Equity Markets Snapshot For The Week:

- PBOC will be deciding on monetary policy.

- US will publish GDP growth data.

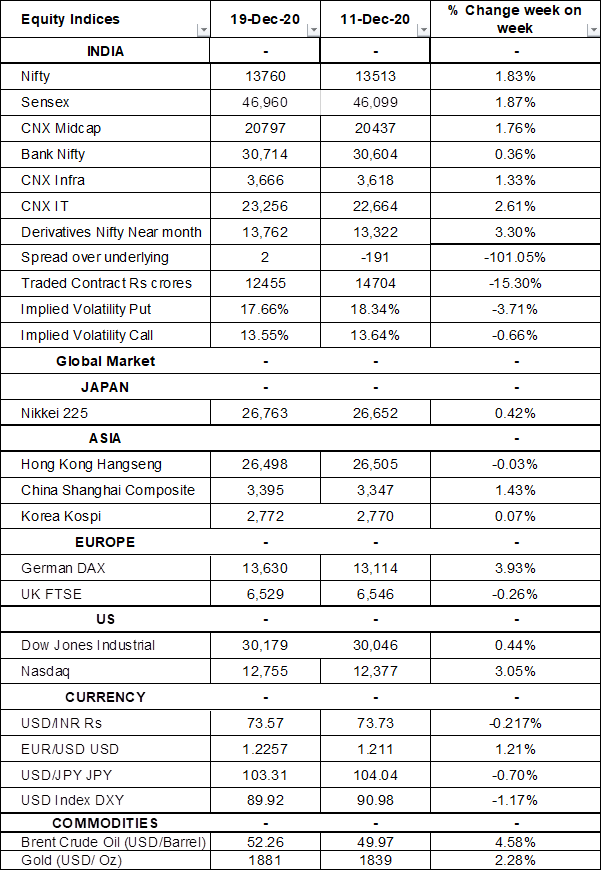

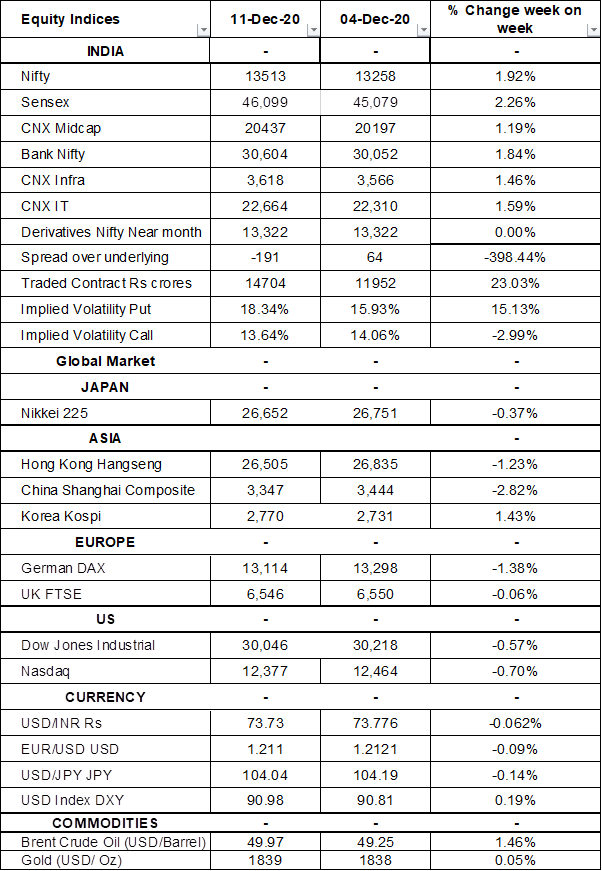

- Implied volatility (IV) for put and call at the money options stood at 18% and 13% levels, respectively.

BSE Sensex index rose 2% from the previous week, booking a 7th straight weekly gain. Market sentiment has been supported by record inflows from FIIs, the roll-out of COVID-19 vaccines, signs of a quicker economic recovery and optimism over a US stimulus package. On macro data front, industrial production increased 3.6% (Y-o-Y)in October 2020, easily beating market expectations of 1.1% growth. CPI inflation eased to 6.93% (Y-o-Y) in November 2020, from an over six-year high of 7.61% in the previous month and compared with market expectations of 7.10%. India trade deficit was revised slightly lower to USD 9.87 billion in November 2020 compared to an initial estimate of USD 9.96 billion.

FIIs/FPIs have bought Indian equity shares worth Rs. 603 billion in November 2020 and Rs. 488 billion in December 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a gain in open interest by 8% for the December series and by 37% for the January series. Implied volatility (IV) fell for put option and call option in the last week. Fall in IV for call option and put option shows steady support for Nifty at present levels.

On the global front, USD 900 billion stimulus package aid agreement has been approved by party leaders. During the week, Dow Jones rose by 0.44%, Nasdaq surged by 3%, and S&P 500 gained by 1%.

European stocks traded cautiously on Friday as investors still wait for a post-Brexit trade deal. On weekly basis, DAX gained by 4% and FTSE declined by 0.26%.

Global Economy

The Federal Reserve left the target range for its federal funds rate unchanged at 0%-0.25% during its December 2020 policy-meeting, in line with forecasts. The Fed will continue to increase its holdings of Treasury securities by USD 120 billion.

Current account gap in the US widened to USD 178.5 billion in Q3Fy20, slightly less than forecasts of a USD 189 billion gap. It is equivalent to 3.4% of the GDP, up from 3.3% in Q2Fy20.

Industrial Production in the US increased 0.4% from a month earlier in November 2020, easing from a downwardly revised 0.9% growth in October and slightly beating market expectations of 0.3%. Still, output remained 5% below its pre-pandemic level.

The Eurozone's trade surplus widened to EUR 30 billion in October 2020 from EUR 27.2 billion in the corresponding month of the previous year. Exports declined 9% and Imported tumbled by 11%.

The IHS Markit Eurozone Services PMI rose to 47.3 levels in December 2020 from 41.7 levels in the previous month, and easily beating market expectations of 41.9 levels.

Japan recorded a trade surplus of JPY 366.8 billion in November 2020, compared with a JPY 88.4 billion deficit a year earlier and market expectations of a JPY 530 billion surplus. Exports fell 4.2% and imports declined by 11%.

Japan Services PMI fell to a three-month low of 47.2 levels in December 2020 from 47.8 levels seen in the prior month.

The number of Americans filing for unemployment benefits increased to 885,000 in the week ended 12th December 2020, from the previous week's revised level of 862,000 and well above market expectations of 800,000.

US crude oil inventories dropped by 3.135 million barrels in the week ended 11th December 2020, following a 15.189 million increase in the previous week and compared with market expectations of a 1.937 million fall.