Stimulus Pill Would Drive Markets

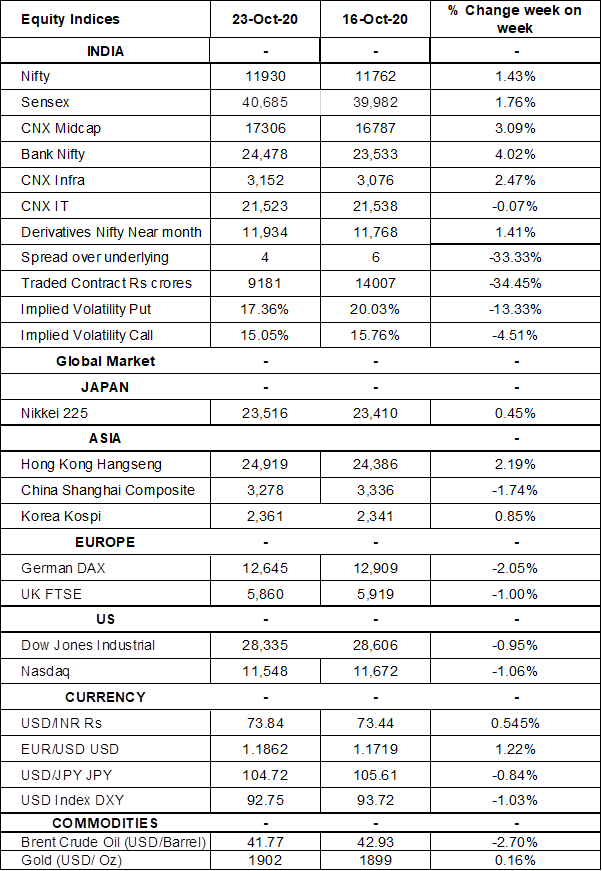

Equity Markets Snapshot For The Week:

- US will publish Q3 GDP growth.

- Alphabet, Apple, Amazon, and Facebook due to report their quarterly results.

- ECB and the BoJ will announce their monetary policy decisions.

- Domestic market participants will look out for Q2Fy21 Corporate Earnings.

- Implied volatility (IV) for put and call at the money options stood at 17% and 15% levels, respectively.

FIIs/FPIs have sold Indian equity shares worth Rs. 77.83 billion in September 2020 and bought shares worth Rs. 156 billion in October 2020 (till 25th October 2020). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a fall in open interest by 1.3% for the October series and fall in open interest by 27% for the November series. Implied volatility (IV) rose for call option and put option in the last week. Fall in IV for put option and for call option shows steady support for Nifty at present levels.

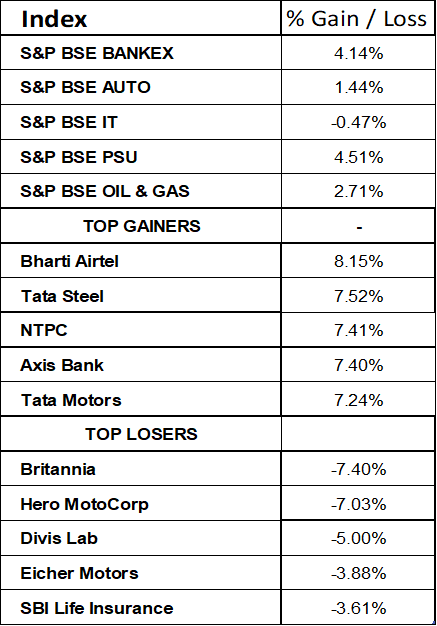

Sensex & Nifty closed on positive on Friday, rebounding from previous trading day’s losses supported by auto sector stocks. News that the FDA approved Gilead Sciences’ remdesivir drug as a treatment against the coronavirus and prospects about a new fiscal stimulus in the US lifted market sentiment. During the week Nifty & Sensex gained by 1.43% & 1.76%.

On the global front, US indices closed on a negative note, as fiscal stimulus uncertainty continued amid rising Covid-19 cases in the US. During the week, Dow Jones declined by 0.95%, Nasdaq corrected by 1%, and S&P 500 down by 0.8%.

European stocks closed on a strong note on Friday, amid strong guidance from auto companies. Germany’s Daimler AG raised its full-year profit forecast and reported stronger-than expected quarterly results while Renault said it should have positive cash flow from cars by the end of 2020. During the week, FTSE declined by 1% and DAX fell by 2%.

Brent Crude Oil prices declined by 3% during the week, investors remain worried about fuel demand recovery as the number of coronavirus infections continue to rise and several countries including France, Germany, Spain and Italy imposed fresh movement restrictions. Libyan oil output is expected to rise further by the end of the month, also pressuring crude prices. However, prospects of an extension to OPEC-led supply cuts prevented further declines.

Global Economy

The IHS Markit US Services PMI rose to 56 levels in October 2020 from 54.6 levels in the previous month and beating market expectations of 54.6 levels. The IHS Markit US Manufacturing PMI edged up to 53.3 levels in October 2020 from 53.2 levels in September 2020.

The IHS Markit Eurozone Manufacturing PMI increased to 54.4 levels in October 2020 from 53.7 levels in September 2020, beating market forecasts of 53.1 levels. The reading pointed to the biggest increase in factory activity since August 2018 as output and new orders growth quickened. IHS Markit Eurozone Services PMI fell to 46.2 levels in October 2020 from 48 levels in the previous month and below market expectations of 47 levels.

The Eurozone current account surplus narrowed sharply to EUR 21.8 billion in August 2020 from EUR 32.1 billion in the corresponding period of the previous year.

Japan Manufacturing PMI rose to 48 levels in October 2020 from a final 47.7 levels a month earlier, preliminary data showed. This marked the slowest deterioration in the health of the manufacturing sector since January 2020. Japan Services PMI fell to 46.6 levels in October 2020 from a final 46.9 levels in September 2020.

The number of Americans filing for unemployment benefits declined to 787,000 in the week ended 17th October 2020, from the previous week's revised level of 842,000 and below market expectations of 860,000.

US crude oil inventories dropped by 1.001 million barrels in the week ended 16th October 2020, following a 3.818 million decrease in the previous period and compared to market expectations of a 1.021 million fall, according to the EIA Petroleum Status Report.