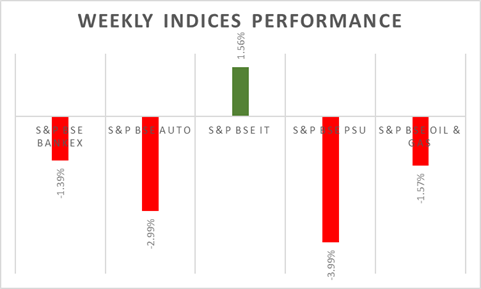

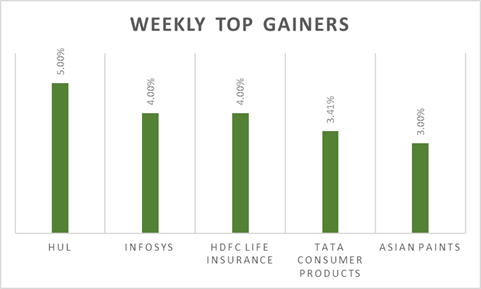

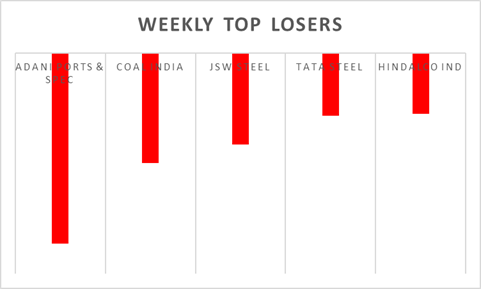

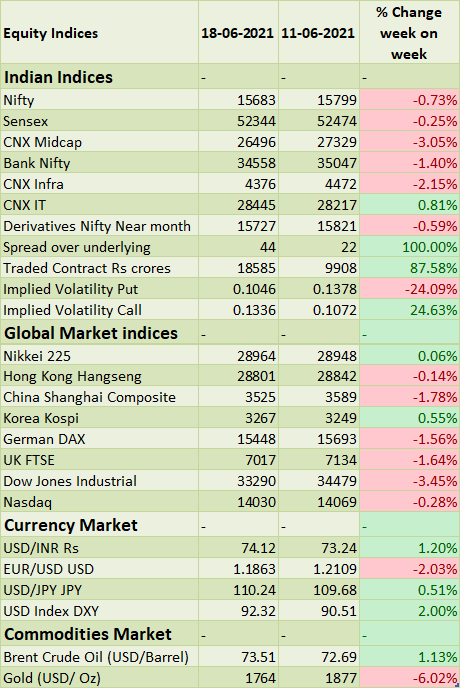

The BSE Sensex & Nifty 50 declined by 0.25% & 0.73% respectively for the week, metals and energy sectors stocks were top losers. Market sentiment was dented by weak global cues amid Fed indication of a rate hike sooner than expected and USD appreciation against INR which breached Rs. 74 level mark. Health experts and few states have hinted that Covid-19 third wave could hit India sooner than expected as local economies have eased lockdown measures and yet Covid-19 protocols by the local public are not up to the safety mark which is causing concerns. However, on the vaccination front, 276 million Indians are inoculated as of 20th June 2021. Markets would turn volatile as the monthly F&O expiry is due this week and might start discounting the impact of the third wave. Agro-chemical manufacturer India Pesticides will open its IPO for subscription on 23rd June 2021 and Shyam Metalics & Sona Comstar are expected to debut secondary markets on 24th June 2021.

FIIs/FPIs have sold Rs. 29 billion in May 2021 and invested Rs. 153 billion in June 2021 (as of 20th June 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across stock futures and index futures. Implied volatility (IV) fell for put options and rose for call options in the last week. Fall in IV for put option and rise in IV for call option shows unsteady support for Nifty at present levels.

Wallstreet indices declined steeply on weekly basis amid a hawkish tone from Fed. The US central bank signalled it might raise interest rates as early as 2023, a faster pace than initially thought, while Chair Jerome Powell said there had also been initial discussions about a bond-buying tapering. On Friday, Dow Jones declined by 500 points and for the week, Dow Jones tumbled by 3.5%, Nasdaq fell by 0.30%, and S&P 500 declined by 2%.

European indices slipped more than 1% on Friday, with energy and financials shares among the worst performers. During the week, FTSE fell by 1.64% and DAX declined by 1.56% .

Commodity prices continued to fall, as dollar appreciated against across all major currencies. China’s moves to ease inflation and hawkish Federal Reserve forecasts lead investors to unwind bullish positions and sell futures contracts. Gold was down 6% this week.

Brent crude oil is up by 1.2% for the week amid investors were upbeat about fuel demand recovery this summer, with vaccination programs in Europe and the US allowing more people to travel. On the supply side, OPEC+ agreed to keep to their plan to gradually ease supply curbs through July 2021.

Global Economy

The Fed left the target range for its federal funds rate unchanged at 0%-0.25% during June 2021 policy-meeting, but policymakers signalled they expect two increases by the end of 2023. New economic forecasts showed the GDP is seen growing 7% in 2021, above 6.5% in the March projection. The 2022 growth was left at 3.3%. Click here to read our analysis on Fed monetary policy.

Total industrial production in the US increased 0.8% from a month earlier in May 2021, following a downwardly revised 0.1% gain in April 2021 and beating market expectations of a 0.6% advance.

The Bank of Japan left its key short-term interest rate unchanged at -0.1% and maintained the target for the 10-year Japanese government bond yield at around 0% during its June policy-meeting.

Japan's consumer prices declined by 0.1% (Y-o-Y) in May 2021, after a 0.4% drop in the prior month. This was the eighth straight month of fall in consumer prices.

Japan's trade deficit decreased sharply to JPY 187 billion in May 2021 from a JPY 856 billion in the same month a year earlier but missing market consensus of a gap of JPY 91 billion. Exports jumped 49.6% (Y-o-Y) to JPY 6,261 billion while imports rose at a softer 28% (Y-o-Y) to JPY 6,448 billion.

Industrial production in China increased 8.8% (Y-o-Y) in May 2021, the lowest rate in 5 months due to softer export orders.