Equity Markets Snapshot For The Week:

- US and China will be publishing inflation figures

- ECB will be publishing monetary policy meeting minutes

- Domestic investors will watch for Q4Fy21 earnings and inflation data

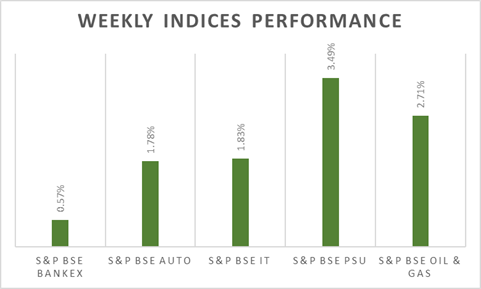

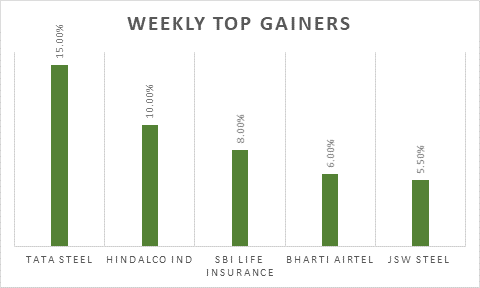

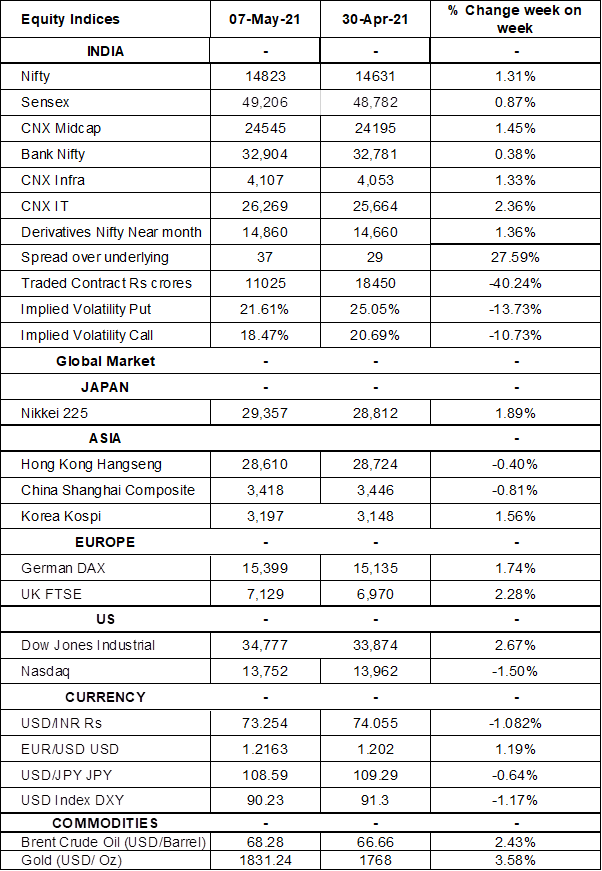

The S&P BSE Sensex and Nifty 50 closed the week 0.9% and 1.31% higher respectively, booking a second straight week of gains, supported by a rally in metal stocks. RBI announced on-tap liquidity window of Rs. 500 billion which banks can utilize to provide fresh lending support to vaccine makers, importers of vaccines, covid-related drugs and priority medical devices, hospitals, pathology labs, manufacturers and suppliers of oxygen and ventilators, logistics firms and also to patients for treatment. On macro-data front, IHS Markit India Services PMI declined to 54 levels in April 2021 from 54.6 levels in the previous month, and below market expectations of 51.1 levels.

FIIs/FPIs have sold Rs. 96 billion worth of shares in April 2021 and sold Rs. 59 billion in May 2021 (as of 09th May 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Stock Futures and Stock Options. Implied volatility (IV) rose for put options and fell for call option in the last week. Rise in IV for put option and fall in IV for call option shows unsteady support for Nifty at present levels.

All three main US stock indices closed on strong note on Friday, with the Dow Jones and the S&P 500 finishing at record closing levels as a disappointing payroll report eased worries about the Federal Reserve reducing its stimulus support anytime soon. During the week, Dow Jones gained by 2.67%, Nasdaq declined by 1.50%, and S&P 500 up by 1%.

European stock markets closed on positive note on Friday on the back of upbeat economic data and a strong earnings season. German industrial production rose in March by the most in five months, while better-than-expected exports and imports figures from Europe's largest economy signalled a solid rebound in global demand. During the week, FTSE up by 2.28% and DAX declined by 1.74%.

Global Economy

The ISM Non-Manufacturing PMI for the US dropped to 62.7 levels in April 2021 from an all-time high of 63.7 levels in the previous month and below market expectations of 64.3 levels, indicating slowing growth in the services sector.

The US economy added 266,000 jobs in April 2021, following a downwardly revised 770,000 rise in March 2021 and well below market expectations of 978,000. US unemployment rate rose to 6.1% in April 2021, from 6% in the previous month and defying market expectations of 5.8%.

The number of Americans filing new claims for unemployment benefits dropped to 498,000 in the week ending 01st May 202, the lowest level since March 2020, when the pandemic first hit the US economy.

The IHS Markit Eurozone Services PMI was revised slightly higher to 50.5 levels in April 2021, from a preliminary estimate of 50.3 levels, signalling the first expansion of business activity since last August 2020.

Germany's industrial production rose by 2.5% from a month earlier in March 2021, following two months of near 2% declines and beating market expectations of a 2.3% growth.

The Jibun Bank Japan Services PMI was revised higher to 49.5 levels in April 2021 from preliminary data and March's final figure of 48.3 levels.

China General Services PMI increased to a four-month high of 56.3 levels in April 2021 from 54.3 levels in the prior month, amid the successful containment of COVID-19 and a further improvement in demand.

China's trade surplus was at USD 42.8 billion in April 2021, easily beating market consensus of USD 28.1 billion and compared with a surplus of USD 45 billion in the same month a year earlier.