Q2Fy21 Earnings & Macro-Economic Data will be Watched

Equity Markets Snapshot For The Week:- Third-quarter results updates in US will be reported from this week starting with JP Morgan Chase, Citigroup, and Johnson & Johnson.Japan will publish current account figures.

- US will publish Industrial Production data.

- Domestic market participants will look out for Inflation data & Q2Fy21 Corporate Earnings.

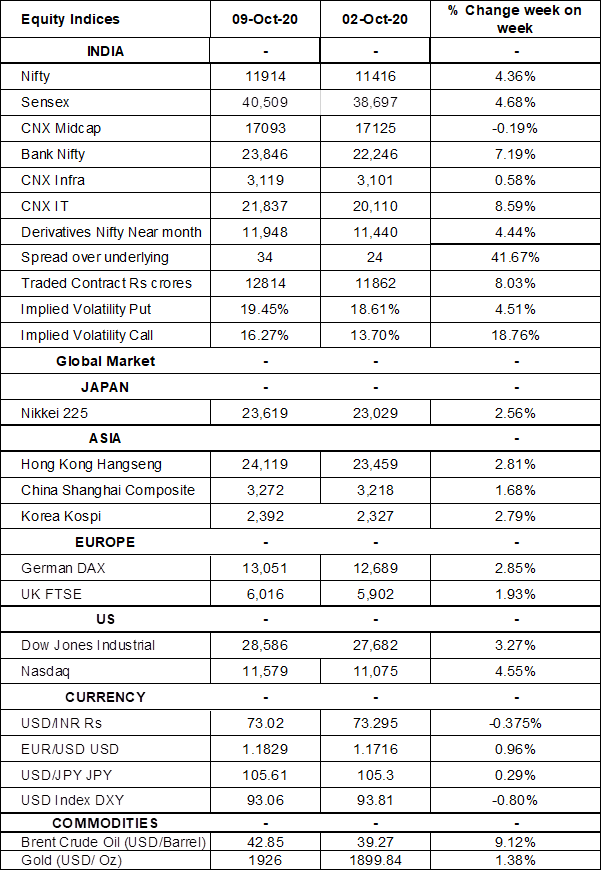

- Implied volatility (IV) for put and call at the money options stood at 19% and 16% levels, respectively.

The Nifty Index futures witnessed a rise in open interest by 9% for the October series and 307% for the November series. Implied volatility (IV) rose for call option and put option in the last week. Rise in IV for call option and put option shows unsteady support for Nifty at present levels.

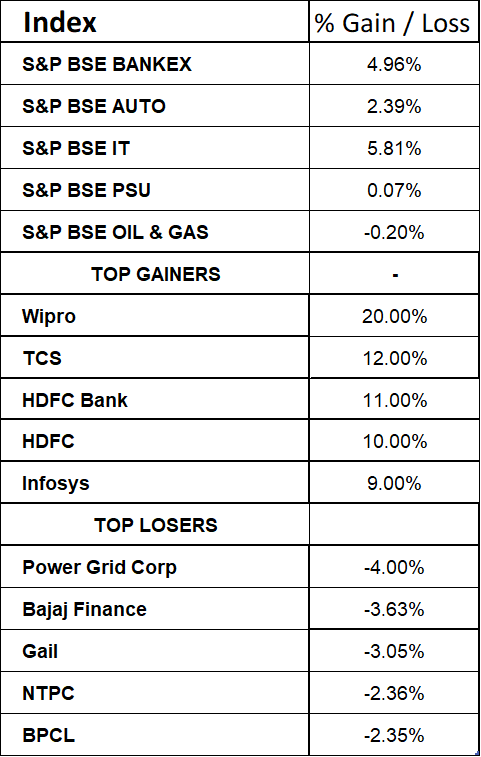

BSE Sensex & Nifty witnessed strong weekly gains of 4.68% & 4.36%, respectively. Upbeat deposit growth & loan book growth from HDFC Bank, Bajaj Finance, Bandhan Bank, and IndusInd Bank boosted market sentiment, S&P BSE Banked surged by 5% during the last week. On the earnings front, TCS reported 4.8% (Q-o-Q) growth in revenues, 6.6% (Q-o-Q) rise in net profit and margins expanded to 26.2%. Management of TCS provided vital commentary over the early return of demand and deal pipeline. Upbeat commentary from TCS management resulted in a rally in the share price of peer group companies like Wipro, Infosys & HCL Tech last week. On economic data front, India Services PMI increased to 49.8 levels in September 2020 from 41.8 levels in the previous month, easily beating market expectations of 44.7 levels.

RBI policy review for October 2020 was all about protecting bond yields from rising so that government borrowing can go through smoothly. Interest rates were maintained status quo though GDP growth forecast for this year is negative, while CPI inflation is expected to come off to closer to target levels of 4% from current levels of over 6%.Click here to read our analysis on RBI policy review.

On the global front, US indices positive streak extended for a third straight session on Friday, as jitters between the White House and Democrats on a new relief package continued. Third-quarter results updates will be reported from this week starting with JP Morgan Chase, Citigroup, and Johnson & Johnson. During the week, Dow Jones gained by 3.27%, Nasdaq surged by 4.55%, and S&P 500 increased by 3.30%.

European indices traded on a mixed note on Friday,upbeat data on China service sector activity improved market sentiment. Meanwhile, a resurgence in coronavirus cases across Europe and its impact on the region's economic recovery continued to worry investors. During the week, FTSE gained by 1.93% and DAX surged by 2.9%.

Brent Crude Oil gained by 9% during the week, amid prospects of more production outages in Europe's North Sea due to an oil-workers strike and Hurricane Delta in the US Gulf Coast halted nearly 1.67 million barrels per day & forced energy companies to shut.

During the week, Gold gained by 1.4% amid a surge in Covid-19 cases across the globe, has raised concerns over prolonged economic recovery. Also, weak dollar boosted sentiment for Gold.

Global Economy

Fed September policy meeting minutes continued to highlight the uncertainty surrounding the economic outlook. With inflation running persistently below Fed's longer-run goal, the Fed judged that it would be appropriate to aim to achieve inflation moderately above 2% for some time.The trade gap in the US widened to USD 67.1 billion in August 2020 from a downwardly revised USD 63.4 billion in July and higher than market forecasts of USD 66.1 billion. It is the largest trade deficit since a record high in August 2006 as imports returned to pre-pandemic levels while exports rose slower.

The IHS Markit US Services PMI was confirmed at 54.6 levels in September 2020, down from the previous month's 17-month high of 55 levels.

ECB September policy meeting minutes showed that policymakers stand ready to take further action to support Europe's economic recovery and inflation amid the COVID-19 crisis, with measures including cutting interest rates deeper into negative territory and changing the conditions of the TLTROs

The China General Services PMI rose to 54.8 levels in September 2020 from 54 levels a month earlier. This was the fifth straight month of growth in the sector and the steepest since June 2020, amid a further recovery from the COVID-19 pandemic.

Japan's current account surplus shortened modestly to JPY 2103 billion in August 2020 from JPY 2135 billion in the same month of the previous year and compared to JPY 1984 billion's market expectations.

The number of Americans filing for unemployment benefits rose by 840,000 in the week ended 03rd October 2020, compared to an upwardly revised 849,000 in the previous period and above market expectations of 820,000

The EIA data showed crude oil stockpiles in the US rose by 0.501 million barrels last week, more than market expectations.