Global equities turned volatile during the start of the last week on the back of higher inflation figures recorded in US. However, Fed is acting as cool as cucumber when it come to inflationary pressures as it still believes it is transitory. Countries like Mexico and Brazil already hiked rates 4 times in this year. UST yields rallied 10 bps which caused sell-off in emerging markets.

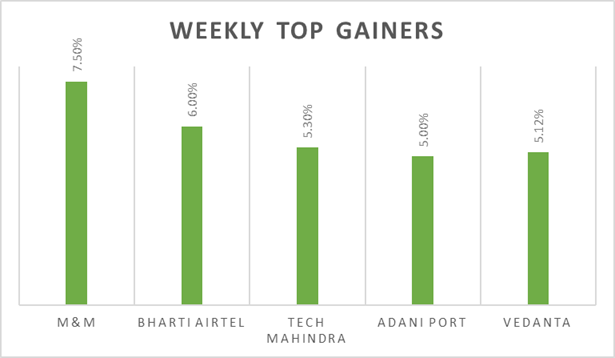

BSE Sensex & Nifty 50 jumped by.28% on Friday, snapping the 3-day losing streak. Gains were driven mainly by IT, financials, and capital goods. Investors sentiment was up as the Prime Minister launched the Retail Direct scheme for retail participation in the G-sec market. Visit Inrbonds.com to know more about investing in bonds. On macro-data front, Industrial output in India went up 3.1% (YoY) in September 2021, easing from an upwardly revised 12% rise in the previous month and below market forecasts of a 4.8% gain. FIIs/FPIs sold Rs. 135 billion in October 2021 and Rs. 46 billion in November 2021 (as of 14th November 2021).

In the week ahead market participants will look for US industrial production data and Japan�s GDP figures.

Wallstreet indices traded higher on Friday despite the consumer sentiment in the US fell in early November 2021 to its lowest level in a decade. Tesla shares drifted lower after Elon Musk sold more shares worth USD 700 million. During the week, Dow Jones down by 0.62%, Nasdaq declined by 1%, and S&P 500 fell by 0.4%.

European markets closed on a positive note, touched new highs on Friday. Better than expected results from corporates helped to offset worries of high inflation. During the week, DAX up by 0.25% and FTSE rose by 0.62%.

Brent crude edged lower but above USD 80 per barrel, third weekly decline in prices amid expectation of US releasing oil reserves to curb higher oil prices. During the week, prices declined by 1%.

Global Economy

Industrial production in the Euro Area edged down 0.2% (MoM) in September 2021, following a 1.7% drop in the previous month but less than market forecasts of a 0.5% fall, as supply constraints and high commodity prices weighed on the sector.

The UK economy advanced 6.6% (YoY)in the third quarter of 2021, below than market expectations.

The annual inflation rate in the US surged to 6.2% in October 2021, the highest since November of 1990 and above forecasts of 5.8%. It is a 3-decade high numbers.

US crude oil inventories rose by 1.001 million barrels in the week ending 5th November 2021, following a 3.291 million advance in the previous period and compared with market forecasts of a 2.125 million increase.

The number of Americans filing new claims for unemployment benefits decreased further to 267,000 in the week ending 6th November 2021, from an upwardly revised 271,000 in the previous period and just above market expectations of 265,000.

Equity Indices | 12-11-2021 | 05-11-2021 | % Change week on week |

Indian Indices | - | - | - |

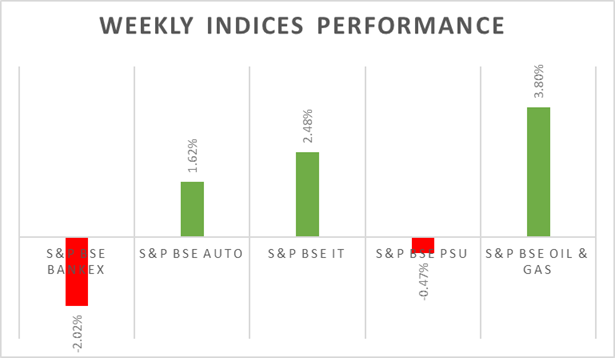

Nifty | 18102 | 17916 | 1.04% |

Sensex | 60686 | 60076 | 1.02% |

CNX Midcap | 31925 | 31442 | 1.54% |

Bank Nifty | 38733 | 39573 | -2.12% |

CNX Infra | 5323 | 5186 | 2.64% |

CNX IT | 36332 | 35334 | 2.82% |

Derivatives Nifty Near month | 18141 | 18138 | 0.02% |

Spread over underlying | 39 | 222 | -82.43% |

Traded Contract Rs crores | 14413 | 17024 | -15.34% |

Implied Volatility Put | 13.65% | 15.27% | -10.61% |

Implied Volatility Call | 11.87% | 15.19% | -21.86% |

Global Market indices | - | - | - |

Nikkei 225 | 29610 | 29611 | 0.00% |

Hong Kong Hangseng | 25328 | 24807 | 2.10% |

China Shanghai Composite | 3539 | 3492 | 1.35% |

Korea Kospi | 2968 | 2969 | -0.03% |

German DAX | 16094 | 16054 | 0.25% |

UK FTSE | 7348 | 7303 | 0.62% |

Dow Jones Industrial | 36100 | 36327 | -0.62% |

Nasdaq | 16199 | 16359 | -0.98% |

Currency Market | - | - | - |

USD/INR Rs | 74.34 | 74.17 | 0.23% |

EUR/USD USD | 1.1444 | 1.1566 | -1.05% |

USD/JPY JPY | 113.92 | 113.4 | 0.46% |

USD Index DXY | 95.12 | 94.32 | 0.85% |

Commodities Market | - | - | - |

Brent Crude Oil (USD/Barrel) | 81.99 | 82.74 | -0.91% |

Gold (USD/ Oz) | 1867 | 1816 | 2.81% |