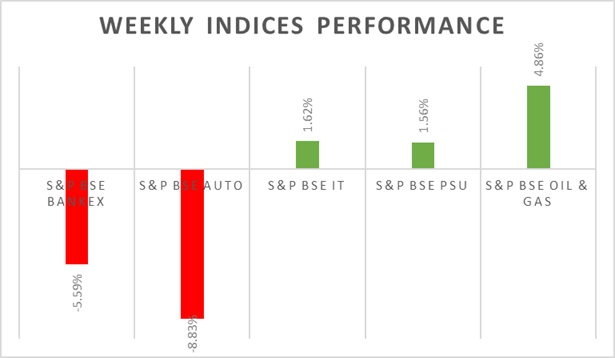

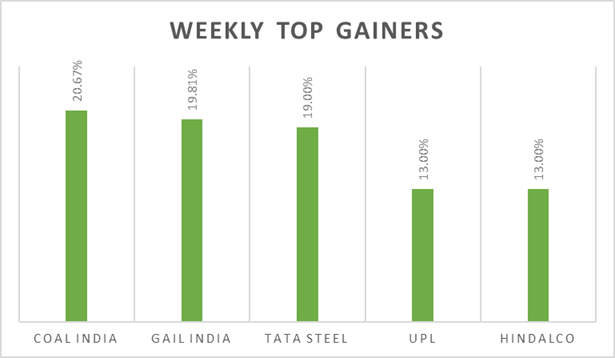

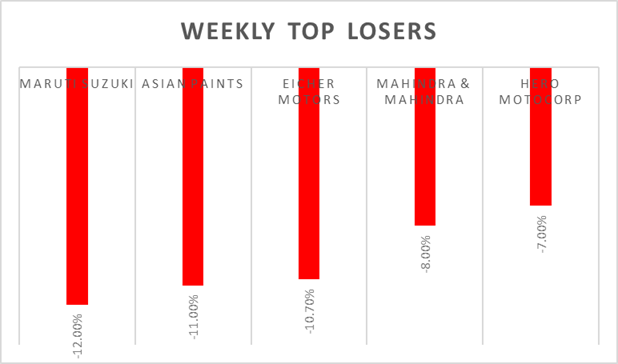

Escalating conflict between Russia & Ukraine, weak domestic Auto sales for the month of February 2022, surging oil prices (increasing inflationary pressures and current account deficit) and domestic GDP growth reported at 8.2% vs market expectation of 9.2%. All the mentioned factors pulled down Sensex & Nifty during the last week, which resulted in 2.5% fall. Markets are likely to stay volatile amid ongoing Russia & Ukraine issue and Fed policy meeting outcome which will hint market participants how aggressively the Fed will hike rates. Last week, commodity prices surged sharply amid supply disruptions (Russia sanctions) and raising fears of higher inflation.

On domestic data front, IHS Markit India Services PMI edged up to 51.8 levels in February 2022 from January's six-month low of 51.5 levels. IHS Markit India Manufacturing PMI increased to 54.9 levels in February 2022 from a four-month low of 54 levels in the previous month.

In the coming week, market participants will watch for US & China inflation data and developments between Russia & Ukraine issue. ECB monetary policy-meeting outcome will be keenly observed.

FIIs/FPIs have sold Rs. 355 billion in February 2022 and Rs. 147 billion in March 2022 (as of 06th March 2022). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest (OI) in stock futures, index options, stock options and index futures.

Wallstreet indices declined on Friday, as the market sentiment was dominated by Russia-Ukraine crisis. On NFP front, US economy added 678,000 jobs better than market expectation. However, wage growth declined on monthly basis. During the week, Dow Jones declined by 1.30%, Nasdaq slipped by 2.48%, and S&P 500 fell by 0.60%.

European indices closed sharply lower on Friday, with the DAX ending at an over 14-month low and FTSE slipped 3% amid escalating conflicts between Russia and Ukraine. On data front, Eurozone reported record high inflation growth of 5.8%. During the week, DAX tumbled by 10% and FTSE declined by 6.70%.

Crude oil futures prices surged by 20% during the week, touching 14-year highs on Friday. US lawmakers push to cut off US imports of oil and petroleum products from Russia. Despite widening sanctions on Moscow, OPEC+ will stick to an existing pact for a gradual increase in production.

Global Economy

The American economy added 678,000 jobs in February 2022, the most in 7 months and way above market forecasts of 400,000. The US unemployment rate edged down to 3.8% in February 2022 from 4% in the previous month, a new pandemic low and below market expectations of 3.9%.

The IHS Markit US Composite PMI was revised slightly lower to 55.9 levels in February 2022 from a preliminary of 56 levels.

US crude oil inventories fell by 2.597 million barrels in the week ended 25th February 2022, following a 4.515 million rise in the previous period and compared with market forecasts of a 2.748-million-barrel gain, data from the EIA Petroleum Status Report showed.

Annual inflation rate in the Euro Area rose to a fresh record high of 5.8% in February 2022 from 5.1% in January 2022, above market expectations of 5.4%.

The IHS Markit Eurozone Services PMI was revised lower to 55.5 levels in February 2022 from a preliminary estimate of 55.8 levels.

The IHS Markit Eurozone Construction PMI fell only slightly to 56.3 levels in February 2022 from 56.6 levels in January 2022, indicating a strong expansion in construction activity. Growth was commonly liked to stronger demand and increasing workloads.

The Caixin China General Composite PMI was at 50.1 levels in February 2022, unchanged from January's five-month low figure and remained below the series average at 52.6 levels.