Equity Markets Snapshot For The Week:

- China will publish trade data.

- Domestic Investors will watch for rising UST yields & crude oil prices.

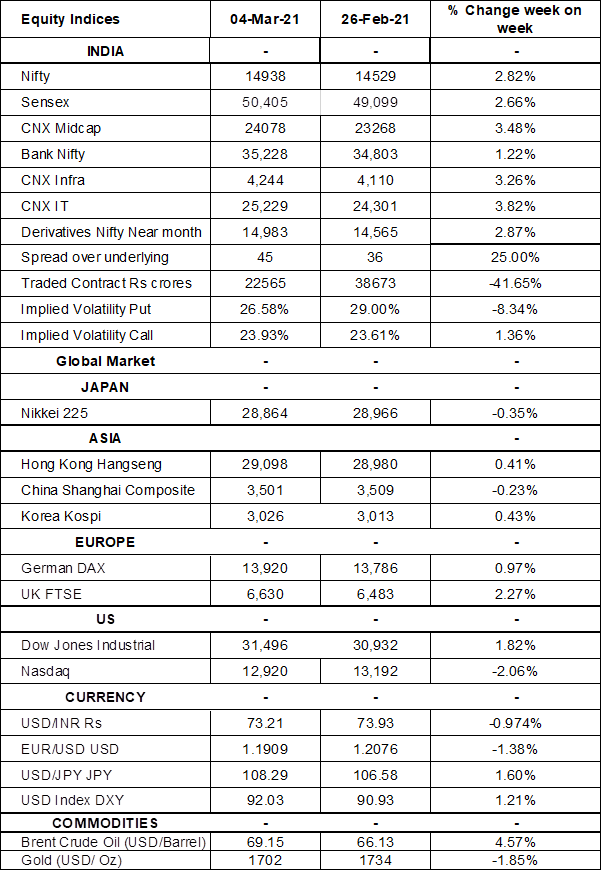

- Implied volatility (IV) for put and call at the money options stood at 26% and 24% levels, respectively.

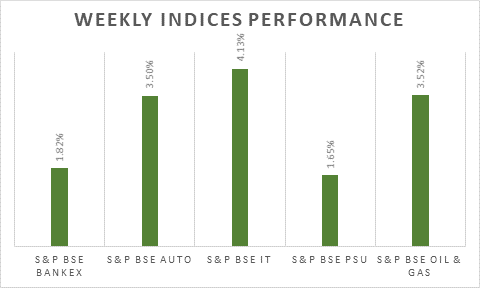

S&P BSE Sensex & Nifty tumbled as much as 1% on Friday, financials, pharma and IT stocks led the losses, amid a spike in bond yields after US Federal Reserve Chair Jerome Powell said that the economic reopening could boost inflation temporarily. On weekly basis, Sensex & Nifty gained by 2.66% & 2.82% respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 257 billion in February 2021 and sold Rs. 8.81 billion worth of shares in March 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures, Index Options and Stock Options.

The Nifty Index futures witnessed fall in open interest by 467% for the March series and rise in open interest by 131% for the April series. Implied volatility (IV) fell for put option and rose for call option in the last week. Fall in IV for put option and rise in IV for call option shows unsteady support for Nifty at present levels.

On the global front, US indices reversed early losses in a volatile session on Friday amid better-than-expected payroll data. US economy added 379,000 jobs in February 2021, way above forecasts of 182,000, and the unemployment rate edged down to 6.2% from 6.3%, suggesting the labour market recovery gained traction. During the week, Dow Jones gained by 1.82%, Nasdaq declined by 2.06%, and S&P 500 closed on a flat note.

US 10-year Treasury note closed at 1.46% levels on Friday after touching an over 1-year high of 1.61% the day before. Investors continue to bet on a strong economic recovery boosted by further fiscal stimulus, low-interest rates and the rollout of Covid-19 vaccines, despite dovish comments from Fed Chair Powell, who reinforced economic recovery remains uneven and monetary support is still much needed.

European indices closed on negative note on Friday, as investors fear that the surge in UST yields and US better-than-expected payroll data could add inflation rates could prompt central banks to tight monetary policy sooner than expected. During the week, FTSE rose by 0.97% and DAX surged by 2.27%.

Brent crude futures rallied 3% to trade around USD 68.8 a barrel on Friday, hitting their highest level since January 2020 and extending an over 4% gain in the previous session, as investors across the globe welcomed major oil producers' decision to keep crude output unchanged in April. In addition, OPEC leader Saudi Arabia said it would maintain its voluntary production cut of an additional 1 million bpd for another month.

Global Economy

The US economy added 379,000 jobs in February 2021, following an upwardly revised 166,000 rise in January 2021 and compared to market expectations of 182,000 amid easing business restrictions. The US unemployment rate edged down to 6.2% in February 2021, the lowest rate since April's record high of 14.8% and below market expectations of 6.3%.

The trade deficit in the US widened to USD 68.2 billion in January of 2021 from a revised USD 67 billion in the previous month, above market expectations of a USD 67.5 billion gap. Exports went up % to an 11-month high of USD 191.9 billion, imports increased at a faster 1.2% to USD 260.2 billion.

The ISM Services PMI for the US decreased to 55.3 levels in February 2021 from 58.7 levels in January 2021, well below market forecasts of 58.7 levels. The reading pointed to the lowest growth in the services sector since a contraction in May 2020.

The number of Americans filing for unemployment benefits rose to 745,000 in the week ended 27th February 2021, from the previous week's revised figure of 736,000 and compared to market expectations of 750,000.

The IHS Markit Eurozone Services PMI was revised higher to 45.7 levels in February 2021, up from a preliminary estimate of 44.7 levels and compared with 45.4 levels in the previous month.

Jibun Bank Japan Services PMI was revised higher to 46.3 levels in February 2021, up from a preliminary reading of 45.8 levels and compared with 46.1 levels in the previous month.