Equity Markets Snapshot For The Week:

- OPEC meeting outcome will be in spotlight.

- US will publish non-farm payroll data.

- Investors in India will watch FM Speech on Budget & RBI Monetary policy outcome.

- Implied volatility (IV) for put and call at the money options stood at 26% and 24% levels, respectively.

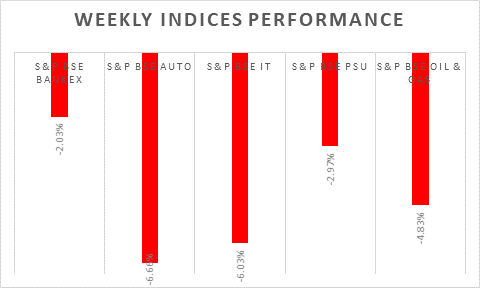

S&P BSE Sensex shed 560 points on Friday, in line with global weakness across markets as investors worried over stretched valuations. Meanwhile, Finance Minister Nirmala Sitharaman tabled the Economic Survey 2020-21 in the Parliament, projecting an 11% growth in the next financial year while GDP is expected to contract by a record 7.7% in the current fiscal year 2021. On macro-front, Infrastructure output in India dropped by 1.3% in December 2020, following a downwardly revised 1.4% fall in November 2020. India's fiscal deficit widened to a all-time high of INR 11.58 trillion in April-December 2020-21 from INR 9.32 trillion in the corresponding period of the previous fiscal year. That was equivalent to 145.5% of the government’s budget estimate.

FIIs/FPIs have bought Indian equity shares worth Rs. 620 billion in December 2020 and bought Rs. 194.73 billion in January 2021 (as of 31st January 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Index Futures, and Stock Options.

The Nifty Index futures witnessed rise in open interest by 348% for the January series and rise in open interest by 104% for the February series. Implied volatility (IV) rose for call option and for put option in the last week. Rise in IV for call option and for put option shows unsteady support for Nifty at present levels.

On the global front, Wall Street indices witnessed sell-off on Friday amid rising concerns over Game Stop, AMC Entertainment etc.. trading frenzy and worries over more tighter regulation on trading practices. During the week, Dow Jones declined by 3.30%, Nasdaq plummeted by 3.5%, and S&P 500 slumped by 3.7%.

European stocks closed lower on Friday amid concerns over rising Covid-19 infections and restrictions. During the week, FTSE slumped by 4.30% and DAX fell by 3.18%.

Brent crude declined by -0.70% during last week to USD 55 a barrel amid demand concerns and slow vaccine rollouts, which outweighed a cut in Saudi Arabian oil supply and falling US oil inventories.

Global Economy

The US economy expanded an annualized 4% in Q4 2020, slowing from a record 33.4% expansion in Q3 as the continued rise in COVID-19 cases and restrictions on activity moderated consumer spending.

The Federal Reserve left the target range for its federal funds rate unchanged at 0%-0.25% during its first 2021 meeting, in line with forecasts.

Industrial output in Japan fell 1.6% (M-o-M) in December after declining 0.5% in the previous month and falling more than the 1.5% expected by consensus.

US crude oil inventories fell by 9.91 million barrels in the week ended 22nd January 2021, the biggest decline since the week ended 24th July 2020 and compared to market forecasts of a 0.43 million rise.

The number of Americans filing for unemployment benefits decreased to 847,000 in the week ended 23rd January 2021 from an upwardly revised 914,000 in the previous week and compared with market expectations of 875,000.