Equity Markets Snapshot For The Week:

- Central banks in the Euro Area, Japan and China will be deciding on monetary policy.

- Flash PMI surveys for the US, UK, Eurozone, Japan and Australia will be keenly watched.

- China will publish Q4 GDP growth data.

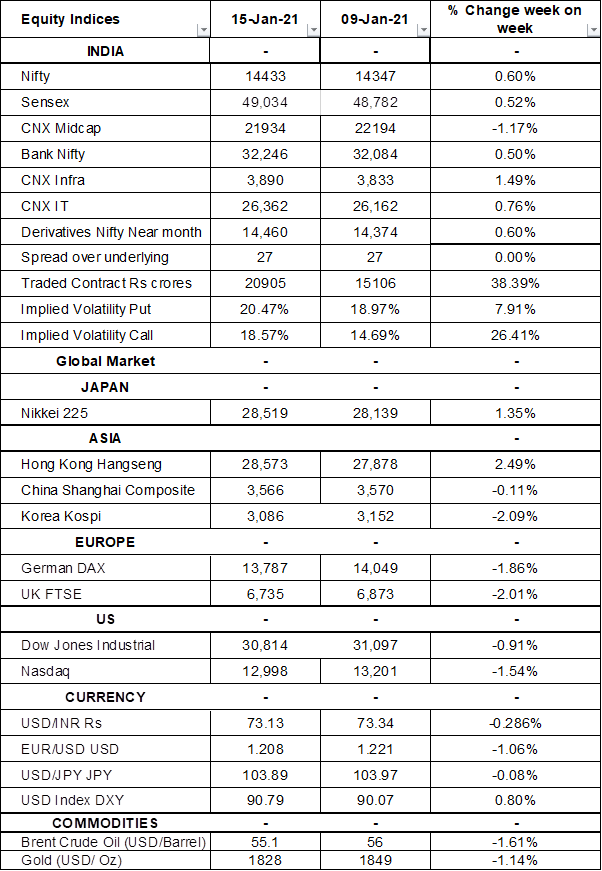

- Implied volatility (IV) for put and call at the money options stood at 20% and 19% levels, respectively.

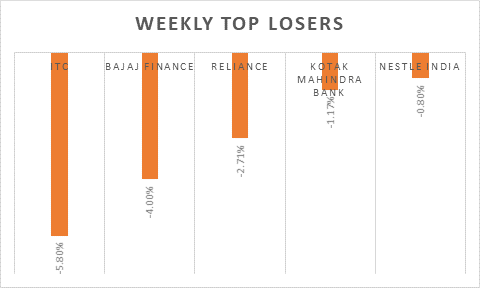

S&P BSE SENSEX shed 550 points on Friday, tracking US equities that ended lower overnight amid concerns that President Donald Trump's impeachment is complicating the early days of Joe Biden's presidency. On macro-data front, India's wholesale prices rose by 1.22 percent year-on-year in December 2020, industrial production fell 1.9% from a year earlier in November 2020, after rising an upwardly revised 4.2% in the previous month and compared with market expectations of a 0.4% drop. CPI inflation dropped to 4.59% (Y-o-Y) in December 2020, the lowest in 15 months, from 6.93% in November and below market expectations of 5.28%. The trade deficit in India was revised lower to USD 15.44 billion in December 2020 from a preliminary estimate of a USD 15.71 billion gap.

FIIs/FPIs have bought Indian equity shares worth Rs. 620 billion in December 2020 and bought Rs. 184 billion in January 2021 (as of 17th January 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Stock Futures, Stock Options and Index Options.

The Nifty Index futures witnessed fall in open interest by 4% for the January series and rise in open interest by 12% for the February series. Implied volatility (IV) rose for put option and call option in the last week. Rise in IV for put option and call option shows unsteady support for Nifty at present levels.

On the global front, Wall Street indices closed on negative note as the banking stocks have witnessed sell-off despite better-than-expected results. On stimulus front, American Rescue Plan proposal includes increasing the additional federal unemployment payments to USD 400 per week and extending them through September 2021. During the week, Dow Jones declined by 0.91%, Nasdaq fell by 1.54%, and S&P 500 corrected by 1%.

European indices declined steeply on Friday, with DAX and FTSE declining by 1%. Pfizer announced it would temporarily reduce deliveries of its vaccine to Europe while it upgrades its production capacity. Concerns about the pace of vaccination mounted in recent weeks as several European countries said they were receiving lower-than-expected supplies and complained about uncertainty over future deliveries. During the week, FTSE declined by 2% and DAX fell by 1.86%.

Global Economy

Annual inflation rate in the US increased to 1.4% in December 2020, from 1.2% in November 2020 and slightly higher than market forecasts of 1.3%.

Industrial production in the US advanced 1.6% from a month earlier in December 2020, following an upwardly revised 0.5% growth in November and easily beating market consensus of 0.5%.

China's trade surplus jumped to a fresh record high of USD 78.17 billion in December 2020 from USD 47.25 billion in the same month a year earlier, beating market expectations of a USD 72.35 billion. Exports soared 18% (Y-o-Y), the seventh straight month of increase, while imports rose at a softer 6.5%.

Eurozone industrial production rose 2.5% from a month earlier in November 2020, a seventh consecutive month of growth and compared with market expectations of a 0.2% increase.

Eurozone's trade surplus widened to EUR 25.79 billion in November 2020, from EUR 20.15 billion in the same period last year and compared with market expectations of EUR 26.0 billion. Exports fell 1% to EUR 197 billion and imports dropped at a faster 4.2% to EUR 171 billion.

US crude oil inventories dropped by 3.247 million barrels in the week ended 8th January 2021, a fifth consecutive period of decline and compared with market expectations of a 2.266 million fall, according to the EIA Petroleum Status Report.

The number of Americans filing for unemployment benefits increased to 965,000 in the week ended 9th January 2021, from the previous week's revised level of 784,000 and well above market expectations of 795,000. It was the highest number since mid-August, amid record increases in COVID-19 cases, deaths and hospitalizations and new restrictive measures across the country.