Equity Markets Snapshot For The Week:

- US will be publishing FOMC meeting minutes

- Eurozone & Japan will be publishing GDP growth figures

- China policy-makers will decide on monetary policy

- Domestic investors will watch for Q4Fy21 earnings

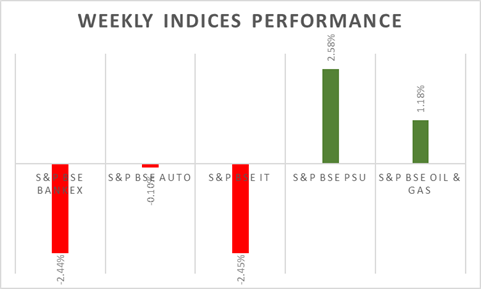

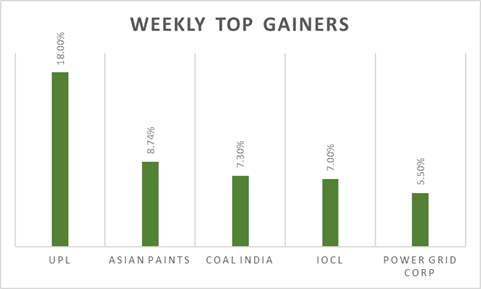

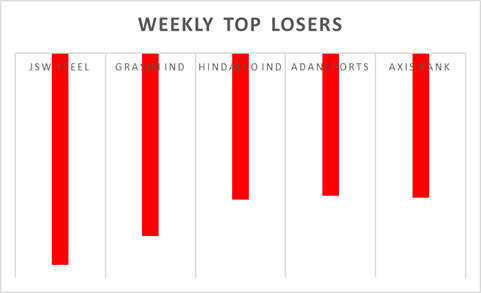

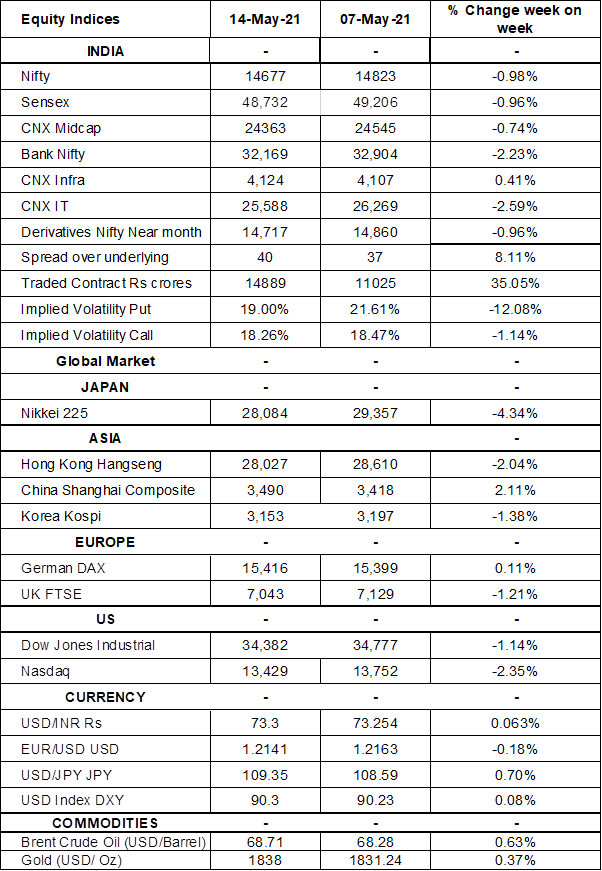

The S&P BSE Sensex & Nifty closed on negative note for the week, on Friday Asian Paints surged by 9% on the back of strong quarterly earnings, however sell-off in index heavy weights IT & financial stocks dampened market sentiment. On macro-data front, Annual inflation rate in India eased to 4.29% in April 2021, the lowest reading in three months from 5.52% in March 2021. India's industrial output surged 22.4% in March 2021 compared with the same month last year when a strict lockdown was in place due to the coronavirus outbreak. India's trade deficit in goods widened to USD 15.1 billion in April 2021, from USD 6.76 billion in the same period last year.

FIIs/FPIs have sold Rs. 96 billion worth of shares in April 2021 and sold Rs. 64 billion in May 2021 (as of 14th May 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Stock Futures and Stock Options. Implied volatility (IV) rose for put options and fell for call option in the last week. Fall in IV for put option and call option shows steady support for Nifty at present levels.

US indices closed on strong note on Friday, as dovish remarks from several Fed officials soothed concerns that rising inflation will prompt the US central bank to tighten policy sooner than expected. Fed policymakers have said that any increase in price pressures will be transitory and expected to wane as supply chains adjust to rising demand. During the week, Dow Jones declined by 1.14%, Nasdaq fell by 2.35%, and S&P 500 slipped by 1.35%.

European stock markets closed on positive note on Friday as dovish remarks from several central bankers soothed concerns that rising inflation will prompt central banks to tighten policy sooner than expected. During the week, FTSE up by 2.28% and DAX declined by 1.74%.

Brent crude settled 2% higher at USD 68.71 a barrel to finish the week on a high note on the back of a weaker dollar and prevalent risk appetite. On the supply side, OPEC+ started this month a gradual easing of its oil production curbs, pumping an extra 350,000 barrels a day, saying that demand will grow by 5.95 million barrels per day in 2021.

Global Economy

The annual inflation rate in the US soared to 4.2% in April 2021 from 2.6% in March 2021 and well above market forecasts of 3.6%. It is the highest reading since September 2008.

Total industrial production in the United States increased 0.7% from a month earlier in April 2021, easing from an upwardly revised 2.4% growth in March 2021 and missing market consensus of a 1%.

Japan's current account surplus widened to JPY 2,650 billion in March 2021 from JPY 1,929 billion in the same month of the previous year and compared to market expectations of a surplus of JPY 2,800 billion, with exports surging 16.6% while imports rising 3.1%.

Eurozone industrial production increased by 0.1% from a month earlier in March 2021, following a revised 1.2% decline in February but missing market expectations of a 0.7% growth.

The number of Americans filing new claims for unemployment benefits dropped by 34,000 to 473,000 in the week ending 8th May 2021, the lowest level since the pandemic first hit the US labor market in March 2020 and below market expectations of 490,000.

China's annual inflation rate jumped to 0.9% in April 2021 from 0.4% a month earlier and compared with market consensus of 1%.