Equity Markets Snapshot For The Week:

- Central banks in the US, Japan and the UK will be deciding on monetary policy

- US and China will publish industrial output and retail sales.

- Market participants in India will look out inflation data.

- Implied volatility (IV) for put and call at the money options stood at 18% and 13% levels, respectively.

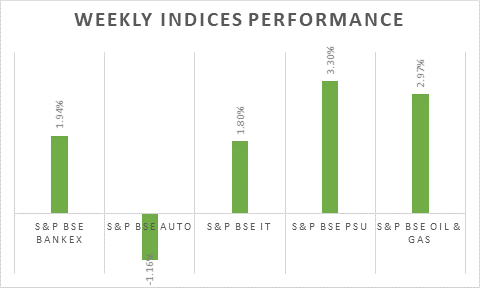

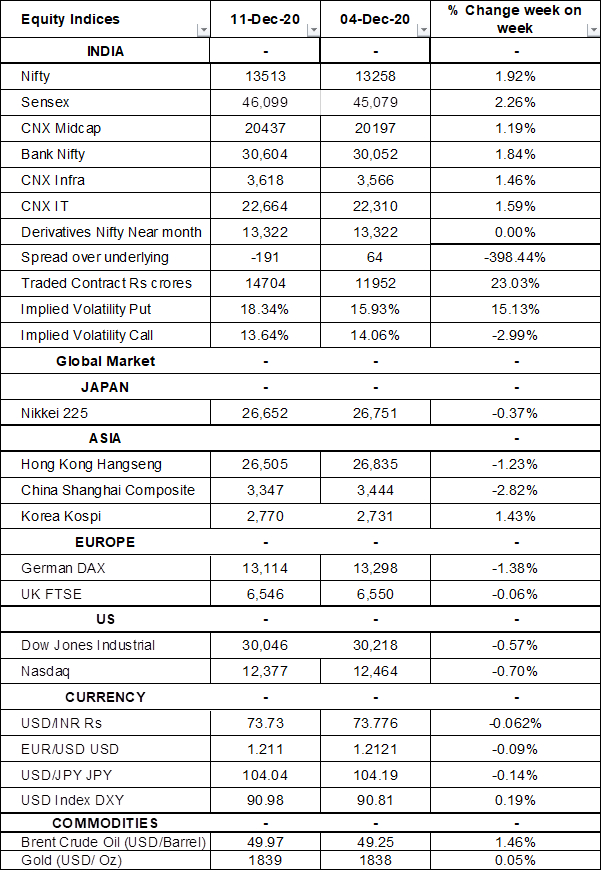

BSE Sensex index rose 2.26% from the previous week, booking a sixth straight weekly gain. The sentiment was supported by optimism over COVID-19 vaccines and signs of slowing India's rate of COVID-19 infections. Sensex & Nifty likely to correct from the current level as markets would witness profit booking, and uncertainty over the US stimulus package would add additional pressure.

FIIs/FPIs have bought Indian equity shares worth Rs. 603 billion in November 2020 and bought shares worth Rs. 333 billion in December 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a fall in open interest by 5% for the December series and fall in open interest by 42% for the January series. Implied volatility (IV) rose for put option and declined for call option in the last week. Fall in IV for call option and rise in IV for put option shows unsteady support for Nifty at present levels.

On the global front, stimulus package uncertainty led to Wall Street indices closing on mixed note. FDA advisory panel recommended the approval of Pfizer and Biontech’s COVID-19 vaccine for emergency use. During the week, Dow Jones declined by 0.60%, Nasdaq fell by 0.70%, and S&P 500 slipped by 0.85%.

European stock markets closed on negative note on Friday, during the week ECB chief Christine Lagarde said the bank expects the Eurozone GDP to expand by 3.9% next year, compared with its September forecast of 5%. The ECB increased the size of its pandemic purchase program by 500 billion Euros, and extended the scheme by nine months to March 2022. On weekly basis, DAX declined by 1.38% and FTSE closed on flat note.

Global Economy

The US posted a budget deficit of USD 145 billion in November 2020, the fiscal year's final month, compared with an USD 209 billion gap in the same period last year and market expectations of a USD 200 billion gap.

The European Central Bank expanded its Pandemic Emergency Purchase Programme (PEPP) by another 500 Euros billion and extended it to at least the end of March 2022 at its December monetary policy meeting, aiming to support the Eurozone's struggling economy amid the coronavirus crisis.

The consumer price index in China unexpectedly declined by 0.5% (Y-o-Y) in November 2020, after a 0.5% rise a month earlier and compared with market consensus of a flat reading.

Annual inflation rate in the US was unchanged at 1.2% in November of 2020, the same as in October and slightly higher than market forecasts of 1.1%.

The number of Americans filing for unemployment benefits increased to 853,000 in the week ended 5th December 2020 from the previous week's revised level of 716,000 and well above market expectations of 725,000.

US crude oil inventories dropped by 0.679 million barrels in the week ended 27th November 2020, following a 0.754 million decrease in the previous period and compared with market expectations of a 2.358 million fall, according to the EIA Petroleum Status Report.