Global markets sentiment would likely to remain volatile for this week as investors will react to lower-than-expected US jobs data, rapid spread of Omicron Covid-19 variant and expectations of Fed & Rbi policy-meetings. Crypto currencies witnessed sharp fall in prices as the risk aversions hits the investors sentiment. On domestic macro-data front, IHS Markit India Manufacturing PMI unexpectedly rose to 57.6 levels in November 2021 from 55.9 levels in October 2021, beating market consensus of 55.1 levels. IHS Markit India Services PMI marginally down to 58.1 levels in November 2021 from 58.4 levels in October 2021 and compared with market expectations of 57.8 levels.

FIIs/FPIs have sold Rs. 59 billion in November 2021 and Rs. 83 billion in December 2021 (as of 05th December). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest (OI) in stock futures, stock options, index futures and rise in OI for index options.

Wallstreet indices closed on negative note amid US NFP & wage growth data which came in lower than expectation. However, unemployment rate came in at 4.2% which is the lowest since the start of pandemic. During the week, Dow Jones down by 1%, Nasdaq fell by 2%, and S&P 500 slipped by 1.95%.

UST yield fall is driven by two factors, one is the risk aversion in markets on the back of a new covid variant that is forcing many countries to close borders and impose lockdowns and the other is the fact that Fed will start to raise rates soon on red hot labour markets. Currently UST is at 1.30% levels.

European markets opened on positive note but closed in red zone, tracking US market cues. Concerns over the new Omicron Covid-19 variant and mounting inflationary pressure weighed on investors sentiment. During the week, DAX fell by 0.58% and FTSE gained by 1.10%.

Global Economy

The US unemployment rate fell by 0.4% to 4.2% in November 2021 from 4.6% in October 2021. US economy added just 210,000 jobs in November 2021, the least since a 306,000 decline in December 2020 and well below market expectations of 550,000.

The IHS Markit US Services PMI reported at 58 levels in November 2021. Business activity and new orders continued to rise at strong paces. IHS Markit US Composite PMI reported at 57.2 levels in November 2021.

US crude oil inventories fell by 0.91 million barrels in the week ending 26th November 2021, following a 1.017 million rise in the previous period, and compared with market forecasts of a 1.237 million drop, data from the EIA Petroleum Status Report showed.

The IHS Markit Eurozone Services PMI was revised lower to 55.9 levels in November 2021. Demand for services increased for a seventh straight month in November 2021, although the expansion was the weakest over this period.

China General Services PMI declined to 52.1 levels in November 2021 from 53.8 levels in the prior month, pointing to the weakest growth in three months.

�Japan Services PMI reported at 27-month high of 53 levels in November 2021 from a preliminary figure of 52.1 levels, and after a final 50.7 levels in the prior month. This was also the second straight month of expansion in services activity.

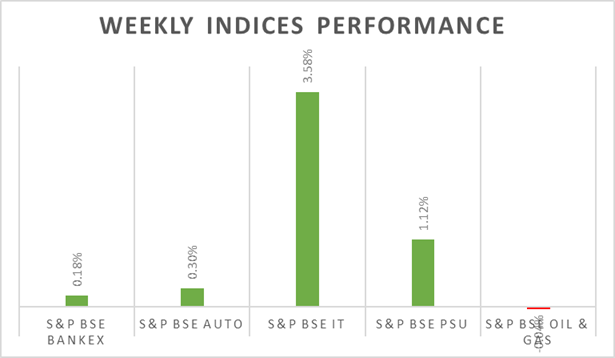

Equity Indices | 03-12-2021 | 26-11-2021 | % Change week on week |

Indian Indices | - | - | - |

Nifty | 17196 | 17026 | 1.00% |

Sensex | 57696 | 57107 | 1.03% |

CNX Midcap | 30293 | 29920 | 1.25% |

Bank Nifty | 36197 | 36025 | 0.48% |

CNX Infra | 4997 | 5003 | -0.12% |

CNX IT | 35848 | 34606 | 3.59% |

Derivatives Nifty Near month | 17252 | 17031 | 1.30% |

Spread over underlying | 56 | 5 | 1020.00% |

Traded Contract Rs crores | 19449 | 24773 | -21.49% |

Implied Volatility Put | 16.99% | 19.01% | -10.63% |

Implied Volatility Call | 13.58% | 12.31% | 10.32% |

Global Market indices | - | - | - |

Nikkei 225 | 28029 | 28751 | -2.51% |

Hong Kong Hangseng | 23766 | 24080 | -1.30% |

China Shanghai Composite | 3607 | 3564 | 1.21% |

Korea Kospi | 2968 | 2936 | 1.09% |

German DAX | 15169 | 15257 | -0.58% |

UK FTSE | 7122 | 7044 | 1.11% |

Dow Jones Industrial | 34580 | 34899 | -0.91% |

Nasdaq | 15712 | 16025 | -1.95% |

Currency Market | - | - | - |

USD/INR Rs | 75.24 | 75.065 | 0.23% |

EUR/USD USD | 1.1316 | 1.1319 | -0.03% |

USD/JPY JPY | 112.82 | 113.31 | -0.43% |

USD Index DXY | 96.15 | 96.07 | 0.08% |

Commodities Market | - | - | - |

Brent Crude Oil (USD/Barrel) | 66.26 | 68.15 | -2.77% |

Gold (USD/ Oz) | 1783 | 1788 | -0.28% |