Equity Markets Snapshot For The Week:

- US jobs data report

- Worldwide PMI surveys

- Domestic investors will watch for Q4Fy21 earnings and further announcement on state wise lockdowns & restrictions due to surge in Covid-19 cases . This week, Kotak Mahindra, LTTS, Home First Finance, SBI Life, Adani Ports and Godrej Properties will report earnings.

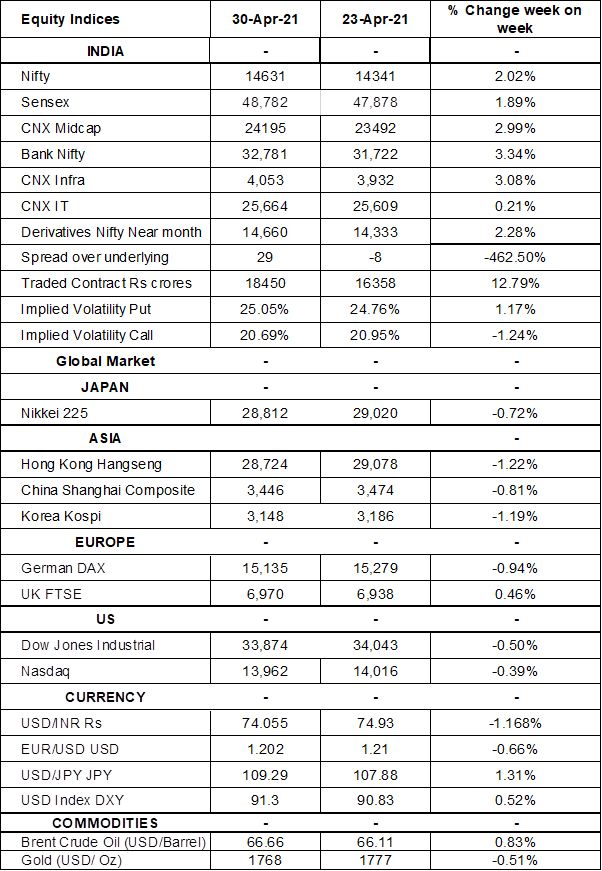

The S&P BSE Sensex tumbled 2% to 48,782 on Friday, following four straight sessions of gains, with financials and consumer goods stocks leading the losses. Investors remained concerned about India's economic recovery amid rising COVID-19 cases and the ongoing restrictive measures. On macro-data front, infrastructure output in India rose by 6.8% (Y-o-Y) in March 2021, the most since July 2018.

FIIs/FPIs have bought Indian equity shares worth Rs. 104 billion in March 2021 and sold Rs. 96 billion worth of shares in April 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Stock Futures and Stock Options. Implied volatility (IV) rose for put options and fell for call option in the last week. Rise in IV for put option and fall in IV for call option shows unsteady support for Nifty at present levels.

On the global front, all three main US stock indices closed on negative note on Friday, amid broader market sell-off led by the energy sector. Worries about rising coronavirus cases and soaring Treasury yields once again kept sentiment subdued. During the week, Dow Jones fell by 0.50%, Nasdaq declined by 0.40%, and S&P 500 down by 0.08%.

European markets closed mostly lower on Friday, with the benchmark DAX closing around the 15,150 level to end the week on a sour note, as investors reacted negatively to preliminary report on first-quarter economic activity. The eurozone entered a double-dip recession in the first quarter of 2021, with Germany, Italy and Spain falling back into contraction territory. France, however, recorded a small expansion. During the week, FTSE up by 0.46% and DAX declined by 0.94%.

Global Economy

The Fed left the target range for its federal funds rate unchanged at 0%-0.25% and said it will continue to purchase bonds at a rate of USD 120 billion a month despite acknowledging a rise in inflation and the improvement in the economy.

The US economy grew by an annualized 6.4% in the first quarter, following a 4.3% expansion in the previous three-month period and slightly beating market expectations of 6.1%.

The number of Americans filing new claims for unemployment benefits decreased further to 553,000 in the week ended 24th April 2021 from an upwardly revised 566,000 in the previous week and slightly above market expectations of 549,000.

The official NBS service PMI for China dropped to 54.9 levels in April 2021 from a four-month high of 56.3 levels in the prior month. Still, this was the 13th straight month of growth in the service sector, as a recovery in the economy from the COVID-19 hit continued. NBS manufacturing PMI for China slipped to 51 levels in April 2021 from 51.9 levels a month earlier and missing market expectations of 51.7 levels.

Industrial production in Japan unexpectedly rose by 2.2% (M-o-M) in March 2021, easily beating market estimates of a 2% fall and after a final 1.3% fall a month earlier.

Stocks of crude oil in the United States increased by 4.319 million barrels in the week ended 23rd April 2021, after a 0.436 million rise in the previous week and compared with market expectations of a 0.375 million gain.