Equity Markets Snapshot For The Week:

- Domestic corporate earnings of Q3Fy21 will be reported from 13th January 2021.

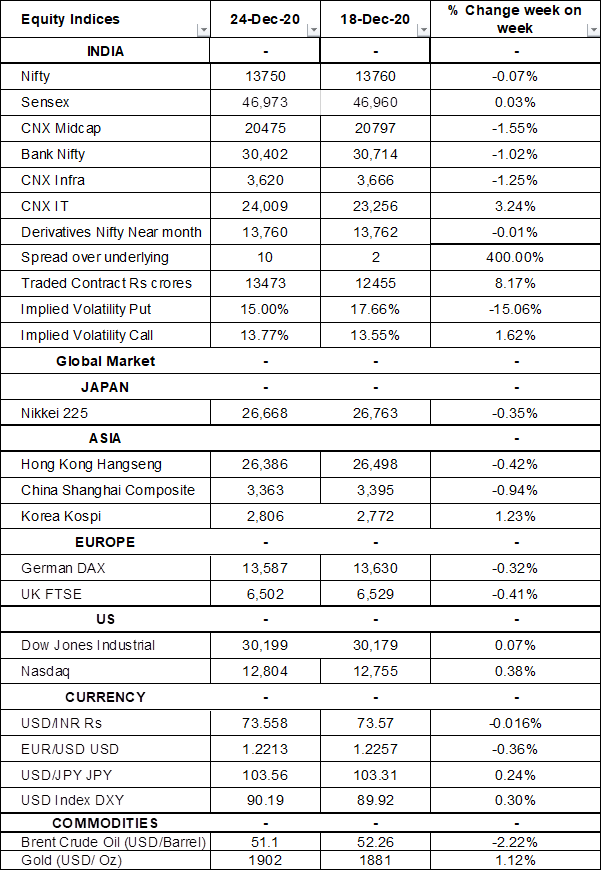

- Implied volatility (IV) for put and call at the money options stood at 15% and 13% levels, respectively.

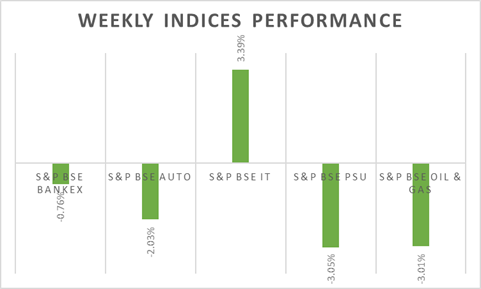

BSE Sensex index closed at record highs inching towards 47,000 mark. Sensex & Nifty recovered from the 3% drop witnessed on Monday due to worry over the mutated Covid-19 virus. Risk sentiment got a boost from a long-awaited Brexit trade deal, while fear of new coronavirus strain seems to be eased out. On weekly basis, Sensex & Nifty closed on a flat note.

FIIs/FPIs have bought Indian equity shares worth Rs. 603 billion in November 2020 and Rs. 566 billion in December 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Stock Futures and Index Futures.

The Nifty Index futures witnessed a fall in open interest by 18% for the December series and rise in open interest by 63% for the January series. Implied volatility (IV) fell for put option and rose for call option in the last week. Fall in IV for put option and rise in IV for call option shows unsteady support for Nifty at present levels.

On the global front, as the Eurozone & UK finally reached Brexit trade deal global markets closed on positive note. Wallstreet investors are still clueless about President Trump signing new spending bill. During the week, Dow Jones closed on flat note, Nasdaq gained by 0.4%, and S&P 500 declined by 0.51%.

Brent crude oil price declined by 2% during last week, as the investors were cautious on demand recovery for oil & oil derivative products.

Global Economy

Corporate profits in the United States rose 27% to USD 2.02 trillion during Q3Fy20, slightly less than estimated and compared with a 10.7% slump in the previous period. It was the sharpest increase in corporate profits since 2009, as the economy continued to recover from the coronavirus pandemic shock.

People's Bank of China injected CNY 110 billion of reverse repos into the market to maintain reasonable and sufficient liquidity of the banking system.

Profits earned by China's industrial firms rose by 2.4% to CNY 5.74 trillion in January-November 2020, after a 0.7% gain in the first 10 months of the year, as the economy recovered further from the COVID-19 crisis. Profits at private-sector grew 1.8%, while those at state-owned industrial firms fell 4.9%.

Industrial output in Japan was unchanged in November from the previous month, compared with a 4% advance in October 2020 and against market expectations of a 1.2% expansion.

US crude oil inventories dropped by 0.562 million barrels in the week ended December 18th, 2020, following a 3.135 million fall in the previous week and compared with market expectations of a 3.186 million decline.

The number of Americans for unemployment benefits decreased to 803,000 in the week ended 19th December 2020, from the previous week's three-month high of 892,000 and compared with market expectations of 885,000.