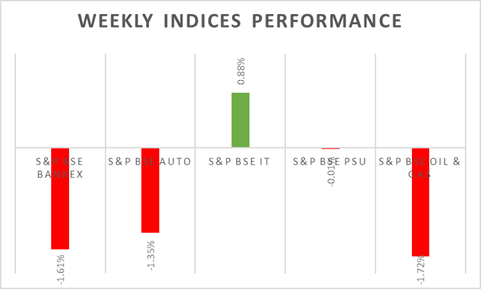

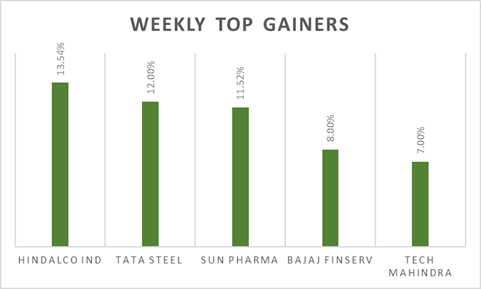

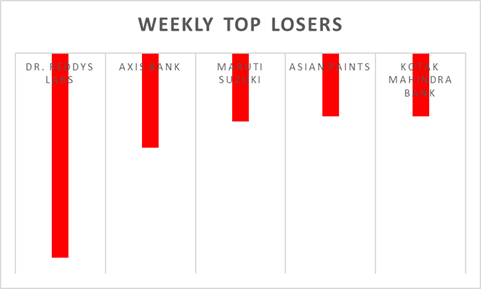

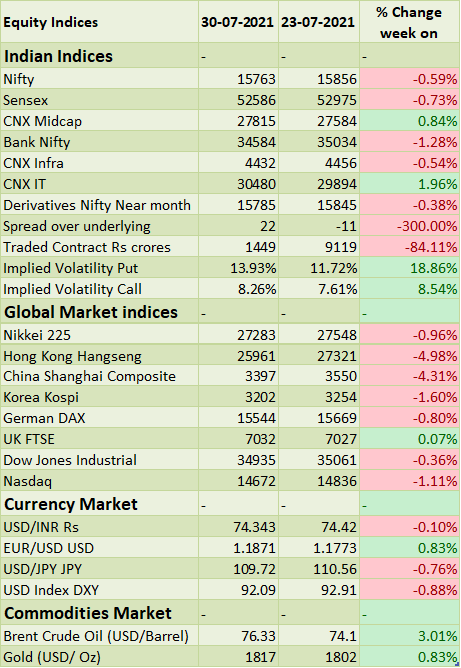

The BSE Sensex & Nifty 50 declined by 0.73% and 0.60% respectively during the last week. Pharma stocks witnessed selling pressure after Dr. Reddy’s reported below expectation earnings, however, the sentiment was lifted on Friday after stellar earnings from Sun Pharma. Metal stocks also witnessed strong traction after reports from Bloomberg cited that China would impose export tax on steel products and ArcelorMittal revised yearly outlook upwards. Auto & Banking stocks have reported mix set of numbers as they were affected the most during the second wave of Covid-19 lockdown and Auto sales for July 2021 are expected to flattish on yearly basis (high base) & MoM basis to be positive (low base). No changes are expected from the RBI policy meeting outcome, catch all the policy-meeting updates from INRBonds.com. On the data front, infrastructure output witnessed 8.9% YoY in June 2021 and GST collections came in at Rs. 1.16 trillion for July 2021. Domestic IPO market will be seeing Rs. 36 billion worth of offers from Devyani International, Windlas Biotech, Exxaro Tiles and Krsnaa Diagnostics.

Next week, domestic investors will watch out for outcome from RBI policy-meeting and Q1 earnings release from Divi’s Labs, SBI, PNB, Adani Ports, Gujarat Gas, M&M, and Hindalco Industries. Global investors in the coming week will watch out for the US non-farm payroll data and worldwide PMI survey levels.

FIIs/FPIs have invested Rs. 172 billion in June 2021 and sold Rs. 113 billion in July 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index options, index futures, and stock futures. Implied volatility (IV) rose for put options and call options in the last week. Rise in IV for call option and put option shows unsteady support for Nifty at present levels.

Wallstreet indices closed on a negative note for the week despite strong earnings from tech stocks. Market participants were concerned about the spread of the delta Covid-19 variant which could dent economic recovery and China’s crackdown on tech companies resulted in a steep fall in the share price of Chinese tech listed stock on US bourses. On the monetary policy side, the US central bank decided to keep its benchmark interest rate at a record-low level of near-zero and the pace of the quantitative easing program unchanged. During the week, Dow Jones fell by 0.36%, Nasdaq declined by 1.11%, and S&P 500 slipped by 0.35%.

European indices fell on Friday, amid fears of regulatory crackdowns in China while the spread of the Delta variant weighed on travel-related stocks. Investors also digested signs of inflationary pressure in Europe after economic data showed Germany's inflation rate jumped in July to the highest level since 1993. During the week, FTSE closed on a flat note and DAX fell by 0.80%.

Global Economy

The Fed left the target range for its federal funds' rate unchanged at 0%-0.25% and bond-buying at the current USD 120 billion monthly pace during the July 2021 meeting. But the central bank offered some hints that asset purchases could start being reduced soon despite the threat to growth from delta variant of the coronavirus.

The number of Americans filing new claims for unemployment benefits dropped to 400,000 in the week ending 24th July 2021, not far from a 16-month low of 368,000 reached at the end of June 2021 but above market expectations of 380,000.

The US economy advanced an annualized 6.5% on quarter in Q2 2021, well below market forecasts of 8.5%, the advance estimate showed.

The official NBS Manufacturing PMI for China fell to 50.4 levels in July 2021 from 50.9 levels a month earlier and missing market expectations of 50.8 levels. This was the weakest pace of increase in factory activity since a contraction in February 2020.

Industrial production in Japan rose by 6.2% (M-o-M) in June 2021, beating market expectations of 5% and reversing from a final 6.5% fall a month earlier.

Annual inflation rate in the Euro Area increased to 2.2% in July 2021 from 1.9% in June 2021, above market forecasts of 2%.

US crude oil inventories fell by 4.089 million barrels during the 23rd July 2021 week, following a 2.108 million increase in the previous period and compared with market consensus of a 2.928 million drop, data from the EIA Petroleum Status Report showed.