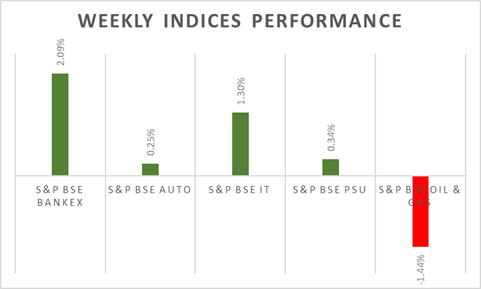

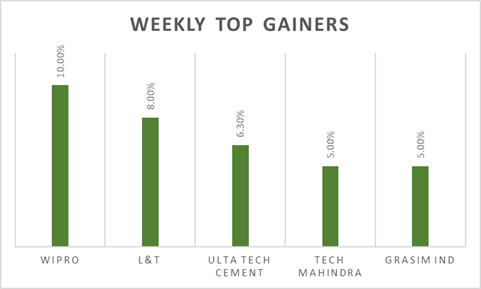

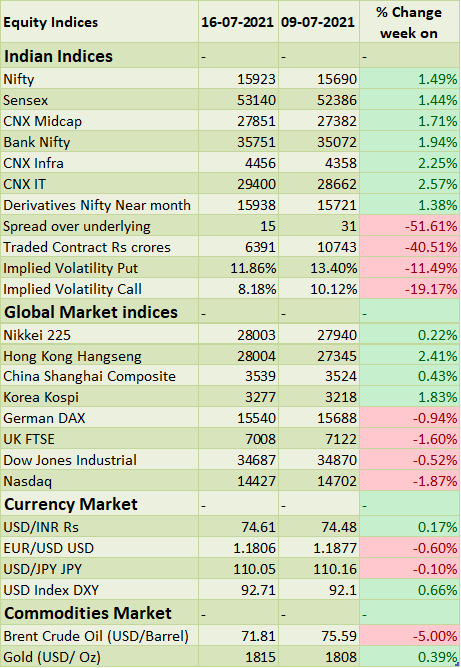

The BSE Sensex & Nifty 50 gained by 1.44% and 1.49% respectively during the last week. Domestic indices touched new highs on the back of in-line IT earnings with stronger guidance. In the coming week, market would take cues from the Nifty company earnings performance & guidance, and from global markets. On macro-data front, CPI stood at 6.26% and WPI came in at 12.07%.

Next week, domestic investors will watch out for Q1 earnings release from HCL Tech, ACC, Asian Paints, Bajaj Finance, Ultra Tech, HUL, Reliance Industries. Clean Science & Tech and GR infra will debut on domestic bourses on 19th July 2021. Global investors will watch out for flash PMI surveys.

FIIs/FPIs have invested Rs. 172 billion in June 2021 and sold Rs. 45 billion in July 2021 (as of 18th July 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index options, stock options and stock futures. Implied volatility (IV) fell for put options and for call options in the last week. Fall in IV for call option and put option shows steady support for Nifty at present levels.

Wallstreet indices closed on a negative note on Friday, despite the better-than-expected retail sales & corporate earnings. FED chair Powel signalled, inflationary pressures will there in the near-term and central bank would continue to support the economy till the labour market recovers to pre-covid levels. The consumer sentiment index from the University of Michigan came in at 80.8 for the first half of July, down from 85.5 last month and lower than expectations, sighting to higher inflation worries. During the week, Dow Jones fell by 0.52%, Nasdaq declined by 2%, and S&P 500 slipped by 1%.

European bourses closed in negative territory on Friday, with the benchmark DAX notching its worst week in a month, as investors weighed concerns over a rise in inflation and an increase in coronavirus cases. During the week, FTSE fell by 1.60% and DAX declined by 0.94% .

Brent crude closed at USD 72 barrel on Friday, the lowest in four weeks, and posting a decline of about 4% for the week, the worst weekly performance since March 2021, amid oversupply concerns and worries that the rapid spread of the Delta variant of COVID-19 could hurt global fuel consumption.

Global Economy

Industrial production in Japan declined by 6.5% (M-o-M) in May 2021, compared with the preliminary reading of 5.9% drop and after a final 2.9% gain a month earlier. This was the first fall in industrial output since February 2021, amid a renewed restrictions in some parts of the country following a surge in local coronavirus infections.

The Bank of Japan left its key short-term interest rate unchanged at -0.1% and kept the target for the 10-year Japanese government bond yield at around 0% during its July policy-meeting. the central bank slashed its projected rates of the GDP for the current FY to 3.8% from earlier forecasts of 4% made in April 2021.

Annual inflation rate in the US accelerated to 5.4% in June of 2021 from 5% in May, hitting a fresh high since August 2008, and well above forecasts of 4.9%.

Industrial production in the US increased 0.4% (M-o-M) in June 2021, below a downwardly revised 0.7% in May 2021 and market forecasts of 0.6%.

The Chinese economy advanced 7.9% (Y-o-Y) in Q2 2021, slowing sharply from a record 18.3% growth in Q1 and missing market consensus of 8.1%. A slowdown in factory activity, higher raw material costs, and new COVID-19 outbreaks in some regions all weighed on the recovery momentum.

Industrial production in China increased 8.3% (Y-o-Y) in June of 2021, the lowest rate in 6 months, but above market forecasts of a 7.8% rise.

The industrial capacity utilization rate in China jumped to record high of 78.4% in the second quarter of 2021 from 74.4% in the same period a year earlier.

Annual inflation rate in the Euro Area was confirmed at 1.9% in June 2021, in line with the preliminary estimate, and slowing from a 2 year high of 2% in May 2021.

The Eurozone trade surplus narrowed to EUR 7.5 billion in May 2021 from EUR 8.9 billion in the same month last year. Exports rose 32% from a year earlier to EUR 188.2 billion while imports advanced at a faster 35.2% to EUR 180.7 billion.