Equity Markets Snapshot For The Week:

- The US will publish non-farm payroll data.

- Japan will publish industrial production data.

- Market participants will look out for outcome for OPEC+ meeting.

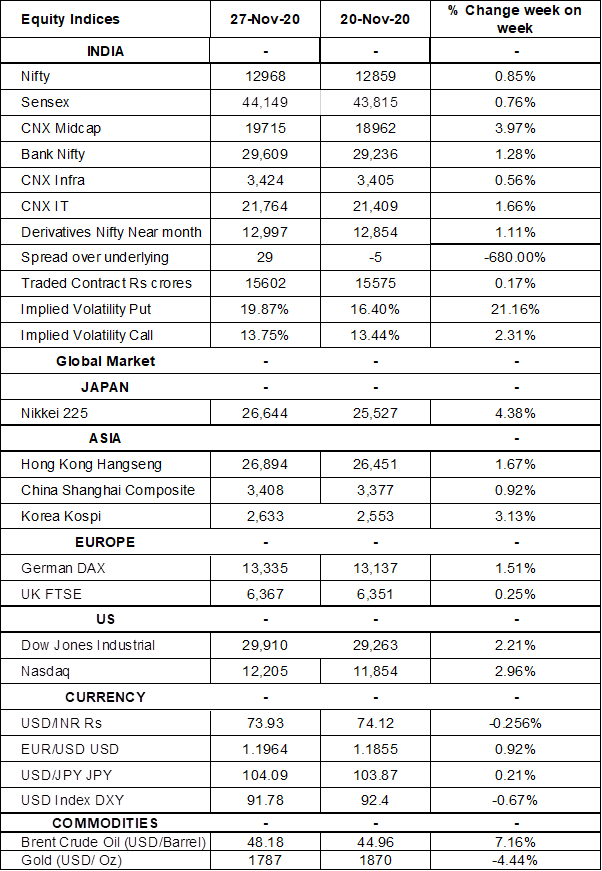

- Implied volatility (IV) for put and call at the money options stood at 20% and 13.75% levels, respectively.

FIIs/FPIs have sold Indian equity shares worth Rs. 195 billion in October 2020 and bought shares worth Rs. 603 billion in November 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a rise in open interest by 402% for the December series and fall in open interest by 25% for the January series. Implied volatility (IV) rose for call option and put option in the last week. Rise in IV for put option and for call option shows unsteady support for Nifty at present levels.

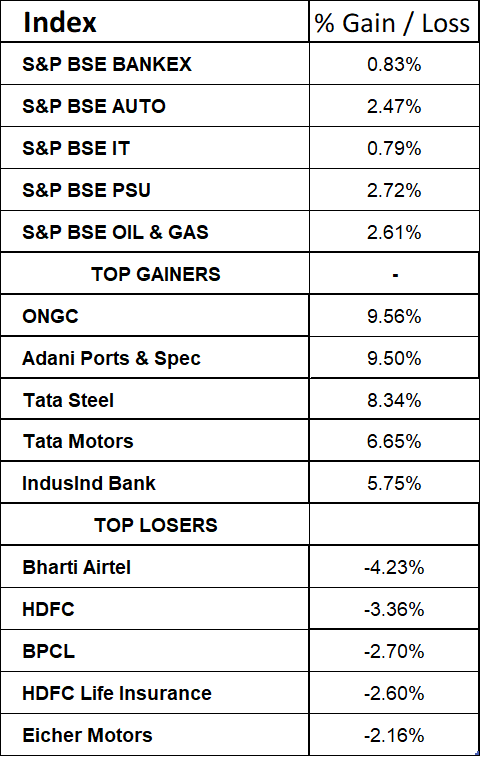

S&P BSE Sensex declined 100 points on Friday. Indian economy shrank 7.5% (Y-o-Y) during Q2Fy21 less than expectations of an 8.8% drop, amid easing of lockdown restrictions from June 2020, higher demand during festival season and a rebound in manufacturing and utilities. On weekly basis, Sensex & Nifty gained by 0.76% & 0.85% respectively. Auto stocks including Maruti Suzuki, Tata Motors, Ashok Leyland, Eicher Motors, Hero MotoCorp, Mahindra & Mahindra, Bajaj Auto and Escorts will be in focus on Tuesday as monthly volume sales data for November 2020 will be released.

On the global front, Wallstreet indices traded on a positive note on Friday, as investors expect Fed would raise asset purchase program and retail sales to surge during holiday season. During the week, Dow Jones gained by 2.2%, Nasdaq surged by 3%, and S&P 500 rose by 1.70%.

European stock markets closed on mixed note on Friday, closing at close to 9month highs amid relaxation of coronavirus restrictions across Europe, vaccine optimism and hopes that a post-Brexit trade deal would be reached. Meanwhile, the ECB has warned in its latest financial stability review that European banks will not see profits return to pre-pandemic levels before 2022. On weekly basis, DAX gained by 1.50% and FTSE rose by 0.25%.

Brent Crude Oil prices gained by 7% during the week, boosted by prospects for effective COVID-19 vaccines and hopes that OPEC+ would delay a planned rise in oil output. Concerns about near term fuel demand and oversupply worries continued to remain.

Gold prices declined by 4.4% during the and closed at 1787 USD/Oz. The risk appetite of investors improved on the optimism of Covid-19 vaccine effectiveness. On the other hand, a weaker dollar and low-interest rates environment has helped to stem further fall in Gold prices.

Global Economy

Fed November monetary policy meeting minutes showed policymakers noted that economic activity and employment had continued to recover but remained well below their levels at the beginning of the year and that the path of the economy would depend significantly on the course of the virus.

Markit US Composite PMI rose to 57.9 levels in November 2020 from 56.3 levels in the previous month, indicating the steepest month of expansion in the US private sector business activity. Markit US Services PMI rose to 57.7 levels in November 2020, from 56.9 levels in the previous month and beating market consensus of 55 levels.

Corporate profits in the United States rose 27.5% to USD 1,569.2 billion in the Q3Fy20, rebounding from a 11.7% plunge in the previous period. The US economy expanded by an annualized 33.1% in Q3 2020, in line with the advance estimate.

Profits earned by China's industrial firms rose by 0.7% (Y-o-Y) to CNY 5 trillion in January-October 2020, after a 2.4% drop in the first nine months of the year, as the economy gradually recovers from the COVID-19 crisis.

The number of Americans filing for unemployment benefits increased to 778,000 in the week ended 21st November2020, from the previous week's revised level of 748,000 and well above market expectations of 730,000.

US crude oil inventories dropped by 0.754 million barrels in the week ended 20th November 2020, following a 0.768 million increase in the previous period and compared with market expectations of a 0.127 million advance.