RBI Policy Outcome will Set Trend for Sensex & Nifty

Equity Markets Snapshot For The Week

- The first presidential election debate between Donald Trump and Joe Biden will take a spotlight next week.

- US will publish jobs data.

- Domestic market participants will look out for RBI policy-meeting outcome.

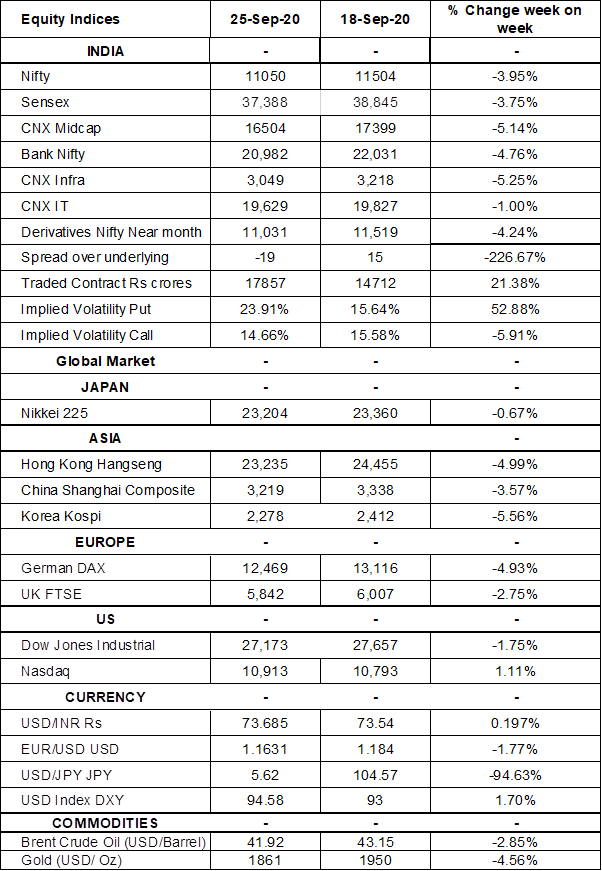

- Implied volatility (IV) for put and call at the money options stood at 23.91% and 14.66% levels respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 466 billion in August 2020 and sold shares worth Rs. 40 billion in September 2020 (till 27th September 2020).Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Index Futures, Stock Options and Stock Futures.

The Nifty Index futures witnessed rise in open interest by 628% for October series and 722% for the November series. Implied volatility (IV) fell for call option and rose for put option in the last week. Fall in IV for call option and rise in IV for put option shows unsteady support for Nifty at present levels.

The BSE Sensex index rebounded sharply on Friday as reports of likely stimulus package from government ahead of festive season boosted market sentiment. During last week, Sensex & Nifty declined by -3.75% & -3.95%.

On global front, US indices traded on a positive note on Friday. Recent warnings from Fed officials about a slowing economic recovery, new coronavirus infections and the risk of another set of lockdowns in Europe continue to weigh on market sentiment. During the week, Dow Jones slipped by 2%, Nasdaq gained by 1.11% and S & P 500 rose by 0.40%.

European indices rebounded in afternoon trading to close on a flat note on Friday, FTSE touched its weakest level since mid-May 2020 earlier in the session. Coronavirus concerns continued after both the UK and France reported a record daily rise in infections on Thursday. In addition, Spain continued to report higher number of confirmed COVID-19 cases. During the week, FTSE declined by 2.75% and DAX plunged by 5%.

During the week, Brent Crude Oil declined by 3%, spike in coronavirus infections worldwide raised fears about fuel demand recovery and concerns over the resumption of exports from Libya.

Global Economy

The IHS Markit US Services PMI fell to 54.6 levels in September 2020 from a 17-month high of 55 levels in the previous month and slightly below market expectations of 54.7 levels.

The IHS Markit US Manufacturing PMI increased to 53.5 levels in September 2020 from 53.1 levels in August 2020, beating forecasts of 53.1 levels.

The IHS Markit/CIPS UK Services PMI dropped to 55.1 levels in September 2020, from an over five-year high of 58.8 levels in August 2020 and compared to market expectations of 56 levels.

Japan's all industry activity index increased by 1.3% (M-o-M) in July 2020, after an upwardly revised 6.8% jump in June 2020.

Profits earned by China's industrial firms fell by 4.4% (Y-o-Y) to CNY 3.7 trillion in January-August 2020, after an 8.1% drop in the first seven months of the year, amid a further recovery from the COVID-19 pandemic.

US crude oil stocks fell by 1.639 million barrels in the week ended 18th September 2020, following a 4.389 million decrease in the previous period and compared to market expectations of a 2.325 million drop, according to the EIA Petroleum Status Report.