Sensex & Nifty closed 2021 on a positive note, breaking out of dwindling weakness. Markets retreated close to 6% in last 2 months over the concerns of higher valuations and negative global cues (Omicron Spread). Q3Fy22 earnings and expectations of Budget will keep domestic investors busy. Also, 5 state elections are due in the next 2-3 months which will also play key role in setting the trend for markets. Covid-19 cases are surging across most of the states and local governments have initiated the curfews to curb the spread, most of it has been already factored-in to the indices. On the global cues, China manufacturing data reported at better-than-expected levels and US weekly unemployment benefits dropped by 8,000 to 198,000 which is close to 52-year lows.

On domestic macro-front:

� India posted a current account deficit of USD 9.6 billion in July-September 2021-22, equivalent to 1.3% of the GDP, compared with a surplus of USD 15.3 billion in the same period of the previous fiscal year.

� Infrastructure output in India increased 3.1% in November 2021, slowing from an upwardly revised 8.4% advance in the previous month. It was the lowest gain since February 2021 amid reduced growth in electricity and steel output.

� India's fiscal deficit narrowed to INR 6.96 trillion in April-November 2021-22 from INR 10.76 trillion in the comparable year-earlier period.t

FIIs/FPIs have sold Rs. 59 billion in November 2021 and Rs. 190 billion in December 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest (OI) in stock futures, index options, stock options and rise in OI for index futures.

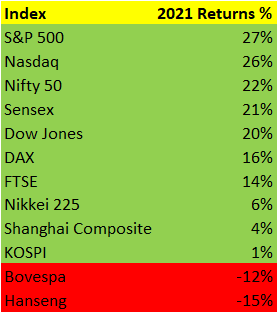

Wallstreet indices closed on negative note on Friday although closed the year near highs. In 2021, S&P gained the most by 27%, Nasdaq rallied by 26% and Dow Jones booked 19% gains. Mid-term US congress elections and Fed tightening monetary policy will be closely watched in 2022. During the week, Dow Jones up by 1%, Nasdaq closed flat, and S&P 500 up by 0.70%.

European markets closed on mixed note on Friday amid rapid rise in Covid-19 cases. FTSE booked 14% gains in 2021 biggest increase in 5 years and DAX closed on high note, booked 16% gains in 2021. Investors will watchout for inflation data and updates from ECB regarding tightening monetary policy. However, BoE already hiked rates by 15bps amid higher inflation fears, this move was taken by central bankers even though UK was witnessing huge number of Covid-19 cases. During the week, DAX up by 0.82 % and FTSE gained by 0.14%.

Crude oil prices gained by 2% during the week rebounded from Omicron fear sell-off. Signs of strong demand buoyed oil prices. Crude oil prices booked highest gains of 50% since 2016.

Global Indices Performance in 2021

Equity Indices | 31-12-2021 | 24-12-2021 | % Change week on week |

Indian Indices | - | - | - |

Nifty | 17354 | 17004 | 2.06% |

Sensex | 58253 | 57124 | 1.98% |

CNX Midcap | 30443 | 29612 | 2.81% |

Bank Nifty | 35482 | 34857 | 1.79% |

CNX Infra | 4950 | 4881 | 1.41% |

CNX IT | 38701 | 37727 | 2.58% |

Derivatives Nifty Near month | 17420 | 17003 | 2.45% |

Spread over underlying | 66 | -1 | -6700.00% |

Traded Contract Rs crores | 12102 | 14084 | -14.07% |

Implied Volatility Put | 16.54% | 16.13% | 2.54% |

Implied Volatility Call | 13.33% | 13.41% | -0.60% |

Global Market indices | - | - | - |

Nikkei 225 | 28792 | 28782 | 0.03% |

Hong Kong Hangseng | 23397 | 23223 | 0.75% |

China Shanghai Composite | 3639 | 3618 | 0.58% |

Korea Kospi | 2977 | 3012 | -1.16% |

German DAX | 15885 | 15756 | 0.82% |

UK FTSE | 7385 | 7372 | 0.18% |

Dow Jones Industrial | 36338 | 35950 | 1.08% |

Nasdaq | 16320 | 16308 | 0.07% |

Currency Market | - | - | - |

USD/INR Rs | 74.48 | 75.004 | -0.70% |

EUR/USD USD | 1.1371 | 1.132 | 0.45% |

USD/JPY JPY | 115.07 | 114.39 | 0.59% |

USD Index DXY | 95.67 | 96.06 | -0.41% |

Commodities Market | - | - | - |

Brent Crude Oil (USD/Barrel) | 77.78 | 76.14 | 2.15% |

Gold (USD/ Oz) | 1829 | 1812 | 0.94% |