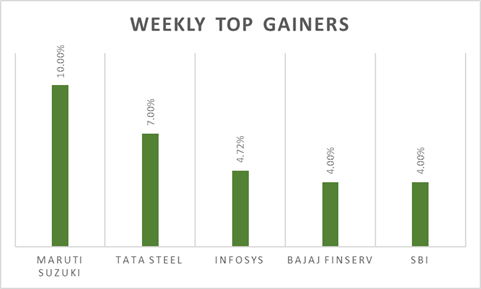

The BSE Sensex & Nifty 50 gained by 1.11% & 1.13% respectively for the week, metals, bank, and pharma stocks were top gainers. News on Russian government preparing to impose export taxes on the country's steel products, nickel, aluminium, and copper boosted sentiment for domestic metal stocks. On the vaccination front, 6 million Indians are getting vaccinated on an average every day. Agro-chemical manufacturer India Pesticides issue oversubscribed by 43 times and KIMS expected to debut secondary markets in this week.

In the week ahead, investors will watch out for PMI data points and US non-farm payroll data. OPEC+ meeting is scheduled in the week which would provide guidance on production plans for rest of the year. Domestic investors will watch out for June Auto sales data and trade figures.

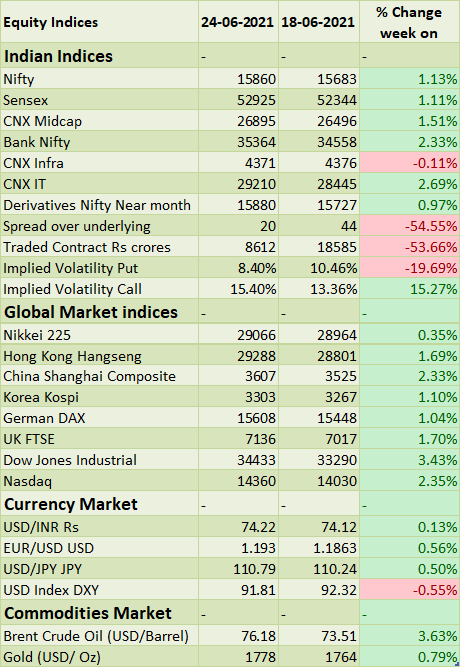

FIIs/FPIs have sold Rs. 29 billion in May 2021 and invested Rs. 153 billion in June 2021 (as of 27th June 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index futures. Implied volatility (IV) rose for put options and fell for call options in the last week. Fall in IV for call option and rise in IV for put option shows unsteady support for Nifty at present levels.

Wallstreet indices closed on a mixed note on Friday, S&P 500 touched new highs. A massive breakthrough in infrastructure plan boosted sentiment in reflation trades. On the economic front, a report showed personal spending stagnated in May 2021. During the week, Dow Jones surged by 3.43%, Nasdaq gained by 2.35%, and S&P 500 up by 2.6%.

European indices closed on a strong note amid strong preliminary PMI data boosted market sentiment. Fears of inflation shrugged off after FED acknowledged that rate hikes will be delayed despite inflationary pressure. During the week, FTSE gained by 1.70% and DAX up by 1% .

Brent crude oil is up by 3.63% for the week amid investors were upbeat about fuel demand recovery this summer, with vaccination programs in Europe and the US allowing more people to travel. On the supply side, EIA Petroleum Status Report showed the US crude oil inventories fell by more than expected 7.61 million barrels and OPEC+ meeting scheduled this week will be keenly watched.

Global Economy

The current account deficit in the US widened to USD 195.7 billion or 3.6% of the GDP in the first quarter of 2021 from a downwardly revised USD 175.1 billion in the previous period and compared to forecasts of a USD 206.8 billion.

The number of Americans filing new claims for unemployment benefits fell to 411,000 in the week ending 19th June 2021, from a revised 418,000 in the previous period and compared with market expectations of 380,000.

The People’s Bank of China (PBoC) injected CNY 30 billion of liquidity with seven-day reverse repurchase agreements, exceeding the CNY 10 billion falling due Thursday. The interest rate for the seven-day reverse repos was set at 2.2%.

The Bank of England voted unanimously to keep its benchmark interest rate on hold at a record low of 0.1% during its June 2021 meeting. The central bank also reiterated it does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.

Profits earned by China's industrial firms increased by 83.4% (Y-o-Y) to CNY 3.42 trillion in January-May 2021, following a 106% surge in the prior period, amid stable economic recovery momentum.