Equity Markets Snapshot For The Week:

- The US will publish non-farm payrolls.

- Domestic market participants will look out for Q2Fy21 Corporate Earnings.

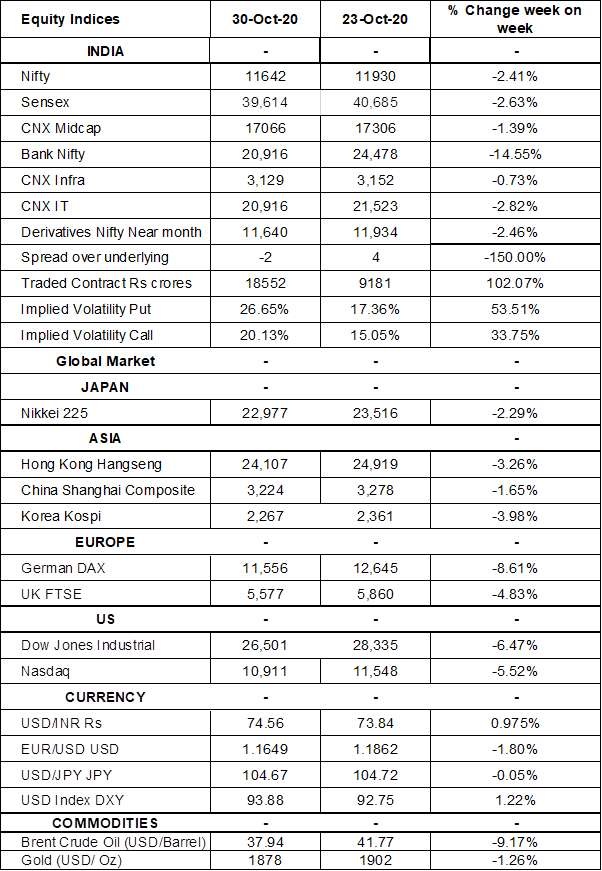

- Implied volatility (IV) for put and call at the money options stood at 26% and 17% levels, respectively.

USA Elections 2020 results have not been announced yet. Democratic candidate Joe Biden is leading Republican nominee, President Donald Trump, in terms of electoral votes. Markets are factoring in Biden's Win in USA Election 2020 as he's inching towards the majority of 270 mark. Joe Biden’s victory is positive for Sensex & Nifty as the US's new stimulus package will boost market sentiment and increase FII inflows in emerging markets.

FIIs/FPIs have sold Indian equity shares worth Rs. 77.83 billion in September 2020 and bought shares worth Rs. 195 billion in October 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a rise in open interest by 321% for the November series and rise in open interest by 123% for the December series. Implied volatility (IV) rose for call option and put option in the last week. Rise in IV for put option and for call option shows unsteady support for Nifty at present levels.

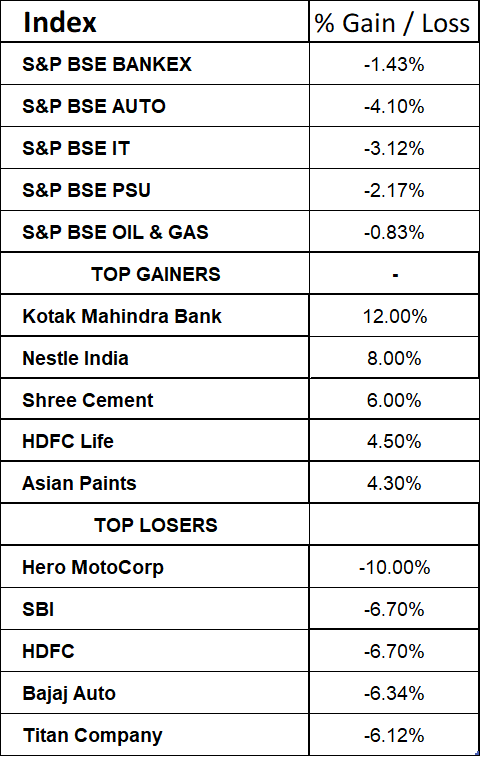

BSE Sensex index dropped 0.4% on Thursday, with Bharti Airtel, ICICI Bank, Maruti, HUL and Bajaj Finance among the worst performers, while Reliance Industries and Nestle India provided some support. On macro-economic front, infrastructure output in India went down 0.8% (Y-o-Y) in September 2020, following a downwardly revised 7.3% drop in August. India's fiscal deficit widened to INR 9.139 trillion in April-September 2020-21 from INR 6.515 trillion in the corresponding period of the previous fiscal year. That was equivalent to 114.8 percent of the government’s budget estimate for this financial year. During the week Nifty & Sensex declined by 2.41% & 2.63% respectively. Overall auto sales for October 2020 witnessed 18% (Y-o-Y) and 14% (M-o-M) growth.

On the global front, US indices traded lower on Friday, dragged down by tech shares as quarterly results of Apple, Facebook & Twitter came in lower than expectation. On contrast, Alphabet reported better than expected results. Meanwhile, investors remain concerned about rising coronavirus infections with US hitting another daily record on Thursday and the results of the presidential elections next Tuesday. During the week, Dow Jones declined by 6.5%, Nasdaq corrected by 5.52%, and S&P 500 down by 5%.

European stocks markets witnessed sharp fall in the month of October, amid concerns about Europe's economic recovery as several countries in the region were forced to impose new lockdowns to curb the spread of the pandemic. Weaker economic data from France and Germany worried investors. On Thursday, the ECB signaled more monetary stimulus might be delivered as soon as December. During the week, FTSE declined by 5% and DAX slumped by 9%.

Brent Crude Oil prices declined by 9% during the week, investors remain worried about fuel demand recovery as the number of coronavirus infections continue to rise and several countries including France, Germany, Spain, UK and Italy imposed lockdown.

Global Economy

The US economy expanded by an annualized 33.1% in Q3 2020, beating forecasts of a 31% surge. It is the biggest expansion ever, following a record 31.4% plunge in Q2.

Eurozone economy grew by 12.7% during September 2020, recovering from a record slump of 11.8% seen during the second quarter and easily beating market expectations of 9.4%.

The European Central Bank left monetary policy unchanged during its October 2020 policy- meeting, as policymakers took a wait-and-see approach until a new round of economic projections is unleashed in December 2020.

Japan's industrial production rose by 4% from the previous month in September 2020, compared with a 1% advance in the prior month.

Manufacturing PMI for China was at 51.4 levels in October 2020, little-changed from a seven-month high of 51.5 levels in the previous month and compared with market expectations of 51.3 levels.

The number of Americans filing for unemployment benefits declined to 751,000 in the week ended 24th October 2020, from the previous week's revised level of 791,000 and below market expectations of 775,000. Initial claims were at their lowest level since late March but remained well above pre-pandemic levels.

EIA reported a rise of 4.320 million barrels in US crude oil stockpiles in the week ended 23rd October 2020, above market expectations of a 1.23 million barrels increase.