Equity Markets Snapshot For The Week:

- Japan will publish industrial production.

- Domestic Investors will watch for Q3Fy21 GDP Growth.

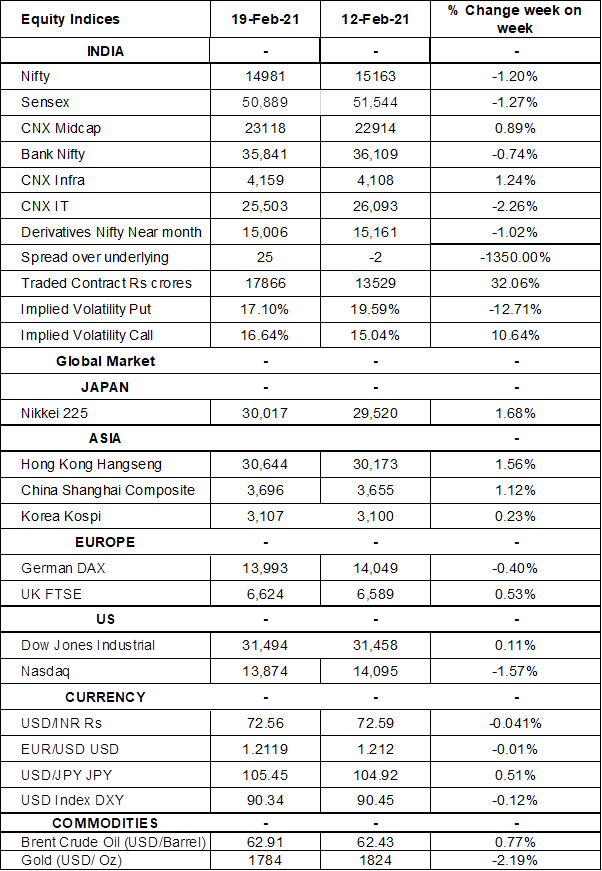

- Implied volatility (IV) for put and call at the money options stood at 17% and 16% levels, respectively.

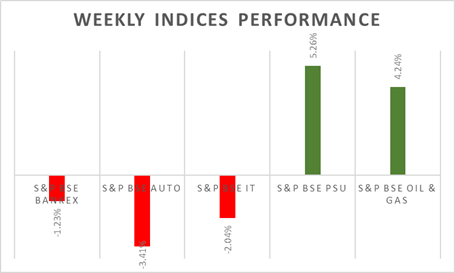

S&P BSE Sensex & Nifty closed on negative note declining as much as 1% on Friday. Indices had witnessed profit-booking pressure in last week resulting in weekly declines of 1.20% each. India's trade deficit in goods narrowed to USD 14.54 billion in January 2021, from USD 15.30 billion in the same month last year and compared with preliminary estimates of a USD 14.75 billion shortfall. Exports were up 6.16% to USD 27.45 billion and imports increased 2.03% to USD 41.99 billion.

FIIs/FPIs have bought Indian equity shares worth Rs. 194.73 billion in January 2021 and bought Rs. 242 billion in February 2021 (as of 21st February 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures, Index Options and Stock Options.

The Nifty Index futures witnessed fall in open interest by 3% for the February series and rise in open interest by 35% for the March series. Implied volatility (IV) fell for put option and IV rose for call option in the last week. Fall in IV for put option and rise in IV for call option shows steady support for Nifty at present levels.

On the global front, Wall Street closed on mixed note on Friday, as fiscal stimulus uncertainty continued amid rising interest rates and supply-side disruptions. On the policy side, Speaker Nancy Pelosi said on Thursday mentioned that the House of Representatives will try to pass a USD 1.9 trillion coronavirus relief plan before the end of February 2021. During the week, Dow Jones gained by 0.11%, Nasdaq declined by 1.57%, and S&P 500 fell by 0.11%.

US Treasury yields have touched 1-year high of 1.33% during last week amid inflationary concerns arising from strong economic activity and further fiscal stimulus. Fed officials recently reiterated inflation is expected to move up and that they were still prepared to keep their easy monetary policy on track.

European indices closed on positive note on Friday, as the manufacturing sector PMI levels touched close to 3 year high despite strict lockdown measures across European countries. However, service sector PMI levels slumped. During the week, FTSE gained by 0.5% and DAX declined by 0.40%.

Global Economy

FOMC members expected that it would be appropriate to maintain the target range for the federal funds rate at 0% to 0.25% and asset purchases at current level until labor market conditions had reached levels consistent with the Committee's assessments of maximum employment and inflation had risen to 2% and was on track to moderately exceed 2% for some time, minutes from last FOMC policy-meeting.

The IHS Markit US Services PMI rose to 58.9 levels in February 2021, from 58.3 levels in the previous month and above market expectations of 57.6 levels, a preliminary estimate showed. The latest reading pointed to the strongest expansion in the service sector since March 2015, as new business growth picked up to a three-month high despite a decline in new export orders.

Industrial production in the US increased 0.9% from a month earlier in January 2021, following a downwardly revised 1.3% growth in December 2021 and beating market expectations of a 0.5% increase.

ECB policymakers agreed that headline inflation was at a very low level and that it continued to be distant from the ECB target, while a further appreciation of the euro posed risk to the inflation outlook, the accounts of the January's policy-meeting showed.

Japan's trade deficit narrowed to JPY 323.9 billion in January of 2021 from JPY 1,315 billion in the same month a year earlier and compared to market expectations of a JPY 600 billion gap. Exports jumped 6.4% and imports dropped 9.5%.

The IHS Markit Eurozone Composite PMI increased to 48.1 levels in February 2021, slightly up from 47.8 levels in the previous month and broadly in line market expectations of 48 levels. The IHS Markit Eurozone Services PMI dropped to 44.7 levels in February 2021, down from 45.4 levels in the previous month and below market expectations of 46 levels.

Japan Services PMI fell to 45.8 levels in February 2021, from 46.1 levels in the previous month, signaling a quicker deterioration in business activity across the service sector.

US crude oil inventories fell by 7.258 million barrels in the week ended 12th February 2021, a 4th consecutive week of decline and compared to market forecasts of a 2.429 million drop, according to the EIA Petroleum Status Report.

The number of Americans filing for unemployment benefits rose to 861,000 in the week ended 13th February 2021, from the previous week's revised figure of 848,000 and compared to market expectations of 765,000.