Markets to move on fresh stimulus talks in US

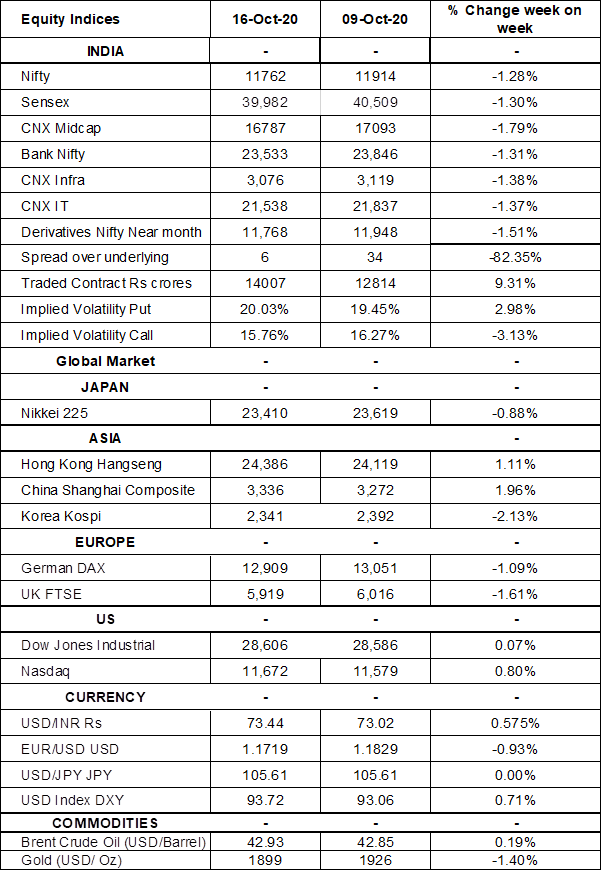

Equity Markets Snapshot For The Week:- Next week will see the final US presidential debate between Trump and Biden.

- PMI surveys for the US, UK, Eurozone, Japan and Australia will be keenly watched.

- China will publish GDP growth.

- Domestic market participants will look out for Q2Fy21 Corporate Earnings.

- Implied volatility (IV) for put and call at the money options stood at 20% and 16% levels, respectively.

FIIs/FPIs have sold Indian equity shares worth Rs. 77.83 billion in September 2020 and bought shares worth Rs. 85 billion in October 2020 (till 16th October 2020).Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a fall in open interest by 8% for the October series and rise in open interest by 146% for the November series. Implied volatility (IV) rose for call option and put option in the last week. Rise in IV for put option and fall in IV for call option shows unsteady support for Nifty at present levels.

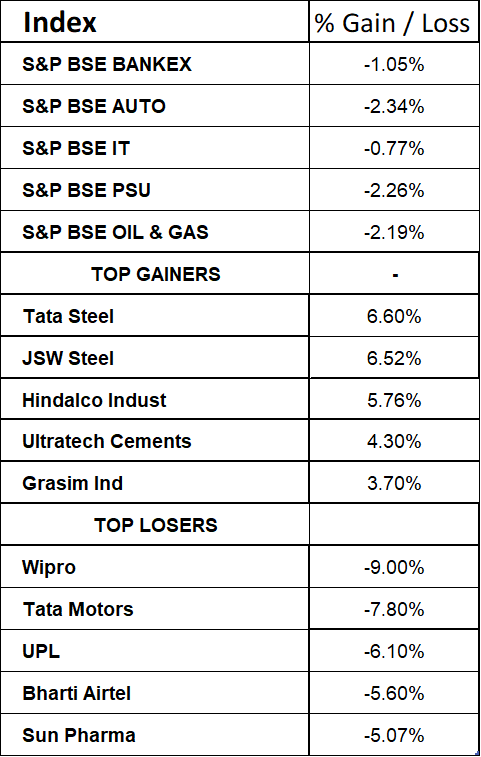

BSE Sensex & Nifty witnessed volatility during the week and closed on weekly loss of 1.30% & 1.28%, respectively. However, on Friday Sensex & Nifty closed on positive note, as bank and tech stocks led the gains as they tried to recover from the previous day's sharp sell-off. Investors cheered news that the India's exports in September grew by 6% (Y-o-Y) while imports plunged nearly 20% (Y-o-Y). On macro-data front, industrial production slumped 8% from a year earlier in August 2020, compared to market expectations of a 7.5% contraction. CPI inflation stood at 7.34% and WPI stood at 1.32%.

On the global front, US indices closed mixed on Friday after three consecutive drops. Mixed economic data and lack of clarity on economic stimulus lead to sharp declines during the week. During the week, Dow Jones gained by 0.07%, Nasdaq rose by 0.80%, and S&P 500 declined by 0.5%.

Stock markets across Europe recorded their best session in nearly three weeks on Friday, recovering from a steep sell-off in the previous day, after Pfizer said it expects to provide safety data and file for authorization of its COVID-19 vaccine as soon as November 2020. During the week, FTSE declined by 1.61% and DAX fell by 1.09%.

Brent Crude Oil prices remained flat during the week, investors remain worried about fuel demand recovery as the number of coronavirus infections continue to rise and several countries including France, Germany, Spain and Italy imposed fresh movement restrictions. Putting a floor under prices were figures from the EIA which showed crude oil stockpiles in the US fell by 3.818 million barrels last week and the API which reported a drop of 5.42 million barrels.

Global Economy

Annual inflation rate in the US edged up to 1.4% in September 2020 from 1.3% in August 2020, in line with expectations and reaching the highest since March 2020. Inflation has been rising consistently since hitting 0.1% in May 2020, the lowest since September 2015, due to the coronavirus crisis.

Industrial production in the US fell 0.6% in September 2020, its first decline in five months, and missing market expectations of 0.5% growth.

The US posted a budget deficit of USD 125 billion in September 2020, compared with an USD 83 billion surplus in the same period last year and market expectations of a USD 124 billion gap.

The Eurozone's trade surplus widened to EUR 14.7 billion in August 2020 from 14.4 billion in the same month of the previous year but below market expectations of a EUR 15 billion surplus.

China's annual inflation rate eased to 1.7% in September 2020 from 2.4% in the previous month and slightly below market expectations of 1.8%.

China's trade surplus narrowed to USD 37 billion in September 2020 from USD 39.1 billion in the same month the previous year, the smallest since March 2020 and far below market expectations of USD 58 billion.

Japan's industrial production rose by 1% from the previous month in August 2020, compared with a 8.7% growth in the prior month, signalling a slowdown in economic recovery.

The number of Americans filling for unemployment benefits rose to 898,0000 in the week ended 10th October 2020, the highest level in almost two months and well above market expectations of 825,000.

US crude oil inventories dropped by 3.818 million barrels in the week ended 09th October 2020, following a 0.501 million increase in the previous period and compared to market expectations of a 2.835 million fall, according to the EIA Petroleum Status Report.