Equity Markets Snapshot For The Week:

- RBI MPC outcomes will be announced

- The US will publish Balance of Trade data

- Eurozone will publish unemployment data.

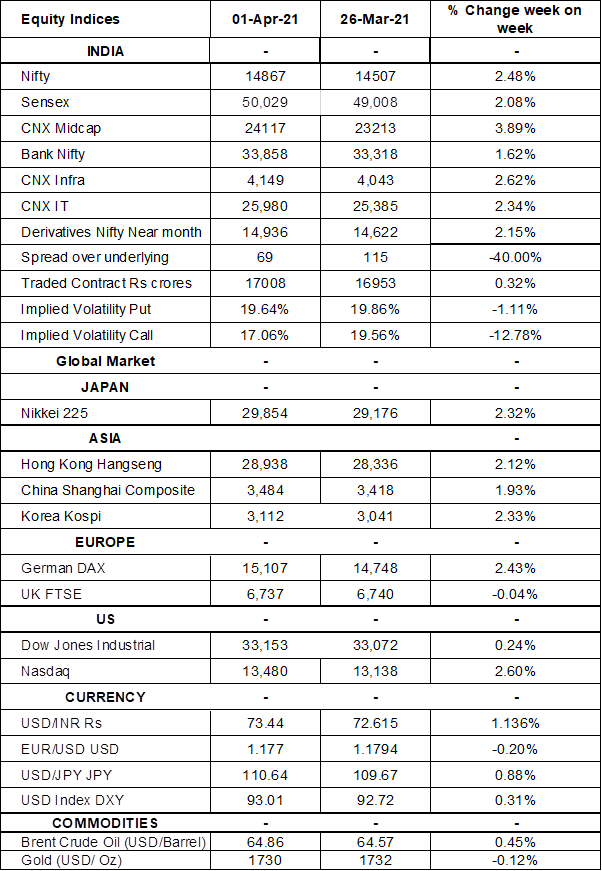

- Implied volatility (IV) for put and call at the money options stood at 19.64% and 17% levels, respectively.

S&P BSE Sensex & Nifty gained 1.05% and 1.2% on 1st April 2021 driven by the positive sentiment created by the announcement of a multi-trillion-dollar infrastructure investment plan by the US President. Market sentiment remained bullish though covid cases are rising faster. RBI MPC decision is expected to impact market movement this week. On weekly basis, Sensex and NIFTY rose by 2.08% and 2.48% respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 257 billion in February 2021 and sold Rs. 105 billion worth of shares in March 2021.

The Nifty Index futures witnessed a rise in open interest by 17.57% for the April series and a fall in open interest by 10.57% for the May series. Implied volatility (IV) fell marginally for the put option and declined for the call option in the last week. Marginal Fall in IV for put option and Fall in IV for call option shows unsteady support for Nifty at present levels.

On the global front, US indices soared driven by an infrastructure spending package announced to boost the economy. On weekly basis, Nasdaq and Dow Jones Industrial rose by 2.6% and 0.24%.

European stock indices closed on a positive note on 1st April. During the week, FTSE came down by 0.04% while German DAX rose by 2.43%.

Global Economy

The IHS Markit US Manufacturing PMI was stood at 59.1 in March of 2021 from 58.6 in the previous month which is the second-highest growth in factory activity on record. The overall expansion was supported by the steepest rise in new orders since June 2014, although production was reportedly held back by supply shortages.

The US unemployment rate fell to 6% in March of 2021 from 6.2% in the previous month, the lowest rate in a year and line with market expectations. The number of unemployed people fell by 262 thousand to 9.710 million while the number of employed rose by 609 thousand to 150.85 million. The labor force participation rate edged up to a 3-month high of 61.5% from 61.4%.

The US economy added a 7-month high of 916,000 jobs in March of 2021 from a revised 468,000 in February.

The IHS Markit Eurozone Manufacturing PMI was revised higher to 62.5 in March 2021, from a preliminary estimate of 62.4 and well above February's 57.9.