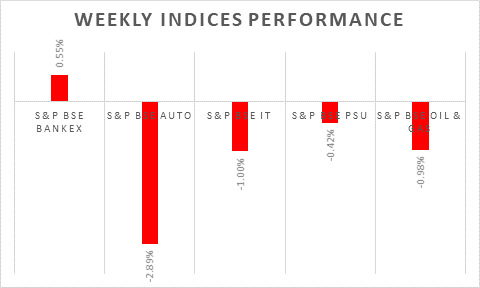

The BSE Sensex & Nifty 50 declined by 0.19% and 0.2% respectively driven factors such as weak global cues and less than market expected Q1 results of some major corporates like TCS. Moreover, impending third wave of corona pandemic continued to dampen market sentiment.

Next week, domestic investors will watch out for consumer inflation and industrial output and Q1 results of major IT companies such as WIPRO, Infosys, Tata Elxsi etc.

FIIs/FPIs have invested Rs. 172 billion in June 2021 and sold Rs. 22.49 billion in July 2021 (as of 11th July 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index options, stock options and stock futures. Implied volatility (IV) fell for put options while it rose for call options in the last week.

Wallstreet indices closed on a strong note on Friday as investors are optimistic about corporate earnings. Market sentiment boosted after publication of less than expected FOMC minutes. Regarding rising inflation, committee commented that it is transitory and is expected to ease in coming months. Bond asset purchase will be continued on the prevailing market condition. During last week, US indices touched new high. On a weekly basis, Dow Jones gained by 0.24%, Nasdaq rose by 0.43%, and S&P 500 up by 1.13%.

European stock indices exhibited uptrend on an average basis. The ECB left monetary policy unchanged during its June meeting, saying it expects net purchases under the PEPP over the coming quarter to continue to be conducted at a significantly higher pace than during the first months of the year. It also revised up GDP projections for 2021 and 2022 to 4.6% and 4.7%, respectively. During the week, FTSE fell by 0.01% and DAX up by 0.24%.

Brent crude oil future prices declined on weekly basis. US crude oil inventories dropped by 6.866 million barrels during the week ended, a seventh consecutive period of decline and compared with market consensus of a 4.033 million fall, data from the EIA Petroleum Status.

Global Economy

The IHS Markit US Composite PMI was revised slightly lower to 63.7 in June 2021, from a preliminary estimate of 63.9 and compared with May's all-time high of 68.7.

The IHS Markit Eurozone Construction PMI was unchanged at 50.3 in June 2021, indicating a marginal expansion in construction activity. House building remained the only monitored sub-sector to signal growth, with further declines recorded for both commercial and civil engineering work.

UK economy grew by 24.6% year-on-year in May of 2021, slightly less than forecasts of 25.9%. Industrial Production of UK rose by 20.60% in May 2021 on yearly basis.

China's annual inflation rate unexpectedly fell to 1.1% in June 2021 from May's eight-month high and market expectations of 1.3%, amid a sharp decline in cost of food.