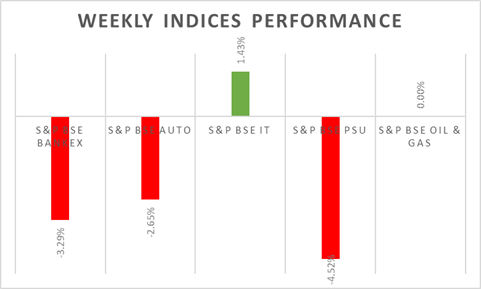

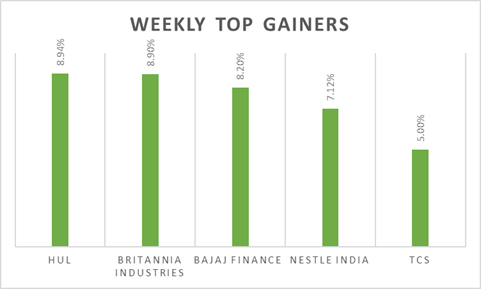

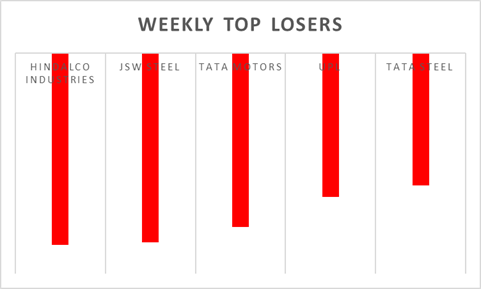

Domestic indices Sensex & Nifty witnessed selling pressure during last week as the broader market volatility increased. Metals, energy, and financial stocks led the losses, amid worries about an early tapering by the US Federal Reserve. For the week, Sensex fell by 0.2% and Nifty declined by 0.14%. Nifty VIX surged by 13% in the previous week. Volatility is expected to remain high as the F&O expiry & talks on the FED taper program nears.

Next week, market participants will look for Federal Reserve Chairman Powell will speak on Friday at the Fed's annual Jackson Hole conference, with investors looking for any details on the central bank's plans for tapering its massive asset purchases program

FIIs/FPIs have sold Rs. 113 billion in July 2021 and invested Rs. 50 billion in August 2021 (as of 22nd August 2021) . Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index options, index futures, and stock futures. Implied volatility (IV) fell for call options and rose for put options in the last week. Fall in IV for call option and rose for put option shows unsteady support for Nifty at present levels.

Wallstreet indices closed on positive note despite gap down opening on Friday. On the week however, all posted weekly losses as investors continue to digest the latest FOMC minutes. During the week, Dow Jones declined by 0.25%, Nasdaq fell by 0.82%, and S&P 500 slipped by 0.50%.

European indices closed on a positive note, however, autos remained under pressure amid expectations of further production cuts due to a semiconductor supply bottleneck. During the week, FTSE fell by 0.50% and DAX up by 0.30%.

The Baltic Exchange Dry Index surged 3% to 4,092 on Friday, its highest since mid-2010 and extending gains for a ninth straight session, attributed to an overall rebound in commodities demand and shipping constraints, especially in China.

Global Economy

Fed officials expressed a range of views on the appropriate pace of tapering asset purchases, but most noted that it could be appropriate to start reducing the pace of asset purchases this year, provided that the economy were to evolve broadly as they anticipated, minutes from the July policy-meeting minutes showed.

Industrial production in the US increased 0.9% in July 2021, following a downwardly revised 0.2% growth in June and beating market expectations of 0.5%.

The number of Americans filing new claims for unemployment benefits fell for a fourth straight period to a new pandemic low of 348,000 in the week ending 14th August 2021, below market expectations of 363,000 and signalling a continued recovery in the US labor market even as many US states struggle to contain rising coronavirus cases amid the spread of the Delta variant.

US crude oil inventories fell by 3.234 million barrels in the 13th August 2021 week, following a 0.447 million decrease in the previous period and compared with market consensus of a 1.055 million drop.

The consumer price inflation rate in the Euro Area was confirmed at 2.2% (Y-o-Y) in July 2021, the highest since October 2018 and above the European Central Bank's target of 2%.

Japan posted a trade surplus of JPY 441.02 billion in July 2021, shifting from a deficit of JPY 14.76 billion in the same month a year earlier and exceeding market consensus of a surplus of JPY 202.3 billion. Exports jumped 37% (Y-o-Y) to JPY 7,356 billion while imports rose at a softer 28.5% to JPY 6,915 billion.

Japan's consumer prices declined by 0.3% (Y-o-Y) in July 2021, after a revised 0.5% drop a month earlier. This was the tenth straight month of decrease in consumer prices, amid weakening consumption due to the ongoing COVID-19 pandemic.