Equity Markets Snapshot For The Week:

- US investors will watch for Q1 earnings

- China will publish Q1 GDP growth data

- Domestic investors will watch for Q4Fy21 earnings and inflation data. This week, Infosys, Wipro, HDFC Bank, ICICI Lombard and HDIL will report earnings.

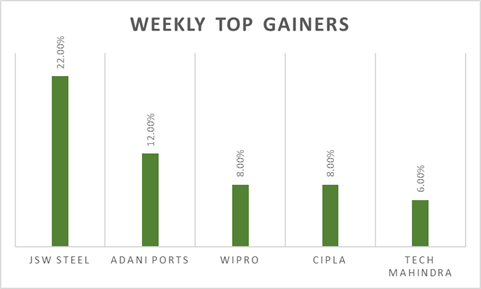

Indian markets recovered post RBI’s dovish commentary during April’s policy-meeting despite rising Covid-19 cases across the country. IT & Pharma stocks gained the most during last week on the back of better earnings expectations and depreciating INR.

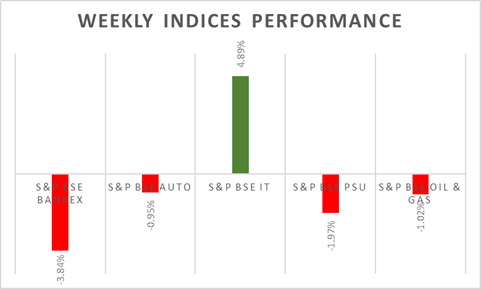

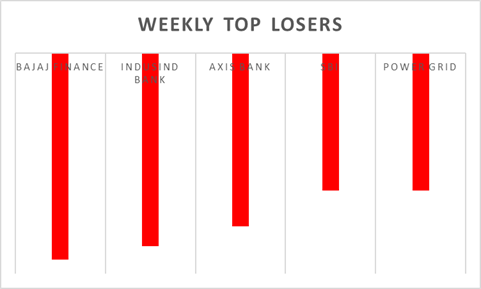

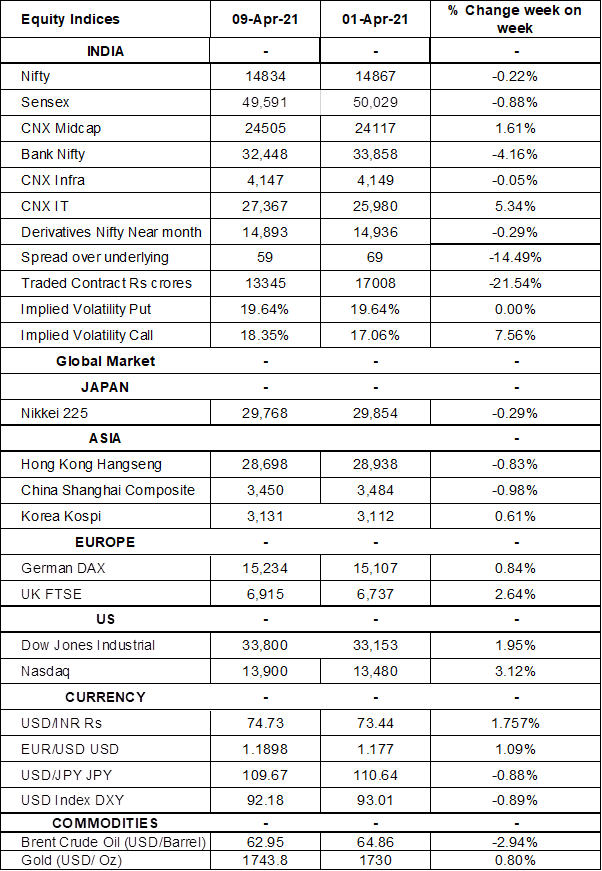

S&P BSE Sensex & Nifty declined by -0.8% and 0.22% on weekly basis respectively. Investors remained concerned about the negative impact of rising COVID cases on India's growth outlook, after many state governments imposed fresh restrictive measures to curb the spread of the pandemic. Composite PMI in India declined to 56 levels in March 2021 from 57.30 levels in the previous month, signalling expansion for the seventh month running. Softer increases were recorded in the manufacturing and service sectors. IHS Markit India Services PMI declined to 54.6 levels in March 2021 from 55.3 levels in the previous month, and slightly above market expectations of 54.5 levels.

The Reserve Bank of India kept its benchmark repurchase rate at 4% during its April policy-meeting, as widely expected, saying it was maintaining an accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Click here to read our analysis on RBI policy outcome.

FIIs/FPIs have bought Indian equity shares worth Rs. 104 billion in March 2021 and sold Rs. 7 billion worth of shares in April 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options. Implied volatility (IV) remained same for put option compared to last week and rose for call option in the last week. Flat IV for put option and rise in IV for call option shows steady support for Nifty at present levels.

On the global front, US indices closed on a positive note on Friday, Dow Jones and S&P 500 touching all-time highs on the back of stimulus package. Dovish Federal Reserve minutes released on Wednesday, which reiterated that the US central bank would keep financial conditions as lenient as possible for the foreseeable future. During the week, Dow Jones gained by 1.95%, Nasdaq surged by 3%, and S&P 500 rose by 2.33%.

European shares booked a sixth consecutive week of gains, their longest weekly winning streak since November 2019, with the DAX 30 adding 0.8% to close at a new all-time high of 15,225 amid the prospect of a strong economic recovery helped by massive fiscal and monetary support and the rollout of vaccines. During the week, FTSE gained by 2.64% and DAX gained by 0.84%.

Global Economy

China General Services PMI picked up to a three-month high of 54.3 levels in March 2021 from 51.5 levels in the previous month, amid a further recovery from the pandemic.

The consumer price index in China rose by 0.4% (Y-o-Y) in March 2021, after a 0.2% drop a month earlier and compared with market consensus of a 0.3% gain.

IHS Markit Eurozone Services PMI revised higher to 49.6 levels in March 2021, from a preliminary estimate of 48.8 levels, signalling a marginal rate of contraction that was the slowest in the current sequence.

ECB policymakers discussed a smaller increase in bond purchases under the PEPP and agreed that the central bank did not need to use the envelope in full if favourable financing conditions could be maintained, the accounts of the March's policy-meeting minutes showed.

Japan's current account surplus narrowed to JPY 2916.9 billion in February 2021 from JPY 3060.5 billion in the same month of the previous year and compared to market expectations of a JPY 1966 billion surplus.

The number of Americans filing for unemployment benefits rose for a second straight week to 744,000 in the April 3rd week, from the previous period's revised figure of 728,000 and above market expectations of 680,000.