Equity Markets Snapshot For The Week:

- The US & China will publish inflation figures.

- Domestic market participants will look out for Q2Fy21 Corporate Earnings & Inflation data.

- Implied volatility (IV) for put and call at the money options stood at 20% and 14% levels, respectively.

Democratic candidate Joe Biden won against Republican nominee, President Donald Trump in US Presidential Elections. Joe Biden’s victory is positive for Sensex & Nifty as the US's new stimulus package will boost market sentiment and increase FII inflows in emerging markets. However, corporates in USA will see higher tax rates & tighter regulations which could put pressure on profitability margins.

FIIs/FPIs have sold Indian equity shares worth Rs. 195 billion in October 2020 and bought shares worth Rs. 65 billion in November 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a rise in open interest by 2% for the November series and rise in open interest by 52% for the December series. Implied volatility (IV) fell for call option and put option in the last week. Fall in IV for put option and for call option shows steady support for Nifty at present levels.

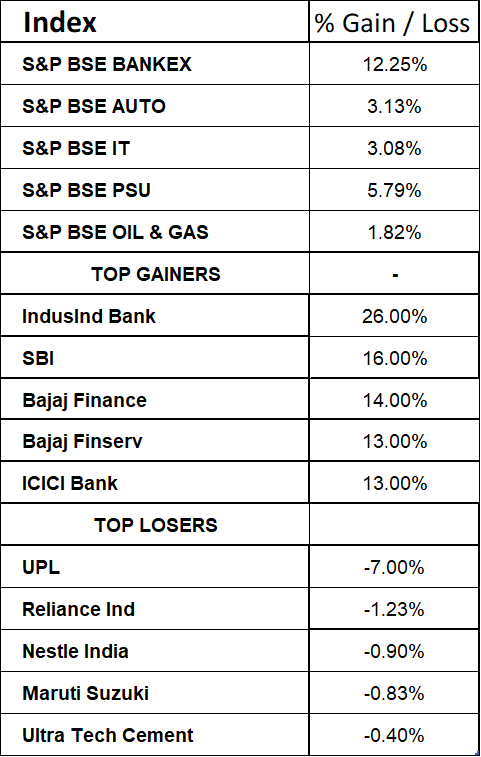

BSE Sensex index gained 1.34% on Friday, with Reliance Industries, Bajaj Finserv, IndusInd Bank and Kotak Mahindra among the top performers. Macro- data showed services activity in India grew for the first time since February in October 2020, suggesting that the relaxation of Covid-19 restrictions enabled to secure new work and lift business activity. Sentiment also strengthened following news that India will kick-start a major drive to attract global investors. During the week Nifty & Sensex gained by 5.33% & 5.75% respectively.

On the global front, US indices traded on a mixed note on Friday. On the macro side, the Labor Department said that 638,000 jobs were added in October 2020 to beat estimates of 530,000, while the unemployment rate fell to 6.9% from 7.9% in September 2020. During the week, Dow Jones gained by 7%, Nasdaq surged by 9%, and S&P 500 up by 6.5%.

European stocks markets witnessed sharp gains during the week as investors cheered for Joe Biden taking the lead in US Presidential Elections. Covid-19 cases continued to rise in Europe despite strict restrictions. Meanwhile, Bank of England increased its bond-buying program by 150 Billion Pounds to 875 Billion Pounds. During the week, FTSE gained by 6% and DAX surged by 8%.

Brent Crude Oil prices gained by 3% during the week supported by US crude stocks fell by 7.998 million barrels, the biggest decline in 2 months. Investors remain worried about fuel demand recovery as the number of coronavirus infections continue to rise.

Global Economy

The Federal Reserve left the target range for its federal funds rate unchanged at 0%-0.25% during its November 2020 policy-meeting, as policymakers took a wait-and-see approach amid US presidential election uncertainty. Officials warned that the ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The US economy added 638,000 jobs in October 2020, easing from an upwardly revised 672,000 in the previous month, but above market expectations of 600,000.

The trade deficit in the US fell to USD 63.9 billion in September 2020 from USD 67 billion in August 2020, in line with market forecasts of USD 63.8 billion. Exports rose by 2.6% and imported edged up at 0.5%.

The IHS Markit Eurozone Services PMI came in at 46.9 levels in October 2020, from a preliminary estimate of 46.2 levels and compared to September’s final 48 levels. It was the lowest reading recorded by the survey since May 2020 and indicated a second consecutive monthly decline in activity.

The IHS Markit Eurozone Services PMI was revised higher to 46.9 levels in October 2020, from a preliminary estimate of 46.2 levels and compared to September’s final 48 level. It was the lowest reading recorded by the survey since May 2020 and indicated a second consecutive monthly decline in activity.

China's trade surplus surged to USD 58.44 billion in October 2020 from USD 42.3 billion in the same month the previous year, and far above market expectations of USD 46 billion. Exports jumped by 11.4% while imports rose at a softer 4.7%.

The number of Americans filing for unemployment benefits declined to 751,000 in the week ended 31st October 2020, from the previous week's revised level of 758,000but above market expectations of 732,000. Initial claims were at their lowest level since late March 2020 but remained well above pre-pandemic levels.

EIA reported a rise of 4.320 million barrels in US crude oil stockpiles in the week ended 23rd October 2020, above market expectations of a 1.23 million barrels increase.