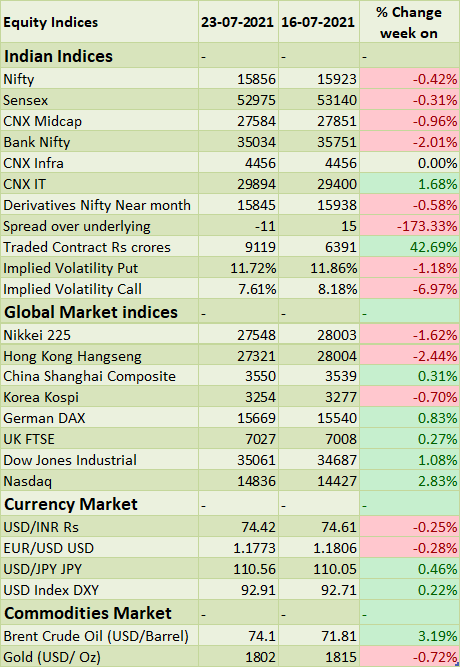

The BSE Sensex & Nifty 50 declined by 0.42% and 0.31% respectively during the last week. ICICI Bank and ITC reported better than expected results and Reliance Industries results came in as per expectations, markets would see gap up opening on Monday as the investors will react to the reported earnings and companies mentioned above have 17% weight in Nifty50 index. Market sentiment improved as the investors shrugged off concerns over third wave & negative global cues and shifted the focus towards earnings season and economic recovery. Global preliminary manufacturing PMI data have come in better than expectations which resulted in Nasdaq and S&P 500 touching new highs. On the IPO front, the stellar debut by food delivery startup Zomato, which ended listing at 65% above its offer price, and incoming week Tatva Chintan will be listed.

Next week, domestic investors will watch out for Q1 earnings release from Dr. Reddy’s Labs, Nestle, Maruti Suzuki, Sun Pharma, Tata Motors, Tech Mahindra and L&T. Global investors in the coming week will watch out for, Apple, Facebook, Microsoft, Alphabet and Amazon quarterly results; while the FED will be deciding on monetary policy.

FIIs/FPIs have invested Rs. 172 billion in June 2021 and sold Rs. 57 billion in July 2021 (as of 25th July 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index options, index futures, and stock futures. Implied volatility (IV) fell for put options and call options in the last week. Fall in IV for call option and put option shows steady support for Nifty at present levels.

Wallstreet indices closed on a strong note on Friday, after Nasdaq and S&P 500 touched new highs. Strong earnings from Twitter & Snapchat and better than expected manufacturing PMI data boosted market sentiment. Investors will be focusing FED meeting which is scheduled for next week. During the week, Dow Jones rose by 1%, Nasdaq surged by 3%, and S&P 500 gained by 2.7%.

European bourses closed in positive territory on Friday, on the back of positive global cues & strong macro-data. European Central Bank to keep its monetary policy accommodative for the foreseeable future. The ECB will keep the pace of the quantitative easing program unchanged and maintain its negative interest rates to support the eurozone economy until there was material progress towards its inflation target. During the week, FTSE rose by 0.30% and DAX gained by 0.83%.

Brent crude closed at USD 74 barrel on Friday, posting gains of about 4% for the week, as investors refocused on prospects that demand will outpace supply even though US stockpiles rose unexpectedly last week.

Global Economy

The European Central Bank revised its forward guidance on interest rates during its July policy-meeting, saying it expects interest rates to remain at their present or lower levels until it sees inflation reaching 2% well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realized progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at 2% over the medium term.

The Eurozone posted a current account surplus of EUR 4.3 billion in May 2021, compared with a EUR 0.7 billion deficit in the same month of the previous year, due to increases in surpluses of both goods and services.

Japan posted a trade surplus of JPY 383.18 billion in June 2021, reversing from a deficit of JPY 290.95 billion in the same month a year earlier and compared with market consensus of JPY 460 billion. Exports jumped 48.6% (Y-o-Y) to JPY 7,221 billion while imports rose at a softer 32.7% to JPY 6,838 billion.

The People's Bank of China (PBoC) left its benchmark interest rates for corporate and household loans steady for the 15th straight month at its July policy-meeting, despite growing expectations for a cut after the central bank lowered the reserve requirement ratio by 50 basis points.

US crude oil inventories rose by 2.108 million barrels in the 16th July 2021 week, ending an eighth consecutive period of declines and compared with market consensus of a 4.466 million fall, data from the EIA Petroleum Status Report showed.

Americans have claimed unemployment benefits in the latest week, above an upwardly revised 368,000 in the previous week and much higher than market expectations of 350,000.