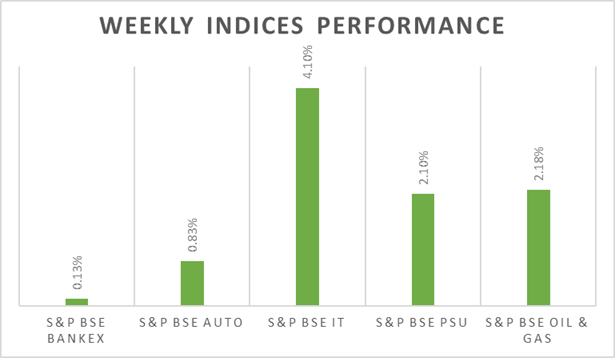

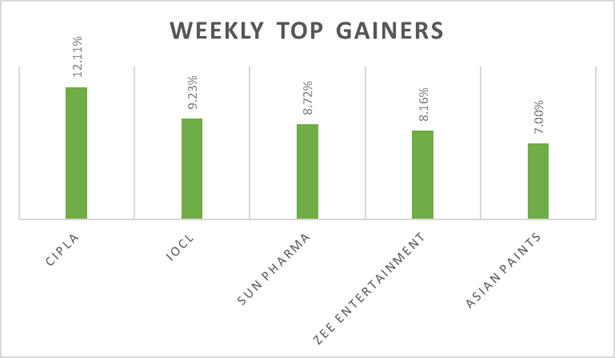

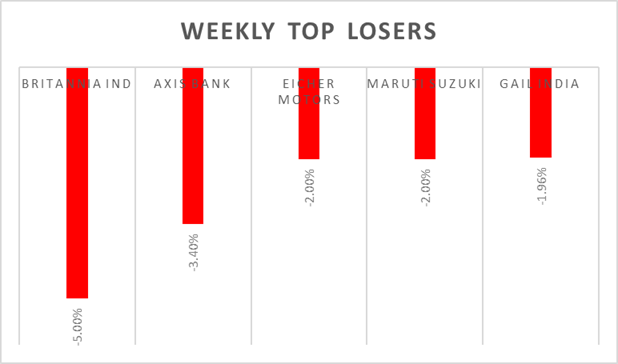

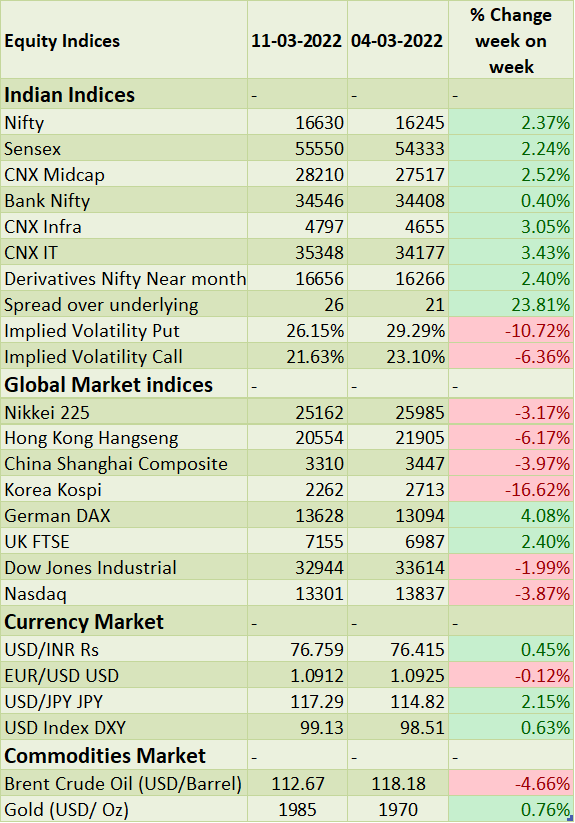

Unlike global equity markets, Sensex & Nifty managed to post weekly gains of 2.3% each. Gains were led mainly by pharmaceuticals, capital goods and banks with 15 out of 30 stocks ending in the green on Friday. Rising energy & food costs due to Russia-Ukraine conflict, decade high inflation growth and normalisation of monetary policies dampened global equity market sentiment. On macro-data front, industrial production in India grew 1.3% (Y-o-Y) in January 2022, advancing from an upwardly revised 0.7% rise in December 2021, but missed market expectations of a 1.5% rise.

In the coming week, market participants will watch for Fed and BoE monetary policy-meeting outcome. Domestic investors will watch out for inflation data.

FIIs/FPIs have sold Rs. 355 billion in February 2022 and Rs. 411 billion in March 2022 (as of 13th March 2022). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest (OI) in stock futures, index options, stock options and index futures.

Wallstreet indices declined on Friday amid US president Mr. Biden called to downgrade Russia�s most favored nation status as a trading partner, enabling new tariffs to be implemented on Moscow and further lifting projections of higher consumer prices. During the week, Dow Jones declined by 2%, Nasdaq tumbled by 4%, and S&P 500 fell by 3%.

10-year US treasury yield topped 2% from 1.67% lows seen in the last week. �Latest CPI data showed that the annual inflation rate in the US accelerated to 7.9% in February 2022, the highest since January 1982.

European indices closed positive on Friday as the short covering seen in the market. Still, market sentiment remains clouded by the war in Ukraine, rising inflation and higher interest rates. During the week, DAX surged by 4% and FTSE declined by 2.70%.

Crude oil futures prices declined from 14-year highs to USD 109 per barrel. Investors weighed efforts to bring more supply to the market against fears of an imminent Russia embargo.

Global Economy

Annual inflation rate in the US accelerated to 7.9% in February 2022, the highest since January of 1982.

The US trade deficit widened to a record high of USD 89.7 billion in January 2022 from an upwardly revised USD 82 billion in the previous month and above market forecasts of an USD 87.1 billion gap.

The number of Americans filing new claims for unemployment benefits increased by 11,000 to 227,000 in the week ended 5th March 2022, from a revised 216,000 in the previous period and compared with market expectations of 217,000.

US crude oil inventories decreased by 1.863 million barrels to 411.6 million barrels in the week ended 4th March 2022, after a 2.597 million drop in the previous period and compared with market forecasts of a 0.657-million-barrel fall, data from the EIA Petroleum Status Report showed.

ECB surprisingly speed up the asset purchase schedule for the coming months during its March 2022 policy-meeting and said that the PAPP could end in the third quarter if the medium-term inflation outlook will not weaken. Monthly net purchases will now amount to 40 billion Euro in April 2022, 30 billion Euro in May 2022 and 20 billion Euro in June 2022, compared to 40 billion Euro in Q2, 30 billion Euro in Q3 and 20 billion Euro in Q4 previously set.

China's annual inflation rate stood at 0.9% in February 2022, unchanged from the previous month and in line with market forecasts.

The Japanese economy advanced 4.6% on an annualized basis in Q4 2021, compared with flash data of 5.4% and reversing from a revised 2.8% contraction in Q3.