Central bankers across the globe turned hawkish and expected to rise interest rates at faster rate the expected resulted in sell-off in equities. Fears of rising inflation triggered central bankers to hike rates despite uncertainties of Omicron Covid-19 variant. Sensex & Nifty declined by 1.5% each on Friday amid the FIIs selling pressure. Click here to read our note on �Fed gets well behind inflation, India could see market bubbles and high inflation�. On macro-economic front, CPI rate in India edged up to 4.91% in November 2021 from 4.48% in October 2021.

In the coming week, investors will watch out for US GDP growth data and inflation figures from Japan.

FIIs/FPIs have sold Rs. 59 billion in November 2021 and Rs. 134 billion in December 2021 (as of 19th December). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest (OI) in stock futures, index options, index futures and rise in OI for stock options.

Aggressive shift to hawkish stance by Fed resulted in sharp sell-off of equities in US market. Lower than expected preliminary estimates of PMI levels and surge in Omicron cases across the world weighed on investor sentiment. During the week, Dow Jones down by 1.70%, Nasdaq slumped by 3.25%, and S&P 500 declined by 1.9%.

European markets closed on negative note tacking US markets movement. ECB during its December policy-meeting announced it would reduce the pace of its asset purchases under its Euro 1.85 trillion. �During the week, DAX down by 0.60% and FTSE declined by 0.32%.

Crude oil prices declined by 2% as traders reassessed the demand outlook amid rising Covid cases globally and as prospects of higher interest rates weighed on sentiment.

Global Economy

Industrial production in the United States rose 0.5% from a month earlier in November 2021, following an upwardly revised 1.7% growth in October 2021 and compared with market expectations of a 0.7% advance.

The number of Americans filing new claims for unemployment benefits increased by 18,000 to 206,000 in the week ended 11th December 2021 from an over five-decade low of 188,000 in the previous period and compared to market expectations of 200,000.

The IHS Markit US Services PMI declined to 57.5 levels in December 2021 from 58 levels in the previous month and below market expectations of 58.5 levels, a preliminary estimate showed.

The ECB during its December policy-meeting announced it would reduce the pace of its asset purchases under its Euro 1.85 trillion PEPP next quarter and wind down the scheme next March 2022, citing the progress on economic recovery and towards its medium-term inflation target.

Construction output in the Euro Area rose 4.4% (Y-o-Y) in October 2021, following an upwardly revised 2% increase in the previous month. That was the strongest rate of growth in construction output since May 2021.

The IHS Markit Eurozone Services PMI declined to 53.3 levels in December 2021 from 55.9 levels in the previous month and below market consensus of 54.1 levels, a preliminary estimate showed.

Industrial production in the Euro Area rose 1.1% from a month earlier in October 2021, rebounding from two consecutive months of contraction but below market expectations of 1.2%.

The Bank of Japan left its key short-term interest rate unchanged at -0.1% and that for 10-year bond yields around 0% during its final meeting of the year. Policymakers decided to taper their corporate debt buying to pre-pandemic levels while extending emergency pandemic funding by six months until the end September 2022.

Japan registered a trade deficit of JPY 954.8 billion in November 2021, compared with market consensus of a JPY 675 billion gap and shifting from a surplus of JPY 325.91 billion in the same month a year earlier.

The au Jibun Bank Japan Services PMI dropped to 51.1 levels in December 2021 from a final 53 levels in November 2021, which was the highest reading in 27 months, a preliminary figure showed.

The Bank of England during its policy-meeting increased bank rate by 15bps to 0.25% for the 1st time since the onset of the pandemic, as inflation pressures mounted in UK, surprising markets that expected no changes due to the threat of Omicron.

Equity Indices | 17-12-2021 | 10-12-2021 | % Change week on week |

Indian Indices | - | - | - |

Nifty | 16985 | 17511 | -3.00% |

Sensex | 57011 | 58786 | -3.02% |

CNX Midcap | 29939 | 31203 | -4.05% |

Bank Nifty | 35618 | 37105 | -4.01% |

CNX Infra | 4891 | 5083 | -3.78% |

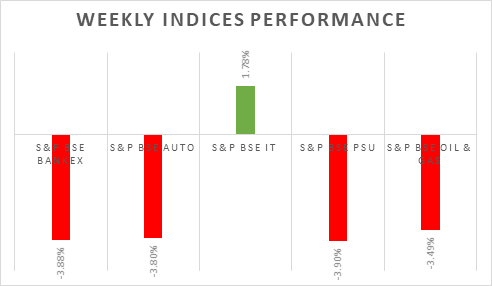

CNX IT | 36647 | 35975 | 1.87% |

Derivatives Nifty Near month | 17022 | 17546 | -2.99% |

Spread over underlying | 37 | 35 | 5.71% |

Traded Contract Rs crores | 18277 | 13155 | 38.94% |

Implied Volatility Put | 16.31% | 15.72% | 3.75% |

Implied Volatility Call | 14.74% | 11.88% | 24.07% |

Global Market indices | - | - | - |

Nikkei 225 | 28545 | 28437 | 0.38% |

Hong Kong Hangseng | 23192 | 23995 | -3.35% |

China Shanghai Composite | 3632 | 3666 | -0.93% |

Korea Kospi | 3017 | 3010 | 0.23% |

German DAX | 15531 | 15623 | -0.59% |

UK FTSE | 7269 | 7292 | -0.32% |

Dow Jones Industrial | 35365 | 35970 | -1.68% |

Nasdaq | 15801 | 16332 | -3.25% |

Currency Market | - | - | - |

USD/INR Rs | 76.013 | 75.717 | 0.39% |

EUR/USD USD | 1.124 | 1.1312 | -0.64% |

USD/JPY JPY | 113.68 | 113.39 | 0.26% |

USD Index DXY | 96.67 | 96.05 | 0.65% |

Commodities Market | - | - | - |

Brent Crude Oil (USD/Barrel) | 73.52 | 75.15 | -2.17% |

Gold (USD/ Oz) | 1798 | 1784 | 0.78% |