Equity Markets Snapshot For The Week:

- FED policy-meeting minutes will be released.

- Eurozone will publish inflation and industrial output data.

- Domestic corporate earnings of Q3Fy21 will be reported from 8th January 2021.

- Markit India’s Manufacturing PMI for December will be released on Monday.

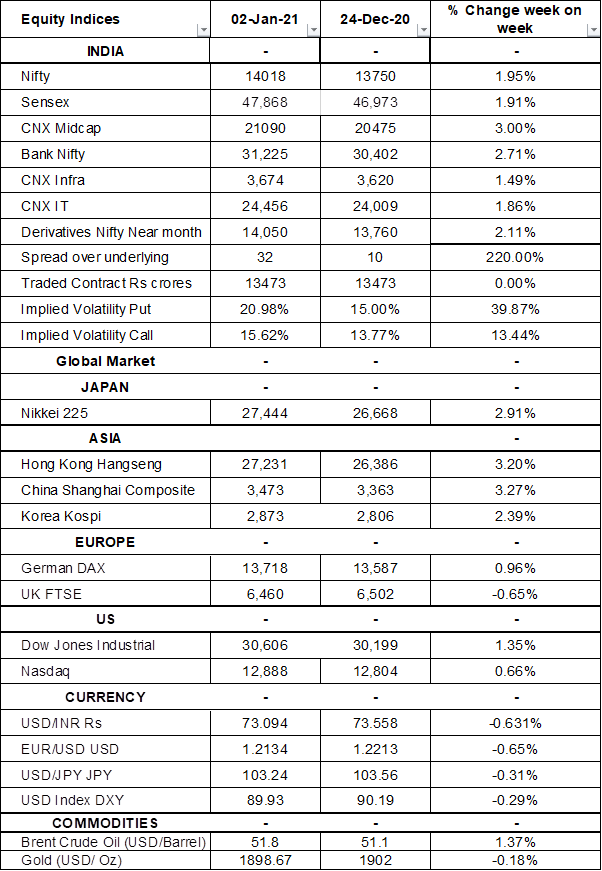

- Implied volatility (IV) for put and call at the money options stood at 21% and 16% levels, respectively.

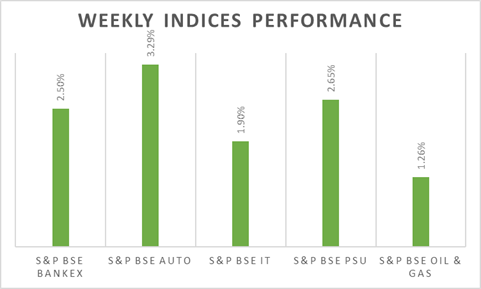

BSE Sensex index closed at record high 47,868 mark. According to Reuters, the budget expansion will rely on asset sales of around USD 40 billion for some of the funding and also India is likely to spend more next fiscal year than this year's budgeted. On the macro-economic front, Infrastructure output in India dropped by 2.6% (Y-o-Y) in November 2020, accelerating from a revised 0.9% decline in the previous month. India's fiscal deficit widened to an all-time high of Rs 10.75 trillion in April-November 2020-21 from Rs 8.08 trillion in the corresponding period of the previous fiscal year. That was equivalent to 135% of the government’s budget estimate for this financial year. India posted a USD 15.5 billion surplus in July-September 2020, or 2.4% of GDP. On weekly basis, Sensex & Nifty gained by 1.95% each.

FIIs/FPIs have bought Indian equity shares worth Rs. 620 billion in December 2020 and bought Rs. 6.17 billion in January 2021 (as of 03rd January 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Stock Futures and Index Futures.

The Nifty Index futures witnessed rise in open interest by 295% for the January series and rise in open interest by 136% for the February series. Implied volatility (IV) rose for put option and call option in the last week. Rise in IV for put option and rise in IV for call option shows unsteady support for Nifty at present levels.

On the global front, S&P 500 and Dow Jones touched fresh highs amid vaccine optimism and further prospects of fiscal stimulus in US. During the week, Dow Jones gained by 1.35%, Nasdaq rose by 0.66%, and S&P 500 jumped by 1.51%.

Global Economy

The number of Americans filing for unemployment benefits decreased to 787,000 in the week ended 26th December 2021, moving further away from a three-month high of 892,000 hit in the week ended 12th December 2021 and compared with market expectations of 833,000.

US crude oil inventories dropped by 6.065 million barrels in the week ended 25th December 2020, following a 0.562 million fall in the previous week and compared with market expectations of a 2.583 million decline, according to the EIA Petroleum Status Report.

China service PMI fell to 55.7 levels in December 2020 from an 8-1/2-year high of 56.4 levels a month earlier. Still, the latest reading pointed to the tenth straight month of increase in the service sector, as the economy recovered further from the COVID-19 crisis.