Equity Markets Snapshot For The Week:

- The US & China will publish industrial production figures.

- Japan will publish GDP growth & inflation figures.

- Domestic market participants will look out for Q2Fy21 Corporate Earnings.

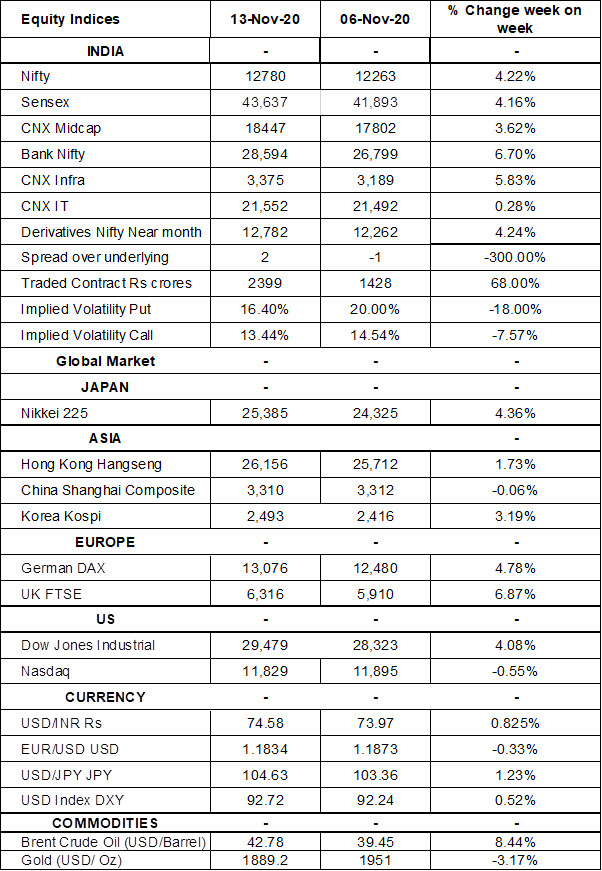

- Implied volatility (IV) for put and call at the money options stood at 16.40% and 13.44% levels, respectively.

FIIs/FPIs have sold Indian equity shares worth Rs. 195 billion in October 2020 and bought shares worth Rs. 294 billion in November 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a rise in open interest by 6% for the November series and rise in open interest by 62% for the December series. Implied volatility (IV) fell for call option and put option in the last week. Fall in IV for put option and for call option shows steady support for Nifty at present levels.

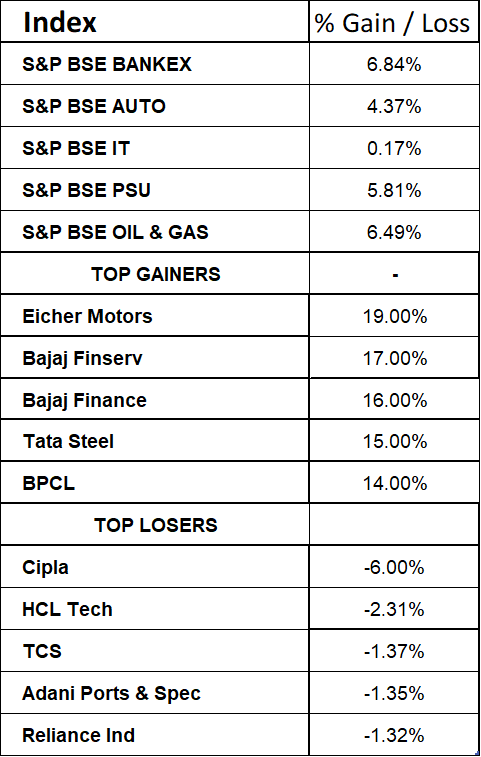

S&P BSE Sensex gained 300 points on Muhurat Trading supported by IT and Banking stocks. Macro - data showed that India's industrial production rebounded 0.2% from a year earlier in September 2020, the first month of growth since February 2020 and easily beating market expectations of a 2% slump. Annual consumer price inflation in India increased to 7.61% October 2020 from a downwardly revised 7.27% in September 2020, above market expectations of 7.3%. It is highest level since May 2014, remaining well above the central bank 2%-6% target range for a seventh straight month and lowering the chances of further interest rate cuts by the central bank.

On the global front, US indices traded on a positive note on Friday. On the corporate side, shares of Disney and Cisco rose after both companies booked quarterly results that beat consensus. Announcement of 90% success of Pfizer vaccine boosted market sentiment. During the week, Dow Jones gained by 4%, Nasdaq declined by 0.55%, and S&P 500 rose by 0.1%.

Brent Crude Oil prices gained by 8% during the week. Brent crude oil futures declined 1.7% on Friday, amid persistent concerns about near term fuel demand as the number of global coronavirus infections continue to rise. Latest data from the EIA showing US crude oil inventories unexpectedly rose in the first week of November and rising Libyan oil production pressured prices.

Global Economy

Annual inflation rate in the US fell to 1.2% in October of 2020 from 1.4% in the previous month and below market expectations of 1.3%. The rate remains well below 2.3% in February before the coronavirus pandemic hit.

Eurozone industrial production dropped 0.4% from a month earlier in September 2020, following four consecutive months of growth and missing market expectations of a 0.7% increase.

UK GDP expanded 15.5% in the three months to September 2020, partially recovering from a record contraction of 19.8% seen in the previous period and compared with market expectations of a 15.8% growth.

The Eurozone's trade surplus widened to EUR 24.8 billion in September 2020 from 18.4 billion in the corresponding month of the previous year and above market expectations of a EUR 22 billion surplus. Eurozone economy grew by 12.6% during September 2020, recovering from a record slump of 11.8% in the previous period.

The number of Americans filing for unemployment benefits declined to 709,000 in the week ended 7th November 2020, from the previous week's revised level of 757,000 and below market expectations of 735,000.

US crude oil inventories rose by 4.278 million barrels in the week ended 6th November 2020, following a 7.998 million drop in the previous period and compared with market expectations of a 0.913 million decrease, according to the EIA Petroleum Status Report.