Equity Markets Snapshot For The Week:

- US will publish non-farm payroll figures.

- Domestic Investors will watch for rising UST yields & crude oil prices.

- Implied volatility (IV) for put and call at the money options stood at 29% and 24% levels, respectively.

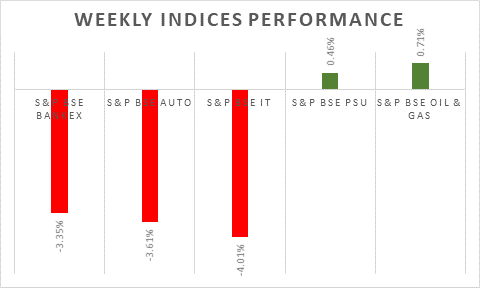

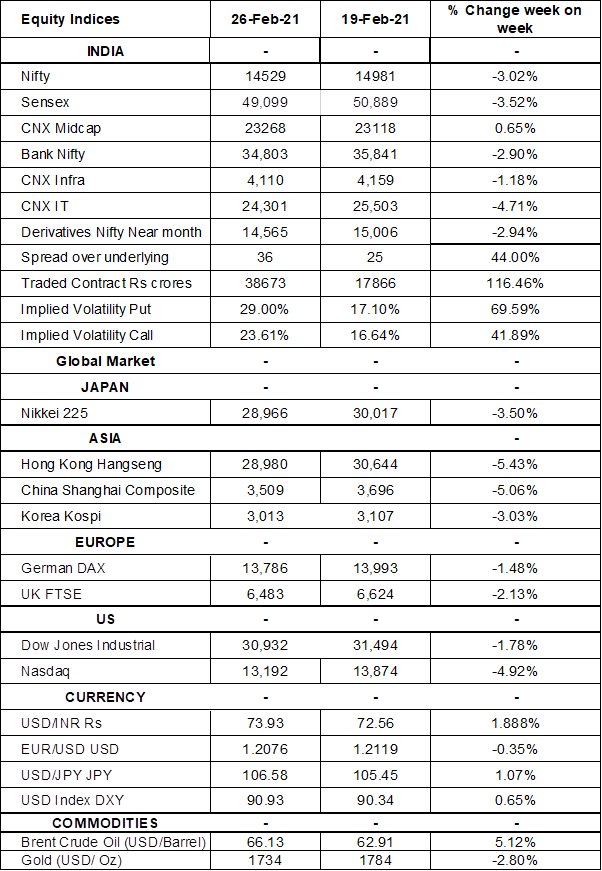

S&P BSE Sensex & Nifty tumbled as much as 4% on Friday suffering steepest declines in 2021, as investors fear that the surge in UST yields and rising inflation rates could prompt central banks to tight monetary policy sooner than expected. Also, geopolitical tensions between the US and Syria mounted following the US air strike targeting Iran-backed militias in Syria. On macro-economic front, India’s Q3 GDP growth clocked at 0.4%. Infrastructure output in India edged up 0.1% (Y-o-Y) in January 2021, following an upwardly revised 0.2% gain in December. Figures for December compare with early estimates of a 1.3% fall. The IHS Markit India Manufacturing Purchasing Managers’ Index rose from 56.4 levels in December to 57.7 levels in January, while the Services PMI rose to 52.8 levels in January from 52.3 levels seen in previous month.

FIIs/FPIs have bought Indian equity shares worth Rs. 194.73 billion in January 2021 and bought Rs. 230 billion in February 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures, Index Options and Stock Options.

The Nifty Index futures witnessed fall in open interest by 467% for the March series and rise in open interest by 131% for the April series. Implied volatility (IV) rose for put option and for call option in the last week. Rise in IV for put option and for call option shows unsteady support for Nifty at present levels.

On the global front, Wall Street closed on steep weekly losses as the UST touched 1-year highs of 1.6%. House of representatives passes USD 1.9 trillion Covid relief bill, send it to Senate. During the week, Dow Jones declined by -1.78%, Nasdaq plummeted by -4.92%, and S&P 500 slipped by -2%.

US 10-year Treasury note closed at 1.46% levels on Friday after touching an over 1-year high of 1.61% the day before. Investors continue to bet on a strong economic recovery boosted by further fiscal stimulus, low-interest rates and the rollout of Covid-19 vaccines, despite dovish comments from Fed Chair Powell, who reinforced economic recovery remains uneven and monetary support is still much needed.

European indices closed on red note on Friday, suffering largest sell-off since the end of October 2020, led by mining stocks, property firms and energy producers. During the week, FTSE fell by 2.13% and DAX declined by 1.48%.

Oil is heading for a 19% monthly gain in February 2021, Brent recovered to pre-pandemic levels earlier this month, bolstered by tightening global supplies and prospects of an economic recovery driven by a COVID-19 vaccination campaign globally and fiscal stimulus.

Global Economy

The US goods trade deficit widened to USD 83.74 billion in January 2021, from USD 83.19 billion in the previous month, the advance estimate showed. Imports rose 1.1% to USD 218.9 billion and exports increased 1.4% to USD 135.2 billion.

The US economy expanded an annualized 4.1% in Q4 2020, slightly higher than the advance estimate of a 4% growth, the second estimate showed.

US crude oil inventories rose by 1.285 million barrels in the week ended 19th February 2021, ending a four-week period of declines and defying market forecasts of a 5.19 million drop, according to the EIA Petroleum Status Report.

The number of Americans filing for unemployment benefits dropped by 111,000 to 730,000 in the week ended 20th February 2021, the lowest in three months, and compared to market expectations of 838,000.

Industrial output in Japan jumped 4.2% (M-o-M) in January 2021, following a 1% decline in December 2020 and above market expectations of a 4% expansion, a preliminary estimate showed.