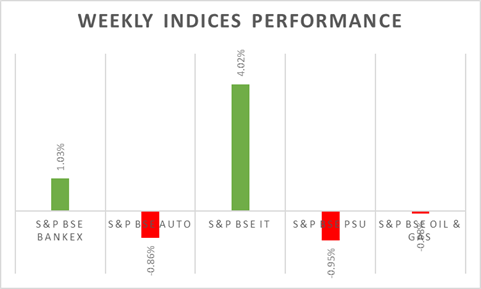

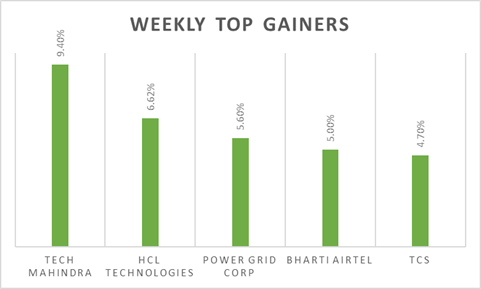

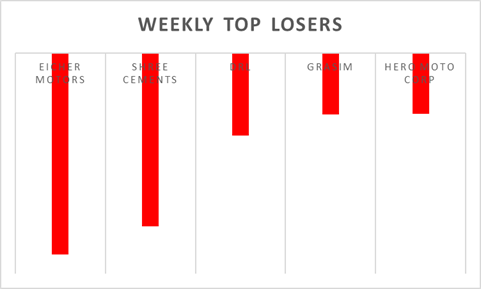

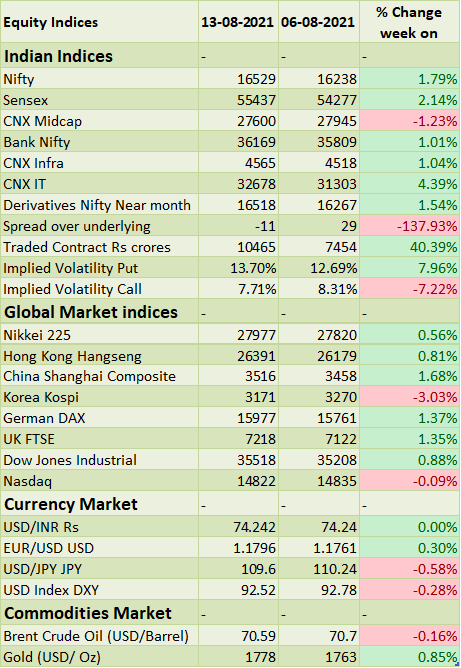

Another week, another new record high was touched by BSE Sensex & Nifty 50. Last week, domestic indices surged by 2% on the back of liquidity and a sharp rally in IT & Metal stocks. Investors have turned risk-averse due to which markets witnessed sell-off in mid-cap & small-cap stocks and money flow has been seen in index large-cap stocks during the last week. Key factors impacting the risk appetite of the investors include the rapid spread of Delta Covid-19 variant across the globe, Taliban invasion of Afghanistan, and mixed Q1Fy22 earnings (especially from mid-cap/small-cap stocks). Out of the whole emerging markets, India and Brazil have witnessed the highest FII inflows in the last 12 months.

On the macro-data front, industrial production growth in India (IIP) rose 13.6% (Y-o-Y) in June of 2021 on the back of a low base, however, compared to 2019 IIP de-grew by 13%. CPI rate eased to 5.59% (Y-o-Y) in July 2021, from 6.26% in the previous month and below market expectations of 5.78%. The domestic trade deficit was revised lower to USD 10.97 billion in July 2021 from a preliminary of USD 11.23 billion.

Next week, domestic markets likely to witness spurt in volatility on the back to weak global cues. Global investors in the coming week will watch out for the Japan and Eurozone Q2 GDP growth figures. US and China will publish retail sales and industrial production data.

FIIs/FPIs have sold Rs. 113 billion in July 2021 and invested Rs. 20.85 billion in August 2021 (as of 14th August 2021) . Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index options, index futures, and stock futures. Implied volatility (IV) fell for call options and rose for put options in the last week. Fall in IV for call option and rose for put option shows unsteady support for Nifty at present levels.

Wallstreet indices closed on a record high territory on Friday, as Dow jones and S&P 500 indices gained momentum after US senates approval of USD 1 trillion and previous week upbeat data of US non-farm payroll data came in better than expectations. During the week, Dow Jones gained by 0.88%, Nasdaq fell by 0.09%, and S&P 500 up by 0.68%.

European indices closed on a positive note, touching new highs. Sentiment dominated by a strong earnings season and the prospect of a solid economic recovery in Europe helped by continued support from central banks. During the week, FTSE gained by 1.37% and DAX rose by 1.35%.

Brent crude slightly down around USD 71 a barrel, as prospects of a demand rebound in the US and Europe against mobility curbs in China to rein the Delta spread. Meantime, the US President called major oil producers to boost output to tackle rising gasoline prices. On weekly basis, Brent Crude prices fell by 0.15%.

Gold prices climbed more than 1% to around USD 1,780 an ounce on Friday, ending the week on a positive note, amid a flight to safety on fears over the rapid spread of the Covid-19 in several countries.

Global Economy

The Eurozone trade surplus narrowed to EUR 18.1 billion in June 2021, from EUR 20 billion in the same period last year, amid a global demand recovery as the world economy continued to re-open. Exports rose 23.8% and imports were up at a faster 28.2%.

Eurozone industrial production fell by 0.3% from a month earlier in June 2021, following a revised 1.1% decline in May 2021 and compared with market expectations of a 0.2% drop.

The US consumer price inflation rate stood at 5.4% in July 2021, unchanged from the previous month's 13-year high and slightly above market expectations of 5.3%.

US crude oil inventories fell by 0.447 million barrels in the 6th August 2021, following a 3.626 million increase in the previous period and compared with market consensus of a 1.27 million drop, data from the EIA Petroleum Status Report showed.

The number of Americans filing new claims for unemployment benefits dropped for a third straight period to 375,000 in the week ending 7th August 2021.

China's annual inflation rate edged down to 1% in July 2021 from 1.1% a month earlier and compared with market consensus of 0.8%.

Japan's current account surplus increased sharply to JPY 905.1 billion in June 2021 from JPY 148.3 billion in the same month of the previous year and above market expectations of a surplus of JPY 779.8 billion.