Equity Markets Snapshot For The Week:

- ECB policy-meeting minutes will be released.

- India will publish inflation and industrial output data.

- Domestic corporate earnings of Infosys, Wipro, HCL Tech and L&T Finance will be reported.

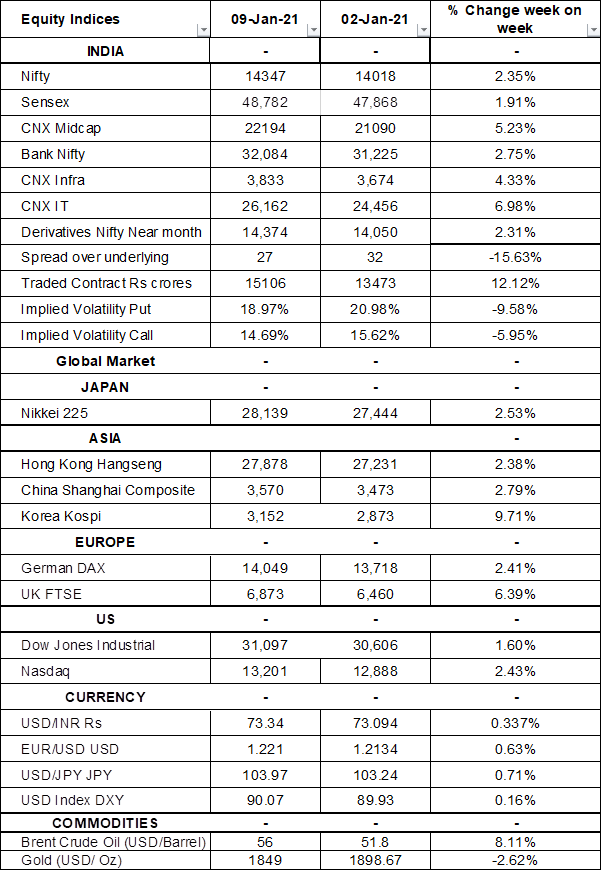

- Implied volatility (IV) for put and call at the money options stood at 19% and 14% levels, respectively.

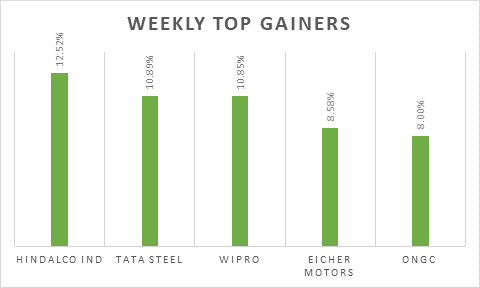

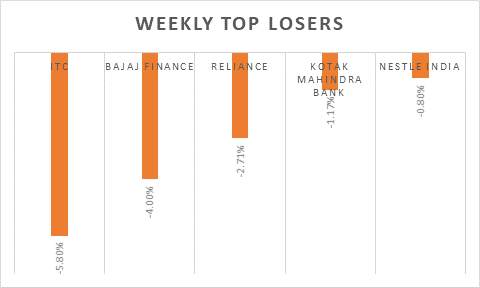

BSE Sensex index closed at record high 48,782 mark taking cues from Wall Street. On earnings front, TCS reported revenues growth of 0.4% (Y-o-Y) in constant currency terms, 5.4% (Y-o-Y) in INR terms, 4.1% (Q-o-Q) constant currency terms & 4.7% (Q-o-Q) INR terms. EBITDA margins stood at 26.6% and net profit margins reported at 20.7%. On yearly basis, healthcare segment showed 18% growth otherwise rest of them are at lower single digit growth. Geographic wise, domestic markets showed higher growth than North America & Europe. Avenue supermart reported 10% (Y-o-Y) growth in revenues. EBITDA margins at 9.1% and net profit up by 16%. Net profit margins reported at 6%. On weekly basis, Sensex & Nifty gained by 1.9% & 2.35% respectively .On the macro front, IHS Markit India Services PMI declined to 52.3 levels in December 2020 from 53.7 levels in the previous month, and below market expectations of 54 level.

FIIs/FPIs have bought Indian equity shares worth Rs. 620 billion in December 2020 and bought Rs. 48.19 billion in January 2021 (as of 10th January 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Stock Futures and Index Futures.

The Nifty Index futures witnessed rise in open interest by 7% for the January series and rise in open interest by 16% for the February series. Implied volatility (IV) fell for put option and call option in the last week. Fall in IV for put option and call option shows steady support for Nifty at present levels.

On the global front, S&P 500, Dow Jones, and Nasdaq touched fresh highs amid vaccine optimism and further prospects of fiscal stimulus in US under democrat-controlled congress. During the week, Dow Jones gained by 1.60%, Nasdaq rose by 2.43%, and S&P 500 jumped by 1.59%.

Brent crude gained by 8.4% during the week, Saudi Arabia engaged in voluntary production cuts of 1 million barrels per day in February 2020 and March 2020 to persuade other members to hold output steady during this period. Supporting prices further were a much bigger-than-expected drop in US crude stocks.

Gold declined by 2.7% during the week amid riots in US capitol pushed dollar and treasury yields up.

European stock markets extended gains on Friday, with DAX 30 closing at record high, market sentiment lifted by better-than-expected data on German industrial output.

Global Economy

The Federal Reserve reiterated it was committed to using its full range of tools to support the US economy, as the uncertainty surrounding the economic outlook remained elevated, minutes of the December 2020 policy meeting showed.

The US economy cut 140,000 jobs in December 2020, well below market expectations of a 71,000 rise. It is the first drop in employment since the job market started to recover in May 2020 from a record 20.787 million loss in April 2020.

The trade deficit in the US widened to USD 68 billion in November 2020 from USD 63 billion in October 2020, well above market expectations of USD 65.2 billion.

The IHS Markit US Services PMI was revised lower to 54.8 levels in December 2020, from a preliminary estimate of 55.3 levels and below November's five-and-a-half-year high of 58.4 levels.

The IHS Markit Eurozone Services PMI was revised lower to 46.4 levels in December 2020, down from a preliminary estimate of 47.3 levels and compared with November's six-month low of 41.7 levels.

China General Services PMI fell to 56.3 levels in December 2020 from a more than a decade-high of 57.8 levels in November, amid ongoing recovery in consumer demand after the country curbed its COVID-19 outbreak.