Equity Markets Snapshot For The Week:

- PMI surveys for the US, UK, Eurozone, Japan and Australia will give an insight about the state of the global economic recovery.

- China will decide on monetary policy.

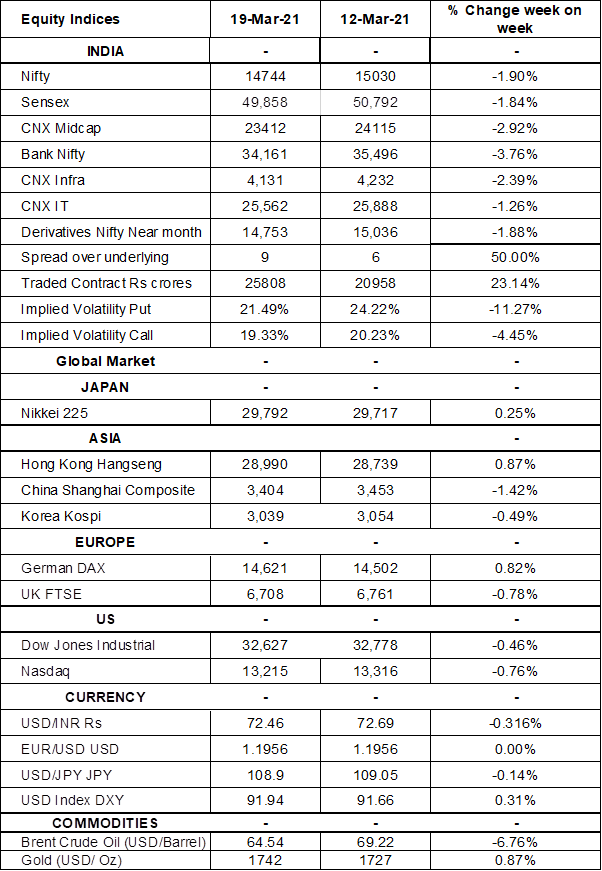

- Implied volatility (IV) for put and call at the money options stood at 21% and 20% levels, respectively.

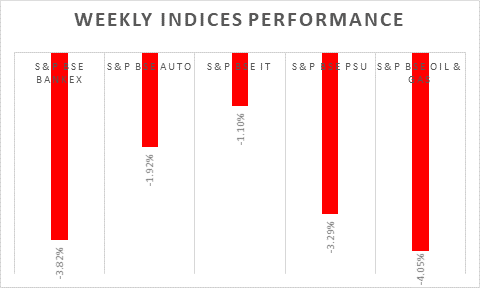

S&P BSE Sensex & Nifty tumbled as much as 2% during last week, due to concerns over a spike in bond yields, rising Covid-19 cases and higher inflation concerns. India trade gap was revised slightly lower to USD 12.62 billion in February of 2021 from a preliminary of USD 12.9 billion in February of 2021. Still, it remains higher than USD 10.16 billion a year earlier. Exports increased 0.7% to USD 27.93 billion and imports rose by 7% to USD 40 billion.

FIIs/FPIs have bought Indian equity shares worth Rs. 257 billion in February 2021 and sold Rs. 142 billion worth of shares in March 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed fall in open interest by 23% for the March series and rise in open interest by 68% for the April series. Implied volatility (IV) fell for put option and for call option in the last week. Fall in IV for put option and for call option shows steady support for Nifty at present levels.

On the global front, US indices closed on a negative note on Friday, after Fed had changed temporary move allowed banks to exclude U.S. Treasury’s and central bank reserves when calculating their Supplementary Leverage Ratio which triggered sell-off in banking stocks and rise in US Treasury bond yields. During the week, Dow Jones surged by 4%, Nasdaq gained by 3%, and S&P 500 fell by 0.81%.

European stocks held onto early losses on Friday, as investors continued to monitor the risk of a surge in inflation and higher yields, and worsening news on the pandemic front. France has announced a new four-week lockdown. During the week, FTSE fell by 0.78% and DAX gained by 0.82%.

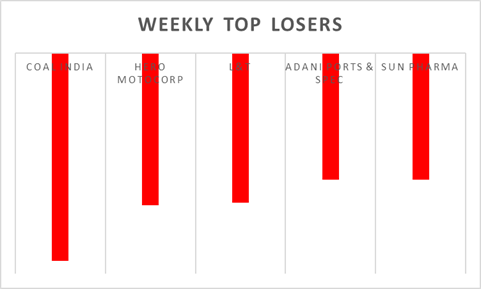

Brent crude prices down more than 8% to around USD 63 a barrel, dragged by a stronger dollar and as investors have grown concerned that a slow vaccination campaign in Europe and surging cases in parts of the world might derail an already tepid demand for crude.

Global Economy

The Fed left the target range for its federal funds rate unchanged at 0%-0.25% during its March 2021 policy-meeting, and signaled a strong likelihood that there may be no rate hikes through 2023. The central bank revised up its GDP forecasts for 2021 to 6.5% and for 2022 to 3.3% due to the approval of President Biden’s $1.9-trillion recovery package and the ongoing COVID-19 vaccination programme.

Industrial production in the United States slumped 2.2% from a month earlier in February 2021, following an upwardly revised 1.1% growth in the previous month and missing market expectations of a 0.3% increase.

The Bank of Japan left its key short-term interest rate unchanged at -0.1% and maintained the target for the 10-year Japanese government bond yield at around 0% during its March 2021 policy-meeting. Policymakers removed their explicit guidance to buy ETF at an annual pace of roughly JPY 6 trillion, saying they would buy it when necessary and maintain a JPY 12 trillion ceiling for annual purchases.

Japan's inflation declined 0.4% (Y-o-Y) in February 2021, after falling 0.6% in the previous month, as the pandemic continued to weigh on consumption.

Japan's trade surplus narrowed to JPY 217.4 billion in February 2021 from JPY 1,106 billion in the same month a year earlier and against market expectations of a JPY 420 billion surplus. Exports declined by 4.5% and imports climbed 11.8%.

Industrial output in Japan surged 4.3% (M-o-M) in January 2021, compared with a preliminary estimate of a 4.2% rise, recovering sharply from a 1% fall in December 2020.

Eurozone's trade surplus widened to EUR 6.3 billion in January of 2020 from EUR 1.6 billion in the corresponding month of the previous year.

The number of Americans filing for unemployment benefits rose to 770,000 in the week ended 13th March 2021, the highest level in a month and above market expectations of 700,000, as the Covid-19 crisis continued to affect the labor market.