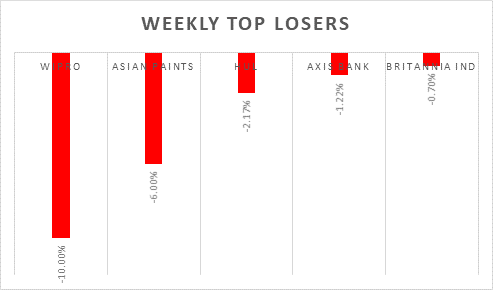

TCS, Infosys, HCL Tech and Wipro reported Q3 earnings during the week, Infosys reported better than expected results and increased revenue guidance for Fy22. HDFC bank reported 13% YoY growth in NIM and sequential drop NPAs, profitability rose by 18% YoY. On the macro-economic front, inflation came in at 5.59% and wholesale price inflation rate in India inched down to 13.56%. India's trade deficit was revised lower to USD 21.68 billion in December 2021, imports jumped 38.55% (YoY) to a record high of USD 59.48 billion and exports surged by 38.91% to an all-time high of USD 37.81 billion.

Investors will watchout for ECB policy-meeting minutes, earnings reports from Goldman Sachs & Netflix and China Q4 GDP growth figures. Bajaj Finance, Cipla, Tatva Chintan, Ultratech Cements, and Bajaj Auto will report Q3 earnings.

FIIs/FPIs have sold Rs. 190 billion in December 2021 and invested Rs. 18 billion in January 2022. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest (OI) in stock futures, index options, stock options and index futures.

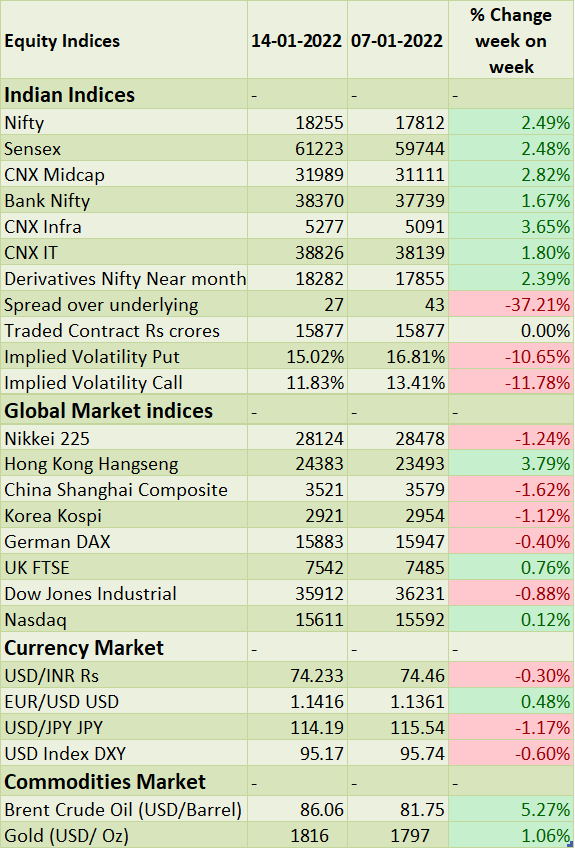

Wallstreet indices bounced back from sharp fall seen on opening as mixed earnings reports weighed on sentiment. JPMorgan Chase and Wells Fargo beat estimates and Citigroup profits dropped sharply. During the week, Dow Jones fell by 0.88%, Nasdaq slightly up by 0.12%, and S&P 500 rose by 0.16%.

European indices closed on negative note on Friday, amid worries about faster policy tightening in the US following hawkish comments from several Federal Reserve officials and as the country's inflation rate hit a 40-year high of 7%. During the week, DAX up by 0.40 % and FTSE gained by 1.35%.

Crude oil prices rose to 14-year highs of USD 86 per dollar as Libya and Kazakhstan and dwindling US crude inventories more than offset mobility curbs in China. US crude stockpiles declined by 4.553 million barrels last week to their lowest since October 2018 and compared to market expectations of a 1.904 million drop.

Global Economy

Industrial production in the US went down 0.1% from a month earlier in December 2021, after an upwardly revised 0.7% increase in November 2021 and compared to market expectations of a 0.3% increase. Manufacturing production declined 0.3% and motor vehicles and parts stepped down 1.3%.

The annual inflation rate in the US accelerated to 7% in the last month 2021, a fresh high since June 1982, in line with market expectations and compared to 6.8% in November 2021.

The number of Americans filing new claims for unemployment benefits rose by 23,000 from the previous period, the most in 8-weeks, to 230,000 in the week ending 8th January 2022, compared with market expectations of 200,000.

The US budget deficit narrowed to USD 21.3 billion in December 2021, compared with a USD 143.5 billion gap in the same period last year and market expectations of a USD 25 billion gap. It was the lowest deficit since December 2019 as outlays increased only 3.7% to USD 508.04 billion, while receipts soared 40.6% to USD 486.2 billion.

The gross domestic product in the UK grew by 1.1% in the three months to November 2021, beating market expectations of a 0.8% expansion and reflecting the strong performance of the services sector.

The Eurozone posted a trade deficit of EUR 1.5 billion in November 2021, the first gap since January 2014. Imports jumped 32% to an all-time high and exports rose by 14.4% touching record highs.

China's annual inflation rate fell to 1.5% in December 2021 from a 15-month high of 2.3% a month earlier. The latest reading was less than market consensus of 1.8%.

China's trade surplus widened sharply to a fresh record high of USD 94.46 billion in December 2021 from USD 75.8 billion in the same month a year earlier, easily beating market forecasts of USD 74.5 billion. Export extended their double-digit growth for the 15th month running, increasing by 20.9% from a year earlier to USD 340.50 billion, while imports rose at a softer 19.5% to USD 246.04 billion.