounting cases and hospitalizations in multiple US states and several countries. Gilead said that its antiviral remdesivir improved clinical recovery in COVID-19 patients, and reduced the risk of death by 62%, while BionTech announced its vaccine treatment could be ready for approval by December 2020. During the week, Dow Jones gained by 1%, Nasdaq surged by 4.02% and S&P 500 rose by 1%.

European stocks closed in green on Friday and investors braced for the next European Union summit on Recovery Fund Plan which is scheduled during next week. During the week, FTSE declined by 1% and DAX gained by 1%.

During the week, Brent Crude Oil gained by 2%, as International Energy Agency raised its 2020 oil demand forecast. On oil inventory front, data from both the EIA and the API showed US crude inventories rose unexpectedly last week.

Global Economy

Japan's current account surplus narrowed to JPY 1176.8 billion in May 2020 from JPY 1631.1 billion in the same month the previous year and compared to market expectations of JPY 1088 billion.

China's annual inflation rate rose to 2.5% in June 2020 from a 14-month low of 2.4% in the prior month and in line with market expectations. Food inflation accelerated to 11.1% from 10.6% in May 2020 as pork prices continued to rise. Car sales in China increased 11.6% to 2.3 million in June 2020, recovering for the third straight month from lows hit during the coronavirus lockdowns.

Producer prices in Japan decreased 1.6% in June 2020 after declining 2.7% in May 2020 and compared to market expectations of a 1.9% decline, mainly explained by a plunge in petroleum & coal prices and chemicals.

The number of Americans filling for unemployment benefits came in at 1.31 million in the week ended 4th July 2020, down from a revised 1.41 million claims in the prior week and below market expectations of 1.38 million. The latest number lifted the total reported since 21st March 2020 to 50 million.

US crude oil stocks rose by 5.654 million barrels in the week ended 04th July 2020, after posting the largest decrease for six months in the previous period and compared with market expectations of a 3.114 million decline, according to the EIA Petroleum Status Report.