Equity Markets Snapshot for The Week:

- Global investors will watch out for US & Japan monetary policy-meeting outcome.

- Domestic investors will watch out for Inflation data and RBI policy-meeting minutes

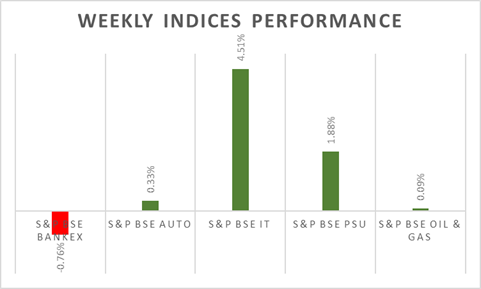

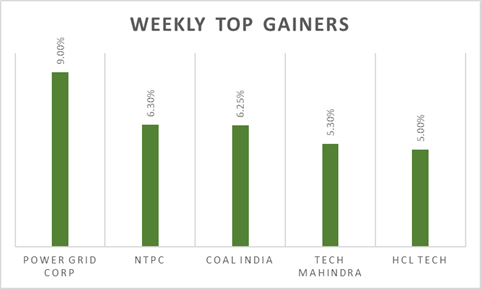

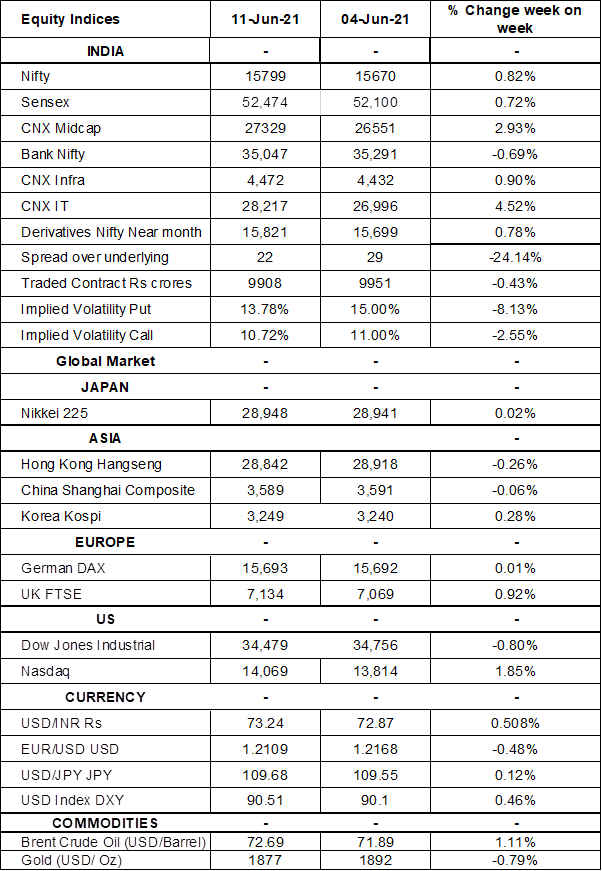

The BSE Sensex & Nifty 50 closed the week on strong note and reported 4th consecutive weekly gains. BSE Sensex & Nifty 50 touched new record highs (guided in our previous weekly equity analysis note) on the back of positive global cues, lower domestic covid-19 cases, and expectations of economy recovery as states have started to ease lockdown restrictions. Investors will watch out for domestic inflation data and FED monetary policy-meeting outcome. With quarterly earnings coming to an end, markets would react more to developments in macro-economic trends. Shyam Metalics, KIMS, Dodla Dairy and Sona Comstar are coming out with IPO in this week. On macro-economic front, Industrial production in India surged 134.4% (Y-o-Y) in April 2021, the biggest increase ever, beating market forecasts of a 120% gain.

FIIs/FPIs have sold Rs. 29 billion in May 2021 and invested Rs. 155 billion in June 2021 (as of 13th June 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across stock futures and stock options. Implied volatility (IV) fell for both put options and for call options in the last week. Fall in IV for put option and for call option shows steady support for Nifty at present levels.

Wallstreet indices closed on a flat note on Friday, as investors are concerned about inflationary pressures. However, FED’s narrated that a surge in inflation is transitory and because of those supply and demand imbalances. During the week, Dow Jones declined by 0.80%, Nasdaq up by 1.85%, and S&P 500 rose by 0.43%.

European stocks gained ground on Friday to end the week at record levels, with the benchmark DAX finishing around 15,700, as investors are increasingly pricing in a robust economic recovery, fuelled by rapid vaccine rollouts, even with headwinds from inflation. During the week, FTSE up by 0.92% and DAX closed on a flat note.

Improving demand sentiment and OPEC-led supply cuts, with brent crude oil breaking above the USD 71 per barrel level for the first time since October 2018. OPEC said in its June report that oil demand would rise by 5.95 million bpd this year, unchanged from its May forecast. On top of that, the oil cartel has recently agreed to keep to its plan to gradually ease supply curbs through July 2021.

Global Economy

Annual inflation rate in the US accelerated to 5% in May 2021 from 4.2% in April 2021 and above market forecasts of 4.7%. It is the highest reading since August of 2008 amid low base.

The US trade gap narrowed to USD 68.9 billion in April 2021 from a record high USD 75 billion gap in March 2021 and in line with market expectations. Exports were up 1.1% and Imports dropped 1.4%.

The number of Americans filing new claims for unemployment benefits dropped to 376,000 in the week ending 5th June 2021, the lowest level in nearly 15 months and compared with market expectations of 370,000.

The European Central Bank left monetary policy unchanged during its June policy-meeting, saying it expects net purchases under the PEPP over the coming quarter to continue to be conducted at a significantly higher pace than during the first months of the year. ECB revised up GDP projections for 2021 and 2022 to 4.6% and 4.7%, respectively, supported by stronger global and domestic demand.

The Japanese economy shrank 1% during Q1 2021, compared with the initial estimate of a 1.3% fall and market estimates of a 1.2% drop and after a 2.8% growth in Q4 2020. This was the first contraction since Q2 2020.

China's annual inflation rate jumped to 1.3% in May 2021 from 0.9% a month earlier and compared with market consensus of 1.6%. This was the highest reading since September 2020, amid a faster increase in cost of non-food goods.