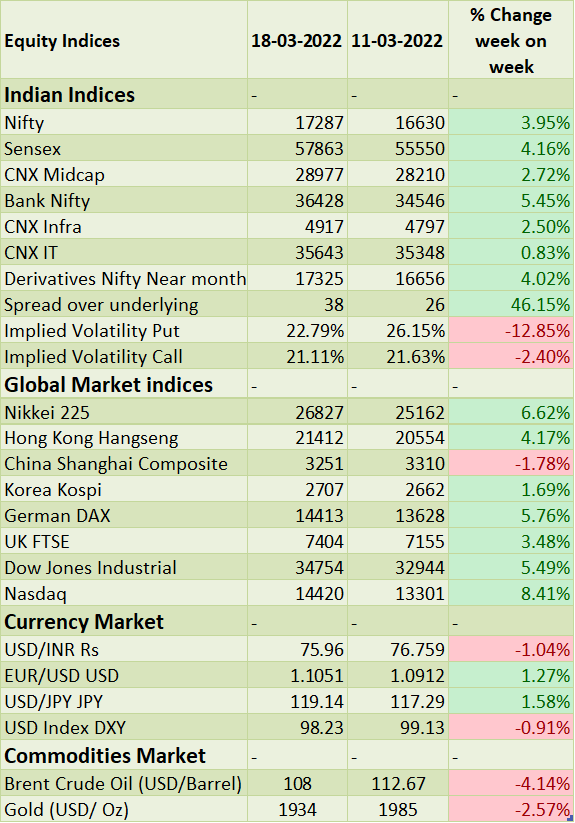

Sensex and Nifty closed the week on a strong note as the broader market volatility cooled-off. FIIs buying supported the indices. However, markets are likely to be range-bounded in the near term and investors will watchout for Q4 earnings which will be out in next month. Also, Fed�s monetary policy outcome could limit the gains (Click here to read our complete analysis.). On commodities front, higher oil prices and food prices could lead to higher inflation growth which would impact corporate earnings. Investors will watchout for new covid cases rise in Europe and China which is causing lockdown in few cities of China.

FIIs/FPIs have sold Rs. 355 billion in February 2022 and Rs. 420 billion in March 2022 (as of 21st March 2022). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest (OI) in stock futures, index options, stock options and index futures.

Wallstreet indices closed positive on Friday. Investor�s sentiment was boosted on the back of economic growth recovery. US 10-year treasury touched 2-year highs of 2.24% before closing at 2.15% as bond investors digest the latest Fed policy-meeting outcome. During the week, Dow Jones gained by 5.5%, Nasdaq surged by 8.4%, and S&P 500 up by 6%.

European indices closed the week on a strong after market participants digested interest rate hikes by the Federal Reserve and Bank of England while following negotiations between Russia and Ukraine. During the week, DAX surged by 5.76% and FTSE up by 3.5%.

Global Economy

Inflation, strong economy, wage growth and rising commodity prices left the Fed policymakers on edge, as they hiked rates by 0.25% for the first time since December 2018. Policymakers expect the inflation to be at 4.3% by end of 2022 cooling-off from 4-decade highs of 7.9% reported in February 2022, which is far from 2% target zone.

Click here to read our complete analysis.

Industrial production in the United States increased 0.5% from a month earlier in February 2022, following a 1.4% rise in January 2022 and in line with market expectations.

The number of Americans filing new claims for unemployment benefits fell by 15,000 to 214,000 in the week ended 12th March 2022, the lowest in 10 weeks, from a revised 229,000 in the previous period and compared with market expectations of 220,000.

Production in US factories rose 1.2% from a month earlier in February 2022, the most in 4 months following a downwardly revised 0.1% increase in January 2022 and above market expectations of a 0.6% gain.

US crude oil inventories rose by 4.345 million barrels to 415.9 million barrels in the week ended 11th March 2022, recovering from a 1.863 million fall in the previous period and compared with market expectations of a 1.375-million-barrel fall.

China's industrial production rose by 7.5% (Y-o-Y) in January-February 2022 combined, exceeding market consensus of 3.9% and quickening from a 4.3% gain in the prior period.

The trade balance in the Euro Area swung to a Euro 27.2 billion deficit in January 2022 from a Euro 10.7 billion surplus a year earlier. It is a record high trade gap as imports jumped 44.3% driven by a surge in energy purchases. Exports increased at a softer pace 18.9%.

The Bank of Japan left its key short-term interest rate unchanged at -0.1% and that for 10-year bond yields around 0% during its March policy-meeting.

The core consumer price index in Japan, which excludes fresh food but includes fuel costs, increased 0.6% in February 2022 from a year earlier.

The Bank of England raised its key Bank Rate by 25bps to 0.75% during its March 2022 meeting, in line with expectations. It is the third consecutive rise in borrowing costs, taking interest rates back to pre-Covid levels.