Equity Markets Snapshot For The Week:

- US will publish non-farm pay-roll data.

- Global investors will watchout for manufacturing & services PMI.

- Domestic investors will watchout for GDP data and RBI policy outcome.

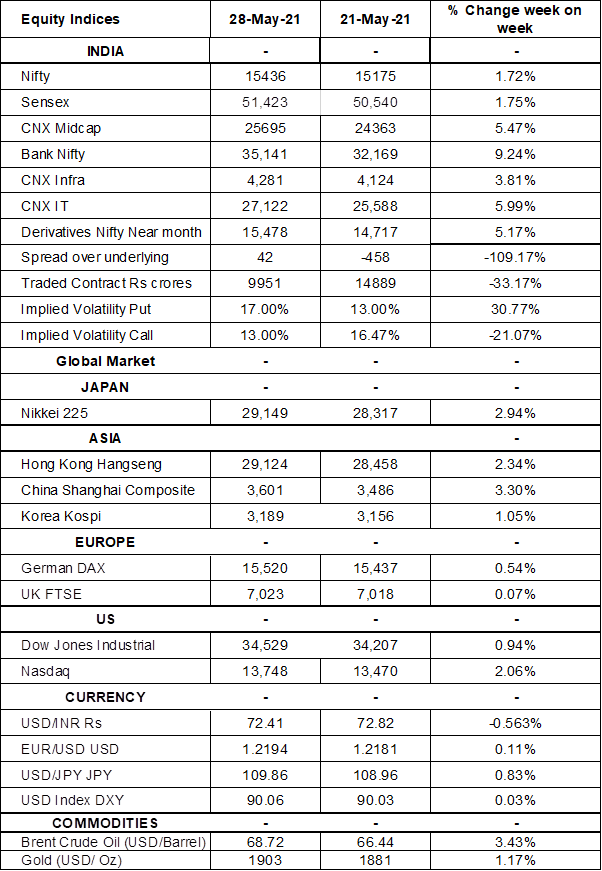

The BSE Sensex closed on positive note on Friday and gained around 2% for the week amid positive global cues. US President Biden administration reportedly will seek USD 6 trillion in federal spending for FY2022 to boost infrastructure plans and social programs. India reported 186,364 new virus cases, the lowest daily rise since 14th April 2021, taking the total tally to 27.56 million.

FIIs/FPIs have sold Rs. 96 billion worth of shares in April 2021 and sold Rs. 34 billion in May 2021 (as of 30th May 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Stock Futures and Stock Options. Implied volatility (IV) rose for put options and fell for call options in the last week. Rise in IV for put option and fall in IV for call option shows unsteady support for Nifty at present levels.

US indices closed on positive note for the week amid optimism about the reopening of the economy and also massive government budget boosted market sentiment. President Biden will seek USD 6 trillion in federal spending for FY2022 to boost infrastructure plans and social programs, which will likely take the nation to its highest sustained levels of federal spending since World War II. During the week, Dow Jones gained by 0.74%, Nasdaq up by 2%, and S&P 500 rose by 0.84%.

European stocks closed on green on Friday to end the week at record levels amid on growing expectations that the Eurozone economy will begin rebounding at a faster pace in coming months as vaccination drives gather pace. Recent data showing that the Eurozone economic sentiment improved to a three-year high in May 2021. During the week, FTSE up by 0.08% and DAX up by 0.54%.

Brent Crude prices gained by 5% during last week amid optimism of global economic outlook, higher demand levels seen in Europe on the back of summer travel and US president USD 6 trillion budget in 2022 boosted sentiment.

Global Economy

US posted a budget deficit of USD 226 billion in April 2021, compared with a USD 738 billion gap in the same period last year and in line with market expectations, as pandemic-related outlays fell, and revenues rose sharply.

Corporate profits in the United States decreased 0.8% to USD 1.94 trillion in the first quarter of 2021, following a 3.3% drop in the previous period.

The number of Americans filing new claims for unemployment benefits dropped by 38,000 to 406,000 last week, the lowest level since the pandemic first hit the labor market in March 2020 and below market expectations of 425,000 as Covid-19 cases steadily decrease due to the vaccination campaign and as restrictions on businesses are being lifted.

US crude oil inventories dropped by 1.662 million barrels for the week ended on 21st May 2021, following a 1.321 million increase in the previous period and compared with market forecasts of a 1.05 million fall, data from the EIA Petroleum Status Report showed.

The US economy grew by an annualized 6.4% in the first quarter, matching the advance estimate and following a 4.3% expansion in the previous three-month period.

Profits earned by China's industrial firms increased by 106.1% yoy to CNY 2.59 trillion in January-April 2021, after a 137% surge in the prior period, as economic recovery momentum continued.

The Bank of Japan left its key short-term interest rate unchanged at -0.1% and maintained the target for the 10-year Japanese government bond yield at around 0% during its April policy-meeting, as widely expected. In a quarterly outlook report, the central bank slashed its consumer inflation forecast for the current fiscal year to 0.1% from earlier predictions made in January of 0.5%.